- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax doesn't seem to offset my taxes owed when I lost money in my business

I have a job where I get W-2, investment income with capital gains, and single-member LLC. After submitting my W-2, investment income I owe about $1k in taxes. After submitting my business income and expenses my business incurred a lost of $4k from consultation, fees, advertisement, etc. I was expecting the taxes owed to drop significantly but to my surprised it was unchanged. What's going on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

A couple of thoughts:

- Have you actually looked at your return to understand what your Schedule C looks like?

- You need to go through the TT questions and make sure you answer the question about at-risk correctly. You need to make sure you check the box where it asks if all of your investment is "at-risk".

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

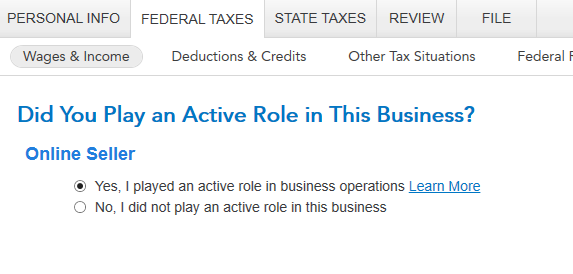

Thanks for the tip. I went back to the Business section where Sch C is. I figured the Active Role might be cause so I change the answer from "No" to "Yes". Right after I selected "Yes" it was able to offset my entire tax owed with some tax return back. The reason I selected "No" before was because I really don't spend much time on this business because its automated.