- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am not getting the recovery rebate credit for my child born in 2020. Turbo tax says the amounts received look right, but we did not receive anything for our child.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Congress passed the 2nd stimulus bill at the end of 2020. Both stimulus checks were an advance credit for your 2020 tax return, The 2nd stimulus checks started going out at the very end of December 2020 and continued into early January 2021. When you fill out the recovery rebate credit it is important for you to enter the entire total of the amount you have received for yourself, your spouse, and your dependent children so far. Entering the wrong amount might delay your 2020 refund.

It should help you if you bear in mind that the purpose of the question is to determine if you have already received the amounts you should have received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

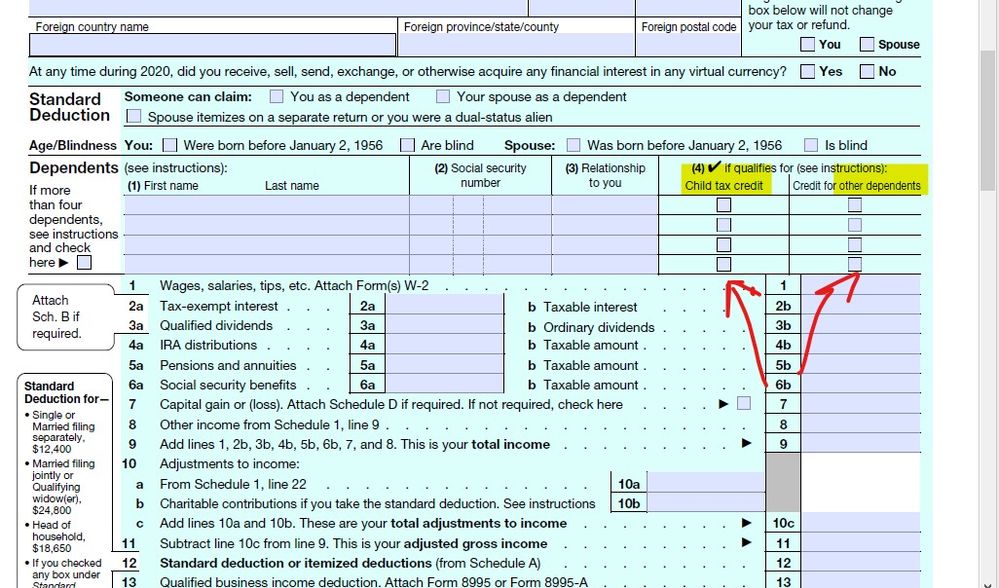

LOOK at the form 1040 on the dependent line ... which box is checked ??? Child tax credit OR other dependent ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You can peek at only the Federal form 1040 (and Sch 1-3) and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2020 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.