- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find my charitable contribution carryover for 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

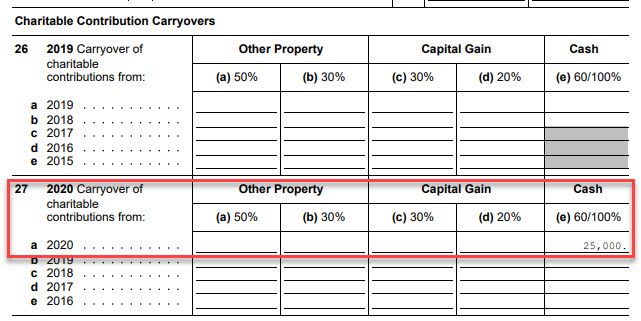

Charitable contribution carryovers will appear on the page 3 of the Federal Carryover Worksheet.

You will not see this worksheet if working online unless you print your return.

- Click on Tax Tools in the left column

- Select Print Center

- Click Print, save or preview this year's return

- Check 2020 Federal return

- Select Include government and TurboTax worksheets (optional)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you have already filed the 2020 return then you need to "break into" your account to get to the print center ... to do this log in and scroll down and click on ADD A STATE to open up the return ... then use the instruction in the other answer to get the PDF with the worksheets included ... just save the PDF and review on the screen and print just the pages you want instead of the entire PDF file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I see each column has a percentage for 30% or 50%, what does mean?

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Contributions are made to different categories of charities ... there should be a blue LEARN MORE hyperlink for more info on the subject.

Read up on limits starting on page 15 here : https://www.irs.gov/pub/irs-pdf/p526.pdf