- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The easiest/simplest way is to just show the car as removed from the business for personal use in April 2019. Then you can claim/report the donation on the personal side under the Deductions & Credits tab in the Charitable Donations section. But you'll need to reduce the donation amount reported on the 1099-C, by the amount of depreciation you took on the vehicle while it was business use.

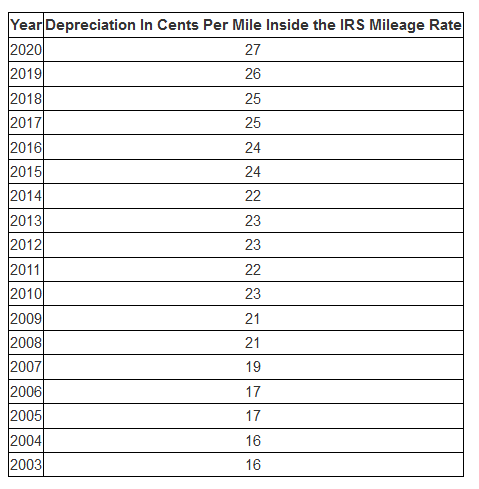

If you took the "per-mile" deduction each year the vehicle was business use, then a portion of that "per mile" deduction you got was depreciation. Just like the amount you can claim per mile each year changes, so does the depreciation amount.

Since you have a record of the starting/ending miles each year and the number of business miles driven each year, it's easy to figure the depreciation you got. Just use the chart below.