- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble claiming stimulus payments for newborn born in August, 2020.

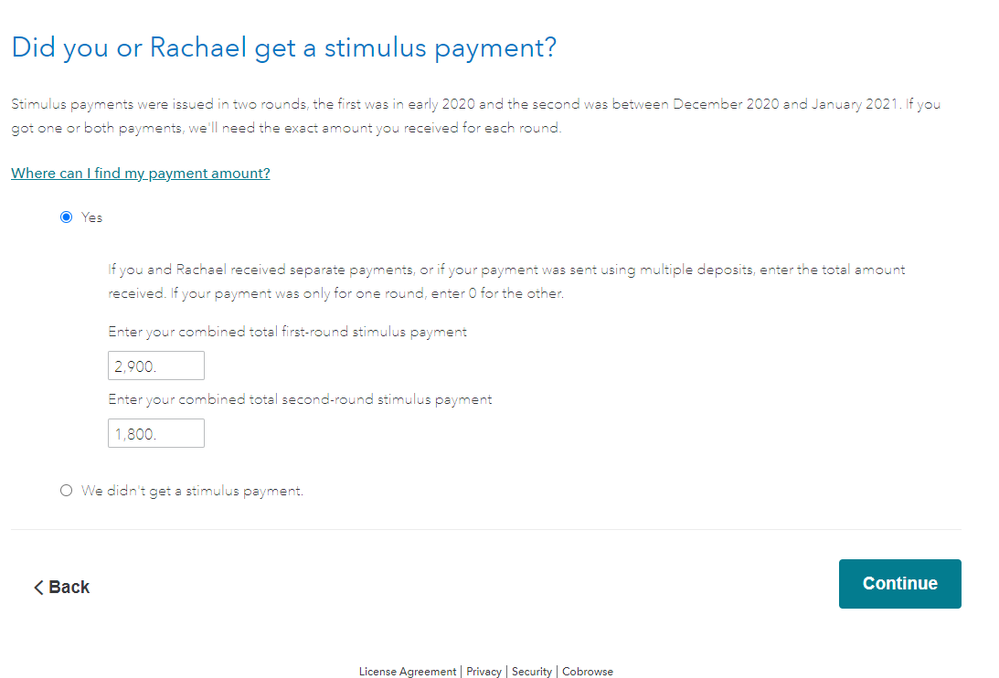

I am trying to claim the $1100 stimulus credit for my newborn who was born in 2020. I updated my household info and added him in, then on the stimulus form I entered the stimulus amounts which I received (for 3 people, 2 parents, 1 dependent, as per 2019 return info) First stimmy: $2900=$1200x2 + $500x1, Second stimmy: $1800 = $600x3

That leaves $1100 outstanding for my newborn. Is there a way I can manually add the 1040 or 1040 - SR to claim the credit? Turbotax isn't recognizing the change in the family and applying it. Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Make sure that the child is correctly reported as a dependent on your tax return. IRS FAQ states:

A qualifying child must have either:

- An SSN that’s valid for employment and assigned to them before the due date of your 2019 return (including the filing deadline postponement to July 15 and an extension to October 15 if you requested it); or

- An ATIN.

An ITIN won’t be accepted for a qualifying child.

Note: When the qualifying child is claimed by spouses filing a joint return, at least one spouse must have an SSN that’s valid for employment for a qualifying child to be considered. If the return isn’t filed by married spouses filing a joint return, the taxpayer filing the return must have an SSN that’s valid for employment for a qualifying child to be considered.

The TurboTax software adds together the entries that you made for receiving stimulus check 1 and stimulus check 2.

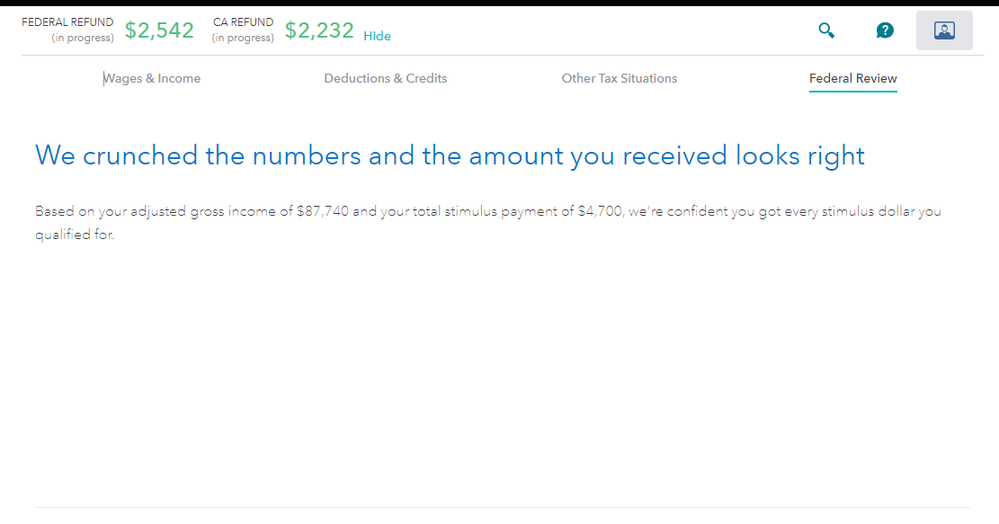

TurboTax will compare your two payment amounts to the computation within TurboTax. The computations within TurboTax are based upon the information that has been entered into the tax software. If you are due an additional amount, it will be issued as a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return.

If you believe that you are due a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return, then you should:

- Check the amounts entered for stimulus check 1 and stimulus check 2, and

- Make sure that you have correctly entered your dependent information.

If there is a difference, it is in one or both of these situations.

In TurboTax Online, you are prompted to input stimulus check 1 and stimulus check 2 information under Review down the left hand side of the screen.

You can also access your stimulus check choices by following these steps:

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Other Tax Situations.

- At the screen Let’s keep going to wrap up. Click on Let’s keep going.

- At the screen Let’s make sure you got the right stimulus amount, click Continue.

- At the screen Did you get a stimulus payment? you can update your stimulus check entries.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yup, he's newly added to my list of dependents. Born in August 2020. TurboTax still isn't recognizing the discrepancy. I input his correct birthdate and SSN. I'm inputting $4700 as the received amount for the 3 family members referenced on my 2019 return that was used to distribute simulus payments. $5800 is the actual amount I should have received if the newborn (in 2020) dependent was factored in based on my # of dependents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yup, he's newly added to my list of dependents. Born in August 2020. TurboTax still isn't recognizing the discrepancy. I input his correct birthdate and SSN. I'm inputting $4700 as the received amount for the 3 family members referenced on my 2019 return that was used to distribute simulus payments. $5800 is the actual amount I should have received if the newborn (in 2020) dependent was factored in based on my # of dependents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

- "An SSN that’s valid for employment and assigned to them before the due date of your 2019 return (including the filing deadline postponement to July 15"

- This is the only discrepancy I can find - being that he was born after July 15th. His SSN wasn't created till August / September. Could this be the reason? Also do you happen to know if the difference will be credited on my 2021 return submitted in 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You will receive the $1100 recovery rebate on the tax return you are filing now, 2020. Question for you - how old was your other dependent on 12/31/2020? And go back through the new addition's information in TurboTax. Make sure the child is showing as your dependent. As long as they are listed as a dependent and you have entered a valid SSN for them, you should get the credit. Make sure you say the child lived with you the whole year even though they were born in August. If you only put 5 months, the child won't be listed as your dependent.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Amazing, it was the "lived with me the whole year" choice that was holding it up. Thank you for your help!