- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

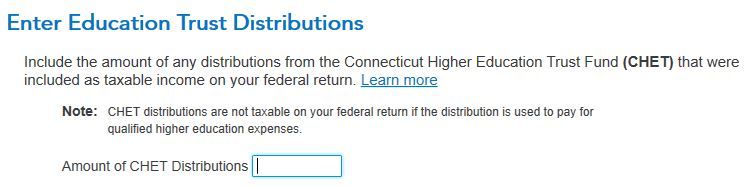

Connecticut tax return form on Education Trust Fund Distributions

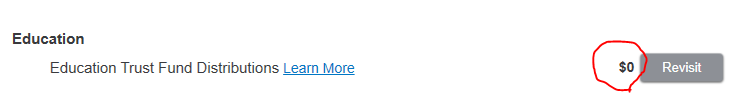

Hi, I'm confused by the above questions. I had a distribution of $21000 from CHET directly paid to a college. According to the Note under the question, CHET distributions are not taxable for qualified higher education expenses (I also like to know how to check it in the federal tax return form). So I entered zero on the box above. However, once clicking continue, I got the following screen with my zero entry circled. It looks like not right now on the screen. Did I enter the number wrong? Please help, and thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

Where any of your Connecticut High Education Trust (CHET) distributions included as federal taxable income?

In the CHET distribution box, enter the amount that taxable on your federal return, if any. You will see this amount on Schedule 1, line 8. If the amount is $0, don't enter anything.;

I don't know why you are getting a red circle by entering a $0. I am not seeing that on my return. Someone would have to look at your return to figure that out.

**Mark the post that answers your question by clicking on "Mark as Best Answer"