- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Robinhood 1099-MISC

So I received a 1099-MISC from Robinhood and in the royalties row I got $1.64 with a C next to it. I'm not even sure how I got this. How would I describe this in turbotax and what do I put in for the descriptions when asked about?

The only two options I get when talking about the source are:

- Investment income from property you own

- Royalty income from your business, including artist royalties or operating a natural resources business (Schedule C)

I'm not sure on how I should go on with this and which way is the correct way to do it. Any help would be appreciated. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

To describe this in TurboTax, you can say something generic, for example: Royalty Income from Robinhood

This can be handled in the Less Common Situations. To enter in TurboTax, follow these steps:

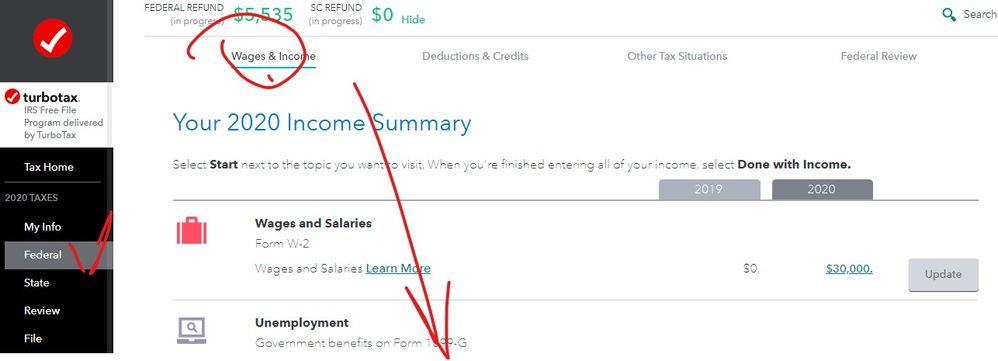

- From the left menu, select Federal

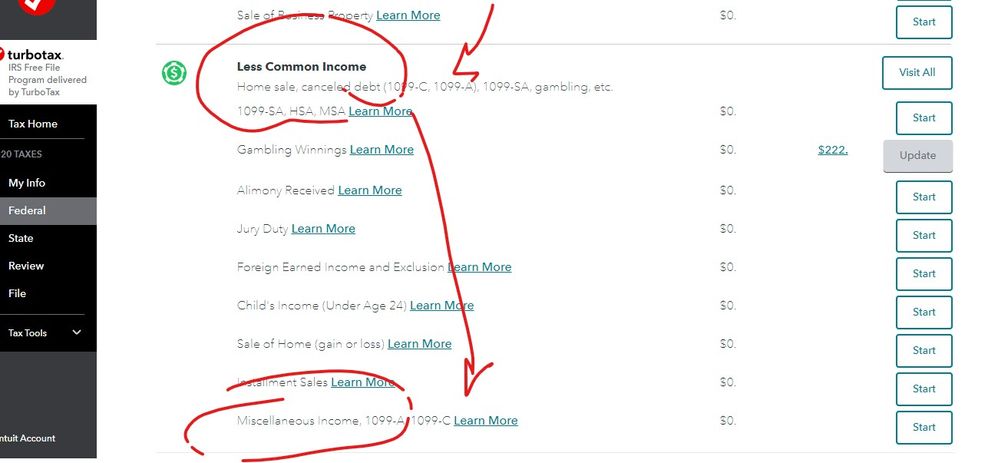

- Wages & Income scroll all the way down to Less Common Income and click Show More

- Select the last listed option for Miscellaneous Income 1099-A, 1099-C, click Start

- Next, select the last listed option Other Reportable Income

- Did you receive any other taxable income, click yes

- Other Taxable Income: Enter your description and the amount and click Continue and Done. Disregard the comment "Do not enter income from Form 1099-MISC here" because this is meant to guide taxpayers reporting typical 1099-MISC income. Your case is less common and this is how you can report it in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you for the answer KathrynG3. I followed those steps but it still wants me to enter a 1099-MISC form. I'm not sure what to pick for the source of income since I do not own any property or have my own business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Follow these directions to post 1099-Misc, box 3 income not subject to self-employment taxes.

- Down the left side of the screen, click Federal.

- In the center of the screen, click Income & expenses.

- On the screen Your income and expenses, scroll all the way down to the last section, Less Common Income.

- Click the Start or Update button for the last topic, Miscellaneous Income, 1099-A, 1099-C.

- On the next screen, Let's Work on Any Miscellaneous Income, scroll down and click the Start or Update button for the last topic, Other reportable income.

- The next screen asks, Did you receive any other taxable income. Click Yes.

- On the next screen, Other Taxable Income, enter a description and the amount. Click Continue.

- On the next screen click Done.

The income will be reported on Schedule 1 line 8 with the description that you entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I received an 1099-MISC for $6 from the sale of sign-up bonus stock received from Robinhood. Turbo Tax has imported 1099-MISC from Robinhood.

My questions:

1. Should I delete the 1099-MISC imported from the Robinhood?

2. Should I complete section Federal Taxes -> Wages & Income -> 1099-MISC & Other Common Income -> 1099-MISC? If so what should be my entries here? Can you please provide me step by step guidance here, greatly appreciate your help.

3. Some of the answers here on the community suggest to use the section Federal Taxes -> Wages & Income -> Less Common Income -> Miscellaneous Income. If I update this section, should I delete the 1099-MISC imported form from Federal Taxes -> Wages & Income -> 1099-MISC & Other Common Income -> 1099-MISC?

Appreciate your help. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

To answer your questions:

1. Yes, delete and re-add it

2. Yes, you could enter the income there, but you need to watch more carefully that you don't inadvertently fall into the self-employed bucket.

Here are the steps to enter it there:

- From the left menu, select Federal>

- Wages & Income>scroll down and click Add more income>

- Other common income click Show more>

- Form 1099-MISC click Start or Revisit

- Fill in the 1099-MISC as received

- The next screen asks for a description, such as Royalty Income from Robinhood; enter and click Continue

- Does one of these uncommon situations apply? Select None of these situations apply and click Continue

- Did this involve work that's like your main job? Select No, it didn't involve work like your main job and click Continue

- How often did you get income for this? Answer you got it in 2019 only and click continue

- Did this involve an intent to earn money? Select No, it didn't involve an intent to earn money and click Continue

- Do you have any other 1099-MISC answer and click Continue

3. Yes. Only enter it once. It is best to delete it from where you initially entered it. You can also check the Delete a form section to verify it is gone. Before entering it and after deleting it at the point of entry, I recommend verifying it is deleted by following these steps:

- From the left menu, select Tax Tools

- Tools

- Delete a Form

- Scroll to Form 1099-MISC. If you see it there and it is the 1099-MISC from Robinhood, re-delete it and confirm that you want to delete it

- If you don't see it, then you successfully deleted it and can continue re-entering it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I think the afformentioned steps no longer apply now that its a year later, 2021. I am having the original issue as described above, I do not own property nor a business so I am stuck with my Robinhood 1099-MISC and have no idea how to input it, tried the steps above but it seems the working and options have changed. Just end up back on the section to either say i own property ect. or a royalty from a business, of which I have neither.

Jared

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

- Down the left side of the screen, click Federal.

- In the center of the screen, click Income & expenses.

- On the screen Your income and expenses, scroll all the way down to the last section, Less Common Income.

- Click the Start or Update button for the last topic, Miscellaneous Income, 1099-A, 1099-C.

- On the next screen, Let's Work on Any Miscellaneous Income, scroll down and click the Start or Update button for the last topic, Other reportable income.

- The next screen asks, Did you receive any other taxable income. Click Yes.

- On the next screen, Other Taxable Income, enter a description and the amount. Click Continue.

- On the next screen click Done.

The income will be reported on Schedule 1 line 8 with the description that you entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I'm also looking for the answer to this question, does no one know what to do?

@Critter-3 you took what @Critter (I assume these are both your account) wrote and copied it. This no longer applies as the Turbo Tax interface does not show what you are describing anymore as "Income & expenses" is no longer a valid option.

@KathrynG3 Do you have an updated answer on how to do this? It looks like things have changed on the site since 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@kenfeier I decided to save myself the headache and just have a tax pro do my taxes. You’re going to have to pay regardless if you do it yourself anyways.

I don’t know how they do it but yeah I couldn’t find the answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

ok ... the it is now called WAGES AND INCOME but it is still there ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You can report it as other income on Sch 1 line 8. Here's how to enter it in TurboTax.

- Click the Federal Taxes tab ( Personal in the Home & Business version)

- Click Wages & Income. (Personal income in the H & B version)

- On the screen "Your 2020 Income Summary," scroll all the way down to the last section, "Less Common Income."

- Click the Start or Update button for the last topic, "Miscellaneous Income, 1099-A, 1099-C."

- On the next screen, "Let's Work on Any Miscellaneous Income," scroll down and click the Start or Update button for the last topic, "Other reportable income."

- The next screen asks, "Did you receive any other taxable income." Click Yes.

- On the next screen, "Other Taxable Income," enter a description and the amount. Click Continue.

- On the next screen click Done.

The income will be reported on Sch 1 line 8 with the description that you entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I also have this issue. My question is, where did my royalties get deposited into? I've received royalties every month (as stated on the 1099), but they weren't credited to my RH account. Why should I report this as an earning when I don't even know where it went? 🙄 I contacted RH 3 biz days ago, and they haven't responded. I will update and let you know once they do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You will have to enter the information from the 1099-MISC in your return. A copy of the form also goes to the IRS and they will be matching it against your return. Use the steps outlined by Critter-3, above to enter the 1099-MISC.

As to where the royalties went, RobinHood should be able to tell you. Perhaps into your account there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Irene2805 and @Critter-3 Thank you for the update. I have added the Royalties as stated by @Critter-3 .

I see that Turbo tax is still asking for my place of business / rental property I own in regards to this Royalty despite filing out the form you requested. I can see on my 1099 MISC where the Royalties came from, do I place that as the place of business? When my information is submitted will the IRS be able to understand why I filed it in this way?