- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter salaried income from a foreign country where the 1099 form isn’t available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

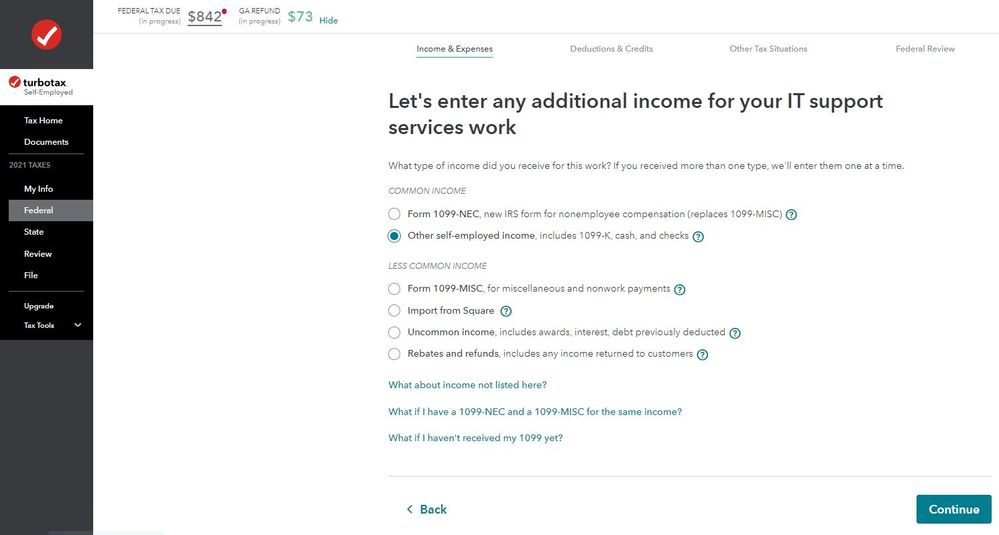

In the section for entering your self-employment income use the option for Other self-employed income, includes 1099-K, cash, and checks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

thank you. I am not sure what you mean. I do not see the 1099 K option

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@arj1y36 wrote:

thank you. I am not sure what you mean. I do not see the 1099 K option

Have you started the Self-Employment section of the program under Income & Expenses? If so, then you should be entering your self-employment income and expenses in that section. In the Income section is the option to enter to enter your income as Cash where a Form 1099 is not needed.

Screenshot -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It's not clear whether you are an employee or self-employed.

If you are an employee, in the Search box type "foreign income" (without the quotes), then click the link that says "Jump to foreign income." When TurboTax asks what form the foreign income was reported on, select "A statement from my foreign employer (could be cash)."

If you are self-employed, enter the income as business income, as DononGA described. Then, to claim the foreign earned income exclusion, follow the instructions above for an employee, but select "A Form 1099-MISC or other self-employment income" and enter the same income that you already entered as business income.