- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ordinary versus Qualified dividends - Why does my Vanguard 1099 include the qualified total under ordinary in box 1a and it is added to income

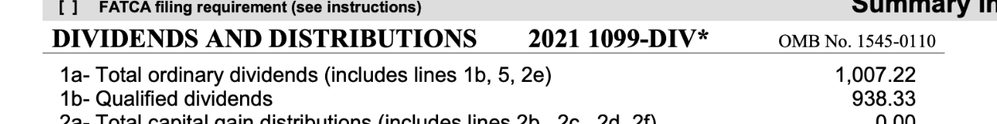

I was reviewing my sons 2021 tax return and noticed something odd. He makes under 40k and had $938 in qualified dividends (box 1b) on his VG 1099 which should be counted as cap gains and his tax rate should be 0% I think. But I see VG reporting $1007 in ordinary dividends (box 1a) which on the 1099 form shows it includes the qualified amount (box 1b) (so my assumption is only 1007-938 or $69 should be ordinary and added to his income.

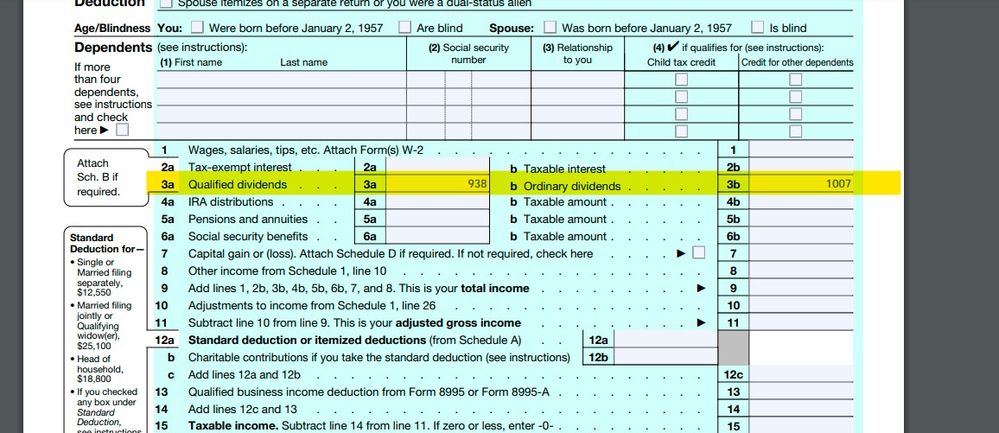

So that $1007 (it's in box 3B on the 1040) appears to be added to his income instead of the $69. Is this right? It doesn't seem right.

Shouldn't VG exclude qualified from Ordinary on their 1099 which loads automatically into TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Ok ... you need to understand the way these are handled on the tax return ... he earned 1007 of total dividends OF WHICH 938 "qualify" for long term cap gains tax treatment ... the way it is reported on the 1099-DIV is correct and you MUST enter it just that way in the program or you will get an IRS letter later.

Now ... the program will enter the total dividends on the form 1040 line 3b and the qualifying div on line 3a. The total on line 3b will be included in the total AGI and that is correct. When it comes to calculating the tax liability it will be done on the Qualifying Dividends and Capital Gains Tax Worksheet so be patient and review that form to see how that works in the end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yeah, Vanguard did it correct. That is how it's supposed to be recorded. It's the terminology that gets confusing to virtually everyone.

Box 1a $$ will properly get added to the total AGI, just like normal capital gains get added to AGI too.

BUT, the 1b $$ are then normally transferred and used on the Qualified Dividends and Capital Gain Tax worksheet when calculating the eventual taxes due. It's on that worksheet that the QuaL Divs are dealt with properly (along with any Cap Gains).

_______________________

Occasionally, a couple other tax worksheets are used to calc taxes, but the 1b$$ would be dealt with properly on those too......it's jsut that the Qualified Dividends and Capital Gains Tax Worksheet is most common.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Now I see it thanks. I took a look at that worksheet. The worksheet itself is messy and confusing but they did back that out of his income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

That is why the program is helpful to do these calculations in the background ... the last time I did that worksheet manually the form was half as long with less supplementary worksheets. 😁