- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EIP disappeared after I entered my son's SSN

I went back into TT for my 2020 filing and entered my son's SSN, after doing so the $1100 EIP credit disappeared from my return and it is stating I only am allocated the $1800 ($1200 + $600) as a max benefit. He was born in 2020 and it was showing the additional $1100 until I added the SSN. Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

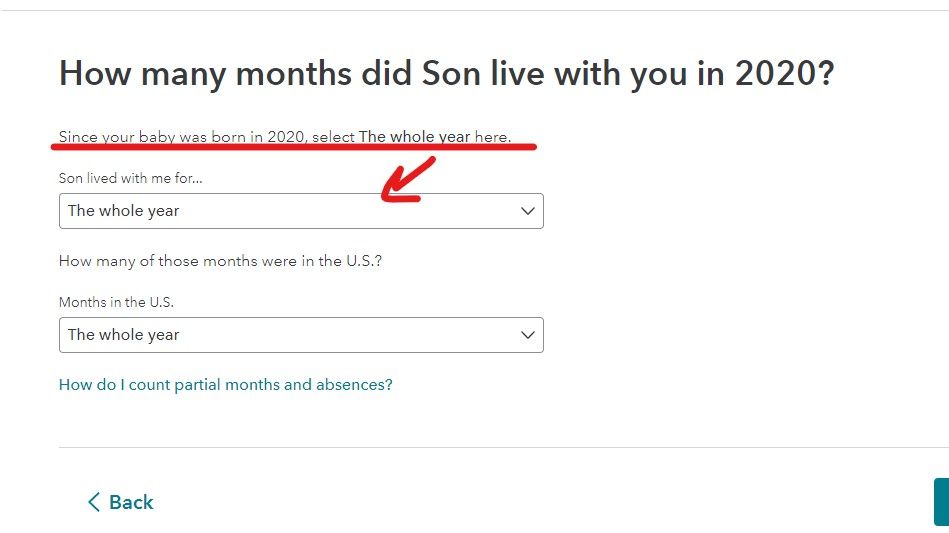

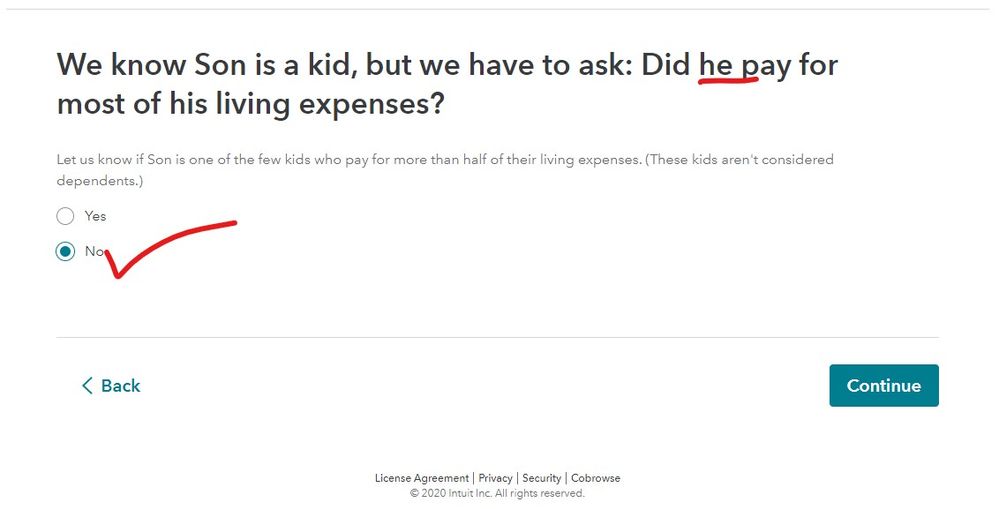

Oh yeah ... bet you made one of the 2 common errors when entering a Newborn ... go back and review the questions in the dependent section and look for these 2 screens ... read them carefully ... for the months the child lived with you choose ALL YEAR and on the screen where is asks if the newborn provided more than 1/2 of their own support the correct answer is NO ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thanks for the suggestion, I rechecked and all those were marked correctly. Apparently, I checked the box that said "this SSN cannot be used for employment purposes" thinking it meant he was not working (don't do taxes while tired). I fixed that one and it is now reflecting the credit correctly. Thank you for having me go back and check all the questions.