- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

Hi, my spouse and I are filing jointly this year. I have earned income and my spouse does not. Both of us contributed $6000 each to traditional IRA and then converted to Roth IRA (total we contributed $12000).

Since my income exceeds the limit for tax-deduction, all of our contributions are not tax-deductible. I am assuming all of the $12000 contributions are not taxable as well since we are using post-tax dollars to contribute. However, the turbo tax shows that $6000 out of $12000 contribution is taxable.

Can someone help me navigate this issue? Thanks a lot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Where do you see the contribution as taxable?

I assume that you have at least $12,000 of taxable compensation in order to make the contributions.

(Taxable compensation is generally wages that you worked for - W-2 or net self-employed income minus the deducible part of the SE tax and any self employment plan contributions, but can include commissions, certain alimony and separate maintenance, and nontaxable combat pay ).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes my AGI income is way above $12000.

Turbotax says it is taxable in both deduction page and Federal Review page.

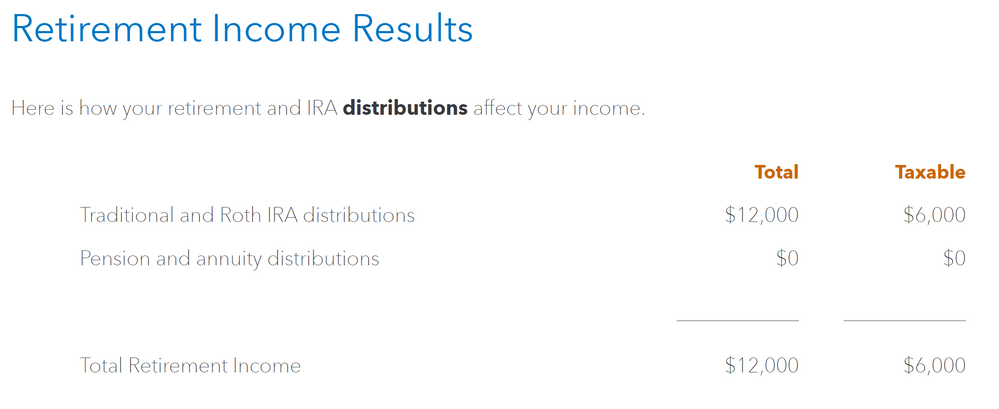

In Deduction Wrap Up step, see image

In Federal Review page, "...your taxable IRA distributions of $6,000..."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

After investigated a bit, I found that the issue is that I wrongly enter 6000 in "Outstanding Rollovers" ("Enter any outstanding 2020 rollovers and recharactizations that were not completed until 2021") for both of us in "Wages & Income" section. I thought it was about how much we rollover to Roth IRA.

Anyway, problem solved. Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

AGI does not matter, Taxable "compensation" does. That is W-2 wages or net self-employed income usually.

However, you screenshot suggests that perhaps when entering the IRA contributions both were entered for the same spouse.