- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

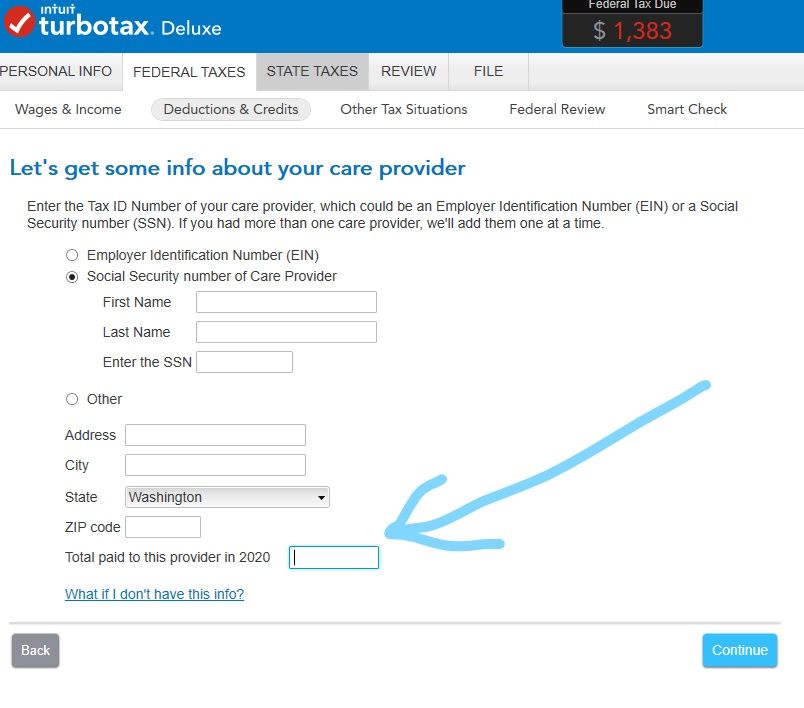

Total Paid to Care Provider

Should the total amount paid to care provider include social security tax and medicare tax if I paid those taxes on their behalf? For example: The gross wage figure I paid to the college student to watch my kids includes those tax amounts, that I then paid to the IRS on her behalf. The net wage figure that she took home as pay does not include those tax amounts.

Which figure do I use when completing TurboTax as the "total amount paid to care provider in 2020?"

Topics:

April 10, 2021

7:26 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Enter the total amount of money tat went out of your pocket for the care.

April 10, 2021

7:29 PM