- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter closing cost deductions for rental property

Where do I enter the Expense for Closing cost?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Settlement fees and closing costs for buying the property become additions to your basis in the property. These include abstract fees, charges for installing utility services, legal fees, recording fees, surveys, transfer taxes, title insurance, and any amounts the seller owes that you agree to pay (back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions).

Costs that are basis adjustments can be part of your yearly depreciation deduction for the rental property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

"Points" are entered in the Assets/Depreciation interview of Rental Properties and Royalties, and amortized over the term of the mortgage.

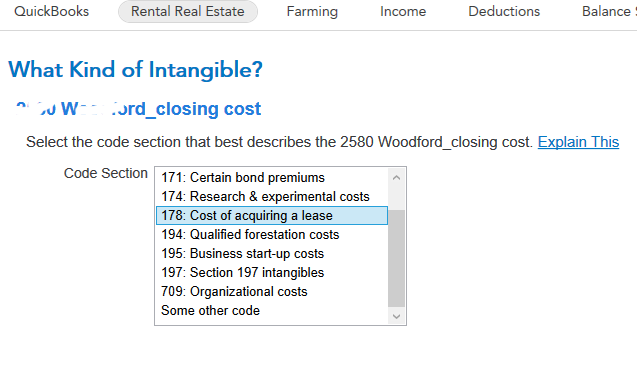

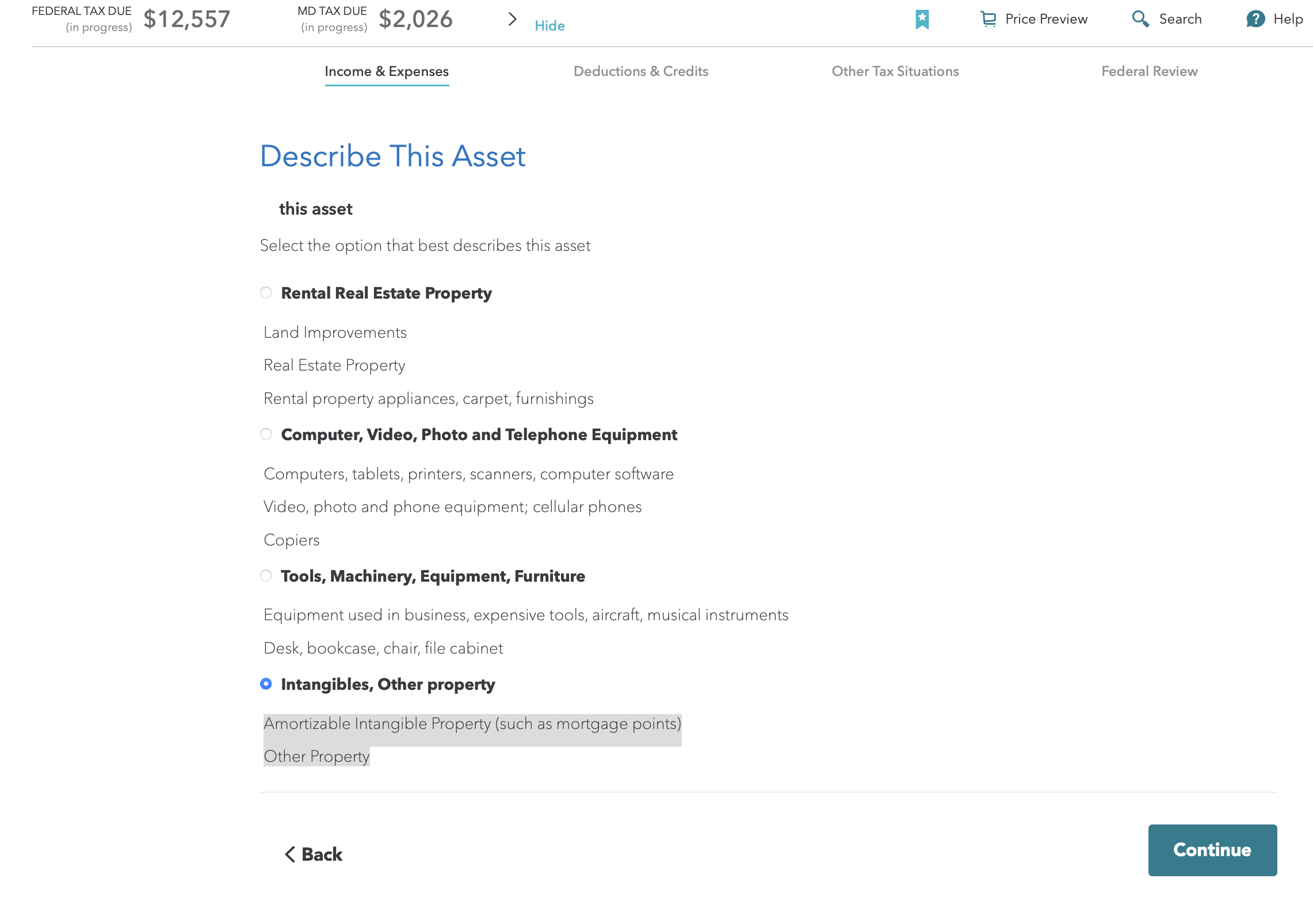

See the following screen shots for aid in navigating;

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

What do you do from there? It asks questions related to hard assets - cost, date purchased, etc? do you enter the full amount of points and other refi fees & the date of refi?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

There are two types of closing costs associated with rental property, and from my experience, the program is effective on dealing with only one type on a consistent basis.

- Coats associated with acquisition of the property are added to the cost basis of the property. An example of this would be the title transfer fees paid at the courthouse to remove the seller's name from the deed and replace it with the buyer's name. The program seems to handle these just fine, *IF* entered correctly in the program.

- Cost associated with acquisition of the loan are amortized and deducted over the life of the loan. An example would be points paid at the closing, as well as the property survey fee if the lender required a survey as a condition of the loan. If the program does not enter these costs correctly in the assets/depreciation section, (it usually doesn't in my experience) then you will have to enter those amortized costs manually.

Here's how to enter the points in the Assets/Depreciation section.. (does not apply to entering the property itself, or any other property assets.)

- Select the Add and Asset button. (go straight to the asset summary if presented that option)

- Select Intangibles/Other Property, then continue.

- Select Amortizable Intangibles, then continue.

- Describe it as something like "2020 Financing Fees". Then enter the amount, and the closing date of the loan. Then continue.

- Select "purchased new", then "100% business use", enter the closing date of the loan (again), then continue.

- Code section is 163:Loan Fees, then continue.

- Useful Life in Years is the length of the loan, then continue.

- You can "show details" if you like. Then continue, and that does it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@RobertG please see my response in this thread for a clearer explanation, as your response was not all inclusive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

What about other costs paid at besides points - such as appraisal fee, HOA fees, insurance premiums, processing fees, property taxes, title-related fees, transaction fees, underwriting fees, etc. Can these also be added as an intangible asset?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

ALL closing costs that are not deductible anywhere else on the return are simply added to the cost basis of the property even if the program doesn't list every single individual possibility. Please be smarter then the dumbed down program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Hi @Critter-3 - I've appreciated you taking the time to respond to my questions the past few days, and at the same time, I'm finding statements like "you really need to do some reading to get educated" and "please be smarter then the dumbed-down program" discouraging. Would you be willing to refrain from these kinds of directives and from making comments about me personally?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I thought I was being encouraging ... sadly this forum doesn't allow my personality to shine thru. I just was trying to sum up the long thread to the brass tacks since the program (that is written at a third grade comprehension level and for the masses) has continually "dumbed" down the process until it is more confusing than it needs to be. They put in all theseseparate categories of expenses ...which doesn't cover everything ... so the users don't know what they are doing.

Brass tacks : on a closing statement ALL the expenses are added to the cost basis (which can be simply added to any category in the program or to the cost of the property yourself) EXCEPT those that are entered elsewhere which are basically any pre paid insurance/mort interest/taxes/etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

The basics for closing costs:

- Costs associated with acquisition of the property are capitalized and depreciated; meaning they are added to the cost basis of the property. An example would be transfer fees paid at the courthouse to remove the seller's name from the deed and replace it with the buyer's name.

- Cost associated with acquisition of the loan are amortized and deducted (not depreciated) over the life of the loan. An example would include loan application fees paid to the lender. These costs should be entered as a physically separate asset in the assets/depreciation section as "other" asset and identified as loan fees. If I recall correctly, you select the one for SEC163 Loan Fees, or something like that.

When you sell a property, any remaining fees to be deducted are fully deductible in the year of sale.

If you refinance the property, how remaining loan fees are dealt with depends on weather you refinance with the same lender, or a new lender.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

prepayments of taxes and insurance that go into an escrow account at closing aren't deductible either. it is the year when money is taken out of escrow that you are entitled to a deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Hi Car, thank you for your detailed answer. I have a no-mortgage rental property and try to enter depreciation information into TurboTax Business. Do you know what code section I should use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I don't know enough about TurboTax Business to be of any help here really.

Typically, those closing costs associated with acquisition of the property are just added to the cost basis of the property. Then "the property" is entered in the Assets/Depreciation section. For residential rental real estate it's depreciated over 27.5 years.

Costs associated with the acquisition of the loan and amortized and deducted (not depreciated) over the life of the loan. Since you have no mortgage, you don't have any amortized costs to enter. So there's no reason I can see for you to be in the "other asset" section.

But like I said, I don't know that much about TurboTax Business. So maybe that's where you're supposed to be for all I know? But I doubt it.