- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why will Turbo tax 2020 not allow me to enter a 1099 R as a charitable cortribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

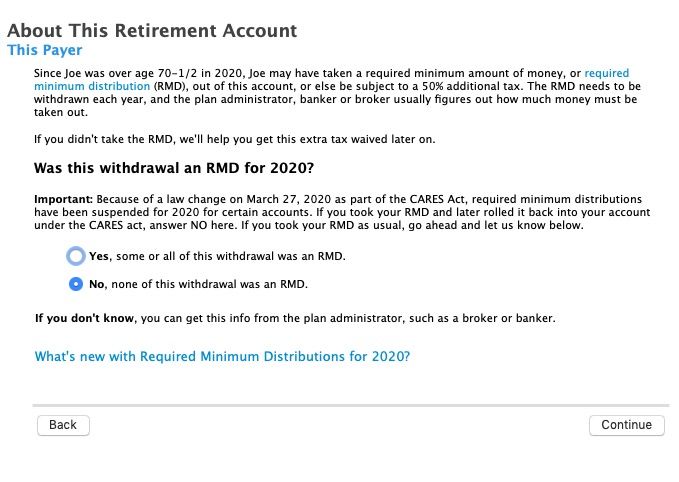

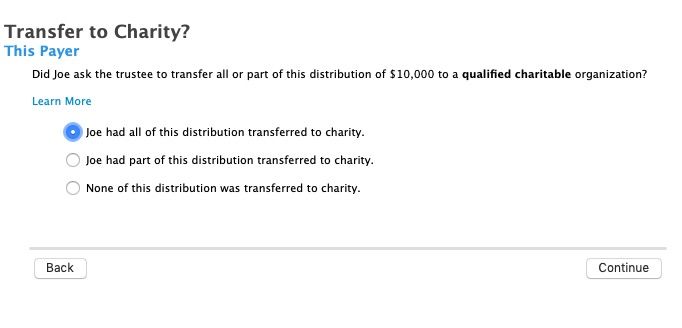

2020 TurboTax presently has a bug the prevents it from asking the necessary question for those with birthdates between July 1, 1949 and June 30, 1950. As a workaround for this, with the CD/download version you can provide the QCD-amount information on the 1099-R in forms mode or in any version of TurboTax you can temporarily change your birthdate in TurboTax to something before July 1, 1949, edit the 1099-R form in TurboTax and answer the question asking how much was transferred to charity, then change your birthdate in TurboTax back to your actual birthdate.

This is due to TurboTax implementing the new IRA RMD age from 70 1/2 to 72, but overlooking that the 70 1/2 age for the QCD did not change. The TurboTax QCD question is tied to the RMD question so if you don't get the RMD question you will not get the QCD question either. This should be fixed in a future update - no telling when, but there is no downside to the workaround as long as the correct DOB is changed back after entering the QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you so much. I fit in the dates you mentioned, and will implement your suggestion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

My birthday is prior to this period but I still do not find anywhere to enter the QCD portion of my RMD. Could there be another way to surpass this "bug?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If your DOB is before 1949 AND the IRA/SEP/SIMPLE box is checked on your 1099-R then yiu shoukd get the screen for a RMD where you say no RMD required for 2020, and then the next screen should ask for the QCD.