- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can we still claim DOT meal allowance in 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you are an employee, DOT meal allowances are a job-related expense which was deductible as an itemized deduction subject to the 2% of AGI floor up to tax year 2017.

They are not deductible in tax year 2018 as under the Tax Cuts and Jobs Act (TCJA), the itemized deductions for job-related expenses subject to the 2% of AGI floor are suspended for expenses incurred after December 31, 2017 through 2025.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Looks like Turbo Tax missed this on the Interview Process

Refer to Publication 463:

Publication 463 (2018), Travel, Gift, and Car Expenses

For use in preparing 2018 Returns

Special rate for transportation workers.

You can use a special standard meal allowance if you work in the transportation industry. You are in the transportation industry if your work:

- Directly involves moving people or goods by airplane, barge, bus, ship, train, or truck; and

- Regularly requires you to travel away from home and, during any single trip, usually involves travel to areas eligible for different standard meal allowance rates.

If this applies, you can claim a standard meal allowance of $63 a day ($68 for travel outside the continental United States) for travel between January 1, 2018, and September 30, 2018. You can claim a standard meal allowance of $66 a day ($71 for travel outside the continental United States) for travel between October 1, 2018, and December 31, 2018.

Using the special rate for transportation workers eliminates the need for you to determine the standard meal allowance for every area where you stop for sleep or rest. If you choose to use the special rate for any trip, you must use the special rate (and not use the regular standard meal allowance rates) for all trips you take that year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

DOT meal allowance. How to claim on turbo tax, for 2019? This is an allowable expense and turbotax keeps rejecting it in 2018 and 2019 is there a work around to make turbo tax allow this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

What rejection message are you receiving? Please paste in the message you are receiving so we can assist you.

Also, what type of business are you in? This will help us research this issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi,

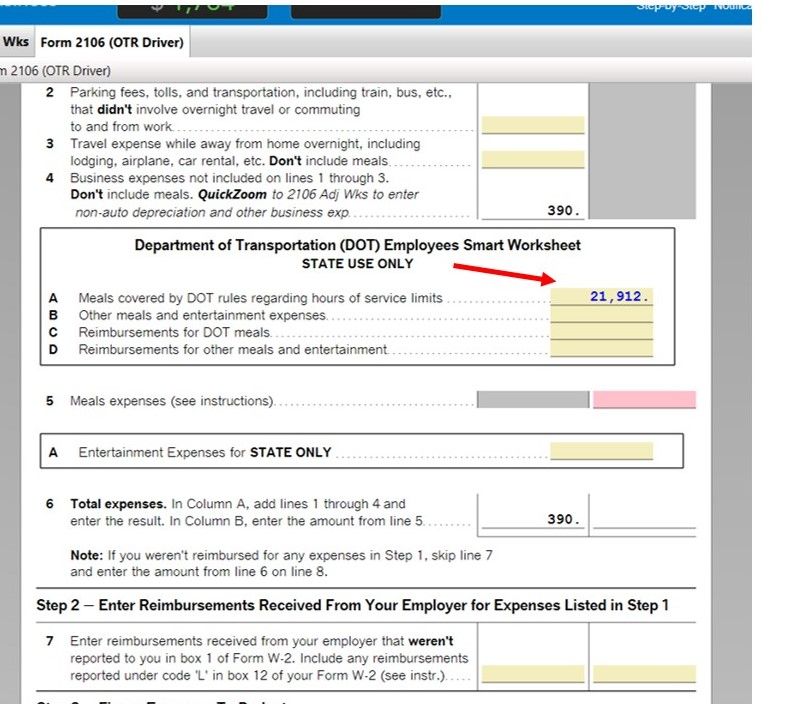

Thanks for asking the questions of the guy above. My son is dealing with a similar situation, as an OTR (CDL) Truck driver, and trying to deduct the DOT Meal expenses. TurboTax is only allowing for State only (see attached 2106 worksheet). Is this deduction only for state, due to limitations? AGI was around $36K, and meals were in excess of $20K since he was on the road most of the year, away from home, sleeping in his truck. Is TurboTax wrong in the software? Or is this a deduction that was eliminated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The ability to deduct DOT meal expenses depends on whether you are an employee (receiving a W-2) or you are an independent contractor or self-employed individual (receiving a 1099-Misc).

The deduction for meals and incidental expenses is not available to employees who receive a W-2. The deduction for job-related expenses or other miscellaneous itemized deductions that exceed 2 percent of adjusted gross income have been suspended. Please see this IRS Article for more information.

Even though the deduction for meals and incidentals is not allowed on your federal return, some states still allow a deduction. TurboTax provides this entry to verify if you are eligible to deduct these expenses on your state return.

If you are self-employed or an independent contractor, you can deduct your DOT meal expenses on Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Individuals subject to "hours of service" limits according to IRS

Publication 463 (2019), Travel, Gift, and Car Expenses

For use in preparing 2019 Returns

You can deduct a higher percentage of your meal expenses while traveling away from your tax home if the meals take place during or incident to any period subject to the Department of Transportation's "hours of service" limits. The percentage is 80%.

Individuals subject to the Department of Transportation's "hours of service" limits include the following persons.

Certain air transportation workers (such as pilots, crew, dispatchers, mechanics, and control tower operators) who are under Federal Aviation Administration regulations.

Interstate truck operators and bus drivers who are under Department of Transportation regulations.

Certain railroad employees (such as engineers, conductors, train crews, dispatchers, and control operations personnel) who are under Federal Railroad Administration regulations.

Certain merchant mariners who are under Coast Guard regulations.

How do we change figure from 50% (standard) to 80% (DOT) to reflect this in Turbo Tax forms?

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Are you an employee or Self-Employed? Refer to the previous comments in this thread.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

My husband is an employee and is an interstate truck operator. The previous comments did not relate to him because his meals are governed by DOT regulations based in the IRS Publication 463 previously cited:

You can deduct a higher percentage of your meal expenses while traveling away from your tax home if the meals take place during or incident to any period subject to the Department of Transportation's "hours of service" limits. The percentage is 80%.

Individuals subject to the Department of Transportation's "hours of service" limits include the following persons.

Certain air transportation workers (such as pilots, crew, dispatchers, mechanics, and control tower operators) who are under Federal Aviation Administration regulations.

Interstate truck operators and bus drivers who are under Department of Transportation regulations.

Certain railroad employees (such as engineers, conductors, train crews, dispatchers, and control operations personnel) who are under Federal Railroad Administration regulations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The rules do apply and the deduction is not available for employees any longer. Make sure what you are referencing is current.

The deduction for meals and incidental expenses is not available to employees who receive a W-2. The deduction for job-related expenses or other miscellaneous itemized deductions that exceed 2 percent of adjusted gross income have been suspended. Please see this IRS Article for more information.

Even though the deduction for meals and incidentals is not allowed on your federal return, some states still allow a deduction. TurboTax provides this entry to verify if you are eligible to deduct these expenses on your state return.

If you are self-employed or an independent contractor, you can deduct your DOT meal expenses on Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you CatinaT1. I do understand what you are referencing; however, I am still confused on this topic after reading the IRS Article?

The document you sent says: Limit on overall itemized deductions suspended.

You may be able to deduct more of your total itemized deductions if your itemized deductions were limited in the past due to the amount of your adjusted gross income. The old rule that limited the total itemized deductions for certain higher-income individuals has been suspended.

THIS MEANS THAT…if you do itemize… your itemized deductions are no longer limited if your adjusted gross

income is over a certain amount.

And although I did read further and saw the section: Miscellaneous itemized deductions suspended.

The previous deduction for job-related expenses or other miscellaneous itemized deductions that exceeded

2 percent of your adjusted gross income is suspended. This includes unreimbursed employee expenses such

as uniforms, union dues and the deduction for business-related meals, entertainment and travel, as well as

any deductions you may have previously been able to claim for tax preparation fees and investment expenses, including investment management fees, safe deposit box fees and investment expenses from pass-through entities. The business standard mileage rate cannot be used to claim an itemized deduction for unreimbursed employee travel expenses during the suspension.

It appears that the miscellaneous itemized deductions are different than his overall itemized deductions used in previous years because he works in the transportation industry.

The document I have been referring to at the IRS websites says:

Publication 463 (2019), Travel, Gift, and Car Expenses

For use in preparing 2019 Returns:

Special rate for transportation workers.

You can use a special standard meal allowance if you work in the transportation industry. You are in the transportation industry if your work:

Directly involves moving people or goods by airplane, barge, bus, ship, train, or truck; and

Regularly requires you to travel away from home and, during any single trip, usually involves travel to areas eligible for different standard meal allowance rates.

If this applies, you can claim a standard meal allowance of $66 a day ($71 for travel outside the continental United States) for travel in 2019.

50% Limit

In general, you can deduct only 50% of your business-related meal expenses, unless an exception applies. (If you are subject to the Department of Transportation's "hours of service" limits, you can deduct 80% of your business-related meal expenses. See Individuals subject to "hours of service" limits , later.)

The 50% limit applies to employees or their employers, and to self-employed persons (including independent contractors) or their clients, depending on whether the expenses are reimbursed.

Exception to the 50% Limit for Meals

Your meal expense isn’t subject to the 50% limit if the expense meets one of the following exceptions.

1—Expenses treated as compensation.

In general, expenses for goods, services, and facilities, to the extent the expenses are treated by the taxpayer, with respect to entertainment, amusement, or recreation, as compensation to an employee and as wages to the employee for tax purposes.

2—Employee's reimbursed expenses.

If you are an employee, you aren’t subject to the 50% limit on expenses for which your employer reimburses you under an accountable plan. Accountable plans are discussed in chapter 6.

3—Self-employed reimbursed expenses.

If you are self-employed, your deductible meal expenses aren’t subject to the 50% limit if all of the following requirements are met.

You have these expenses as an independent contractor.

Your customer or client reimburses you or gives you an allowance for these expenses in connection with services you perform.

You provide adequate records of these expenses to your customer or client. (See chapter 5.)

In this case, your client or customer is subject to the 50% limit on the expenses.

Example.

You are a self-employed attorney who adequately accounts for meal expenses to a client who reimburses you for these expenses. You aren’t subject to the limitation on meal expenses. If the client can deduct the expenses, the client is subject to the 50% limit.

If you (as an independent contractor) have expenses for meals related to providing services for a client but don’t adequately account for and seek reimbursement from the client for those expenses, you are subject to the 50% limit on non-entertainment-related meals and the entertainment-related meal expenses are nondeductible to you.

4—Recreational expenses for employees.

You aren't subject to the 50% limit for expenses for recreational, social, or similar activities (including facilities) such as a holiday party or a summer picnic.

5—Advertising expenses.

You aren’t subject to the 50% limit if you provide meals to the general public as a means of advertising or promoting goodwill in the community. For example, neither the expense of sponsoring a television or radio show nor the expense of distributing free food and beverages to the general public is subject to the 50% limit.

6—Sale of meals.

You aren’t subject to the 50% limit if you actually sell meals to the public. For example, if you run a restaurant, your expense for the food you furnish to your customers isn’t subject to the 50% limit.

Individuals subject to "hours of service" limits.

You can deduct a higher percentage of your meal expenses while traveling away from your tax home if the meals take place during or incident to any period subject to the Department of Transportation's "hours of service" limits. The percentage is 80%.

Individuals subject to the Department of Transportation's "hours of service" limits include the following persons.

Certain air transportation workers (such as pilots, crew, dispatchers, mechanics, and control tower operators) who are under Federal Aviation Administration regulations.

Interstate truck operators and bus drivers who are under Department of Transportation regulations.

Certain railroad employees (such as engineers, conductors, train crews, dispatchers, and control operations personnel) who are under Federal Railroad Administration regulations.

Certain merchant mariners who are under Coast Guard regulations.

I hope these citations help clarify why I am so confused about the 50% versus 80% deductions?

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I apologize for not being more specific about what I need help with.

Yes, Turbo Tax does permit the DOT meal deductions previously mentioned to be used as a deduction for "employees".

The problem we are having is that the rate is locked at 50% (standard deduction) instead of 80% (Special Rates: Department of Transportation's "hours of service" limits) as is explained in the IRS Publication.

I just need to know how to correct/change from 50% to 80% as described at https://www.irs.gov/publications/p463#en_US_2019_publink10009980.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

For a self-employed transportation industry working reporting income and expenses on Schedule C, see the information below to be able to enter the 80% limit for meal and entertainment expenses.

When entering information for the Schedule C business using the CD/downloaded version of TurboTax, use the following steps:

- First, in the Business Profile section, you must be sure that the box for being subject to the DOT hours of service limits has been checked in the Special Situations area toward the bottom of the screen.

- Then, go to the Business Expenses > Other Common Business Expenses area and scroll to the Meals and Entertainment category. Since the DOT box has been checked, you will see a category for the 80% limit where you can enter your information.

When entering information for the Schedule C business using TurboTax Online, use the following steps:

- First, in the General Info section, you must be sure that the box for being subject to the DOT hours of service limits has been checked in the Other Situations area toward the bottom of the screen.

- Then, go to the Business Expenses area and scroll to the Meals and Entertainment category. Since the DOT box has been checked, you will see a category for the 80% limit where you can enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"