- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

Hello,

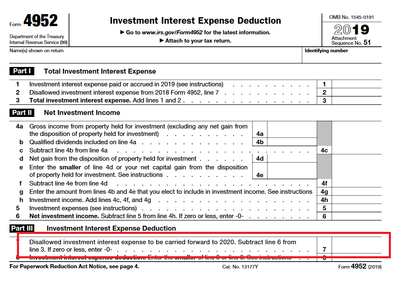

I would like to know if it is possible to carry forward investment interest expense from form 4952 if somebody uses the standard deduction for that year. For example, if investment interest expense on form 4952 is $10,000 for 2019, is it possible file this form in 2019 and carry forward this $10,000 to the 2020 form 4952 even if the standard deduction of $12,200 is used in 2019? I have researched this but it is unclear if this form can still be filed even if deductions are not itemized for a given year.

Thank you

April 12, 2020

7:12 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Yes, you can carry the disallowed portion to the 2020 tax year (you will find that amount on Line 7).

April 12, 2020

7:34 PM

682 Views

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

No it is not possible to carry forward an investment expense into a future year.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 12, 2020

7:35 PM