- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 - business closed

I received a final K-1 for a passive business I invested in. The capital account has a positive balance. (I basically lost all but a portion of my investment). How do I enter this correctly in TT?

Thank you,

Angela

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Did you have this K-1 in prior years? If so did it have losses? Did you use TT for that? If so entering the file K-1 in a total disposition will free up an prior suspended passive activity losses. Ask if you have that but need help understanding it. That can be quite complicated.

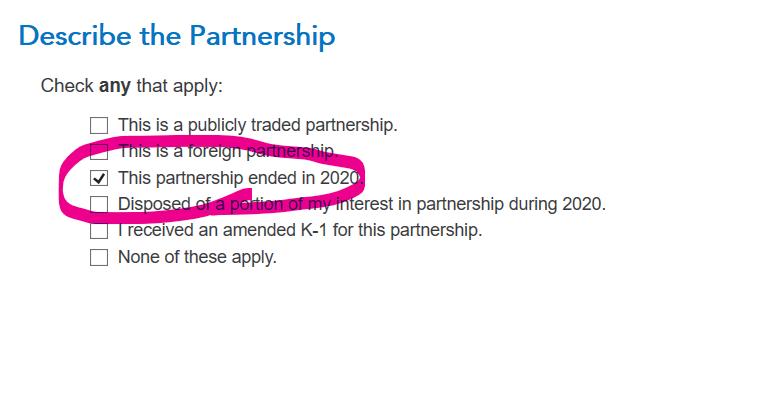

In any case, this year as you go through the K-1 interview you just tell TT the business ended. (The K-1 "final" box should be checked.)

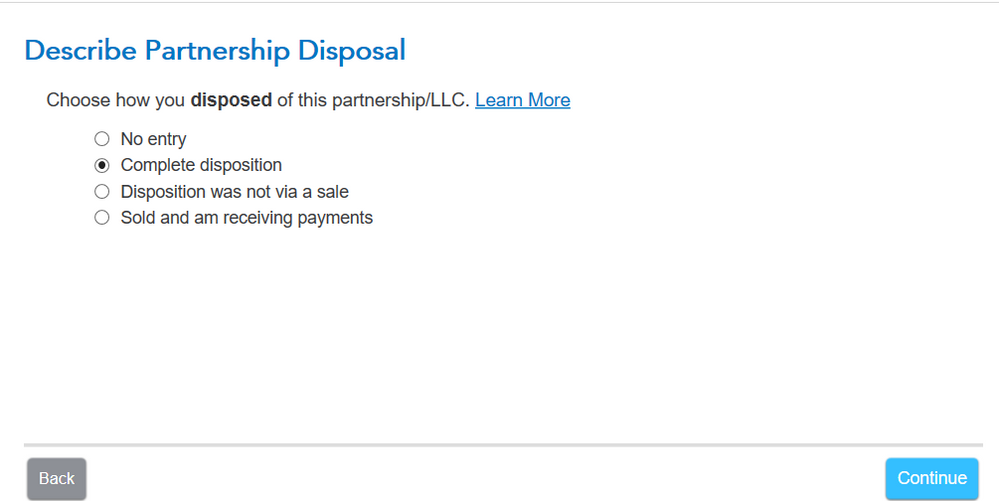

You have a few choices as you'll see below. I'm not sure how much it matters which you choose (e.g. sold or liquidated). Things will work out if you enter it as a sale in which you got $0 (or whatever the business did distribute to you at the end.)

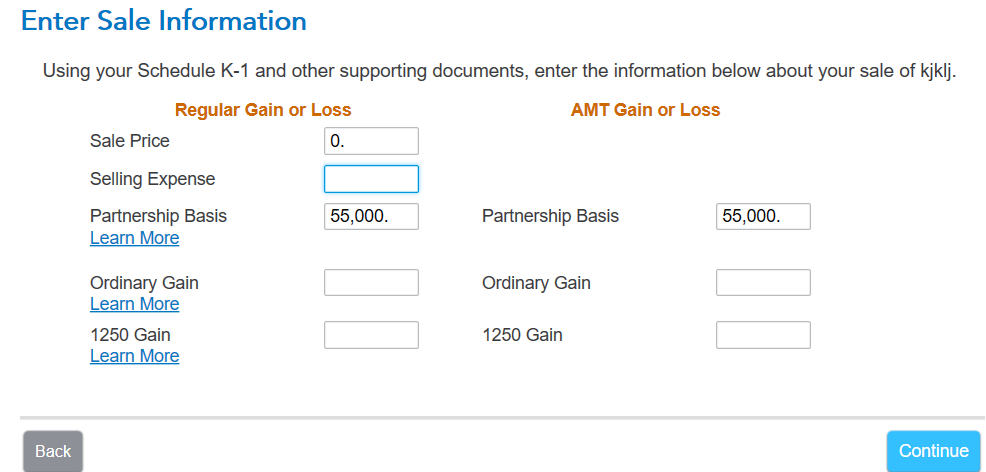

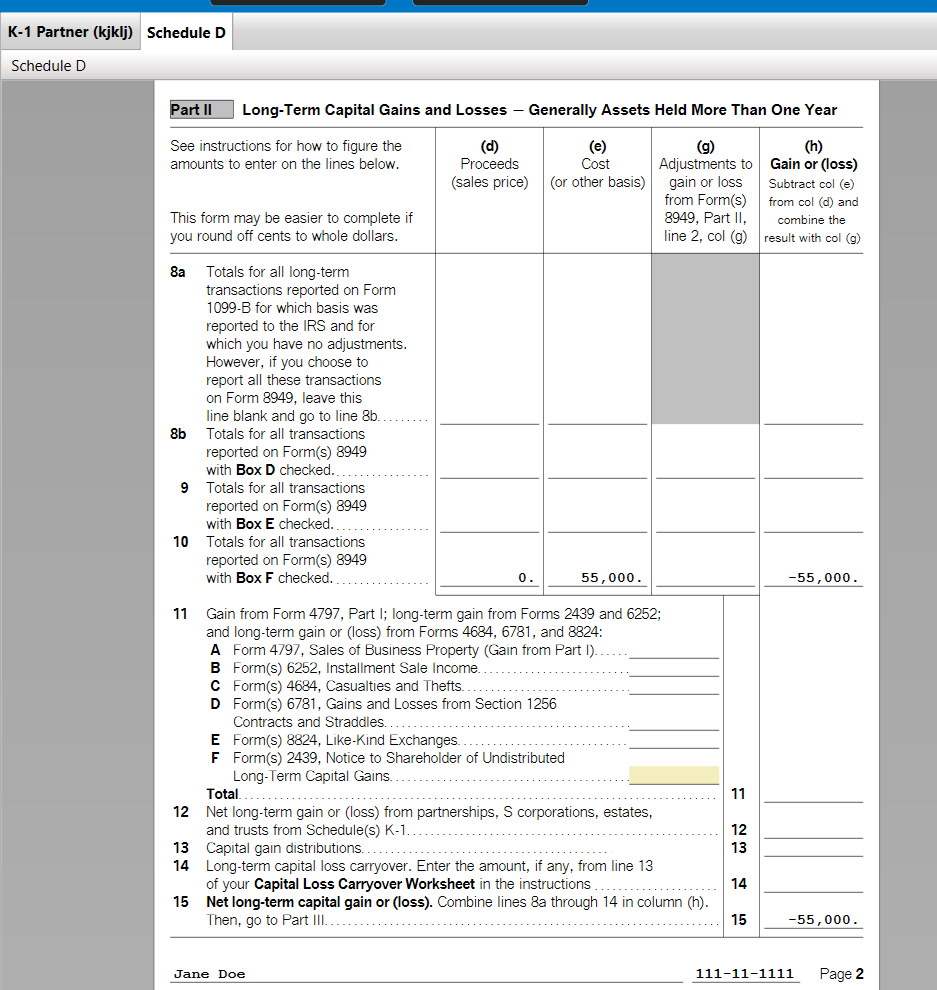

So just enter your purchase info and zero for you proceeds. Then verify that you see the loss shows up on Schedule D line 10 (or 5 if short term).

If you have any entries in the various K-1 boxes (especially box 11) you may need to adjust your basis for those. (See if they flow to other areas of your return). Ask again if that is the case and provide details.

Here are some screenshots of the interview process:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thanks did exactly that and worked correctly. I did go back through my tax returns in TT to confirm my basis (and what losses had been realized already).

Thanks for very detailed response!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

@arhorton glad to help. If you had prior losses that were "recognized" that will usually decrease your basis. (I saw usually because it can depend upon what kind of losses). Also FYI, "realized" means you get the economic benefit (if a gain, or determent if a loss). "Recognized" means that it is taxable income (or a deductible loss). The two often go together but not all the time. E.g. if your passive K-1 enterprise had prior year losses those losses may have been realized but they were not recognized because of the passive activity loss rules. In the year of complete disposition those suspended losses are allowed and recognized. In that example it doesn't really matter much except that the prior losses show up on a different form not a schedule D (as I recall).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thanks for the fantastic response; very helpful and resolved my issue!