- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there another patch on mortgage interest to correct the algorithm. The system is still adding my balance together even when they prior 1098 is marked loan paid off

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

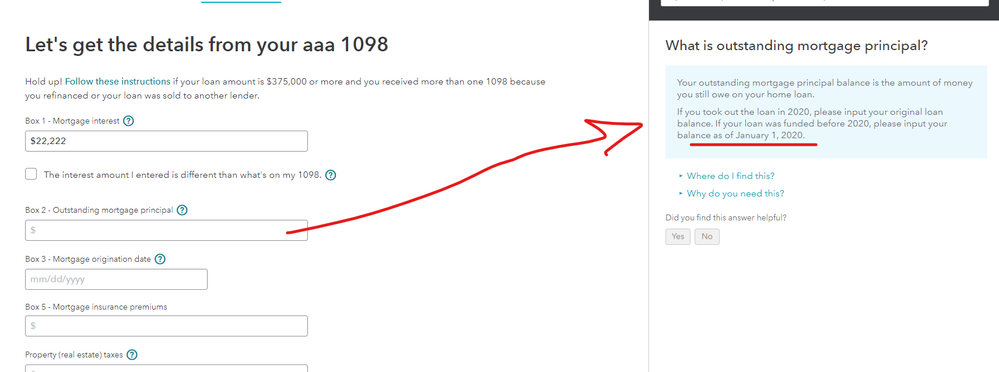

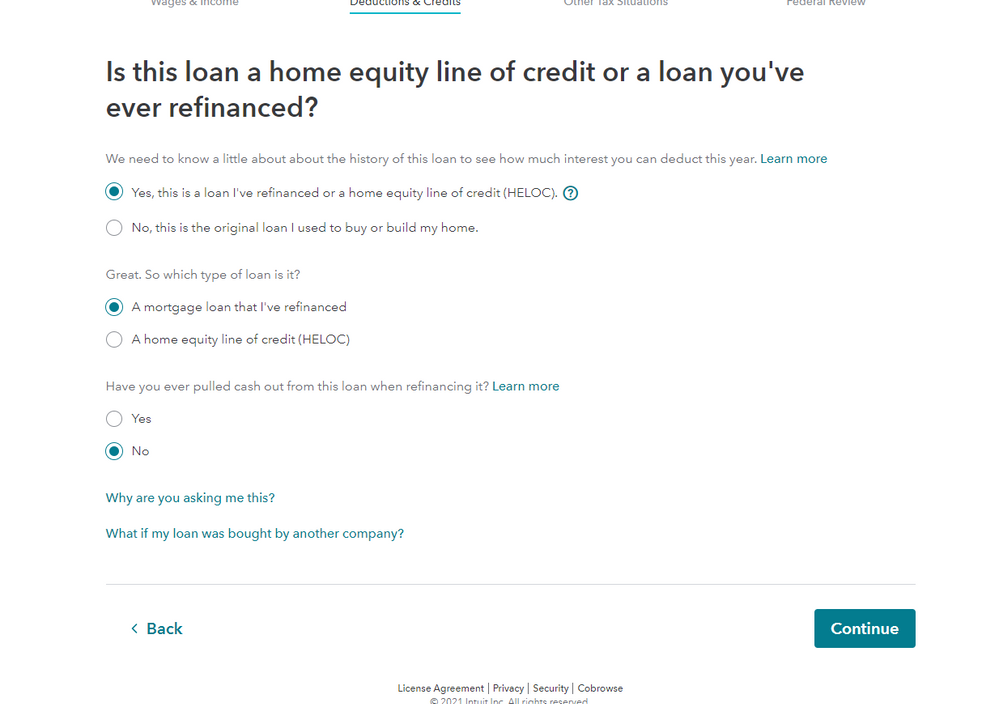

Try this workaround. If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

So close ... ONLY the first 1098 should have the opening balance as of 1/1/2020 and all the other forms will have a zero since the balance of those mortgages was Zero as of 1/1 since they were not in existence at the beginning of the year.