- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

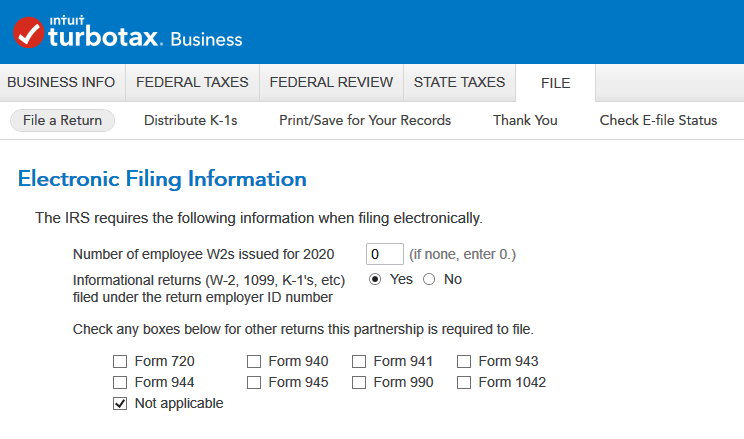

Do I select yes or no to "informational returns filed under the return employer ID number"?

- Multi-member LLC

- For tax purposes, considered a partnership

- Initial filing year (2020) for the LLC

- Operating at a loss this year

- No salaries or wages paid to partners (no W2's)

On the last question before e-filing, there is a question that asks about informational returns, not entirely sure what this means? I plan on generating and distributing K-1's to all 3 partners (including myself).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Partners are NEVER issued W-2 or 1099 forms so unless you have employees or sub contractors the # of W-2 forms is zero and then you did not file payroll tax forms. You should be issuing K-1 forms so your screen shot is correct as is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Awesome, thanks! In what situation would I select NO to that question? I am bit confused with the wording.

Would the answer be NO if I didn't provide any K-1's as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

That exact set of questions are used for all non personal returns and on occasion the form 1041 will not produce K-1 forms but a 1065 will always produce a K-1 for each partner.