- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi Turbo Tax folks. I file MFS and have a dependent care FSA. As part of the FSA I need to file form 2441. This doesn't seem possible right now. Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

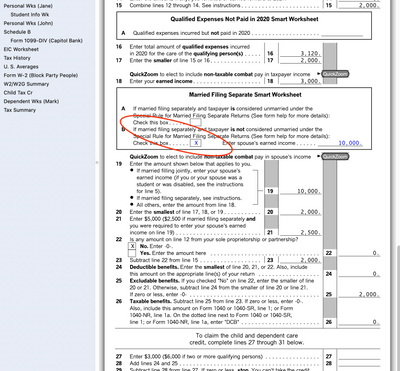

You will have to use the desktop version of TurboTax to complete form 2441 under your circumstance. You can access the form by using the Forms option on your menu bar, then use the Open Forms option and query Form 2441.

You will need to check one of the boxes in the Married Filing Separate Smart Worksheet you will find on form 2441, under line 18.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

ThomasM125 or any expert: OK, exactly what info do I need to fill in on the 2441. I can see the FSA amount on the form, but what else do I have to enter to show that I paid child care providers, which expenses were reimbursed?

And does it matter if the expenses were incurred in 2020, but I was reimbursed in 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Since the child care funding in your Flexible Spending Account (FSA) is considered as a pre-tax dollar contribution, you can take the Dependent Care Credit ONLY on the expenses paid exceeding the total amount contributed in the FSA. For example, if you are allowed to put in $5000 in your FSA as a pre-tax contribution , you are not allowed to take the credit unless you spent more than $5000 on the child care expenses.

To deduct the expenses, you need to enter the total amount spent on child care during 2020 only. You have to show child care provider, Employer Identification or social security of provider, amount paid. TurboTax will do the calculation for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@Cynthiad66 wrote:

Since the child care funding in your Flexible Spending Account (FSA) is considered as a pre-tax dollar contribution, you can take the Dependent Care Credit ONLY on the expenses paid exceeding the total amount contributed in the FSA. For example, if you are allowed to put in $5000 in your FSA as a pre-tax contribution , you are not allowed to take the credit unless you spent more than $5000 on the child care expenses.

To deduct the expenses, you need to enter the total amount spent on child care during 2020 only. You have to show child care provider, Employer Identification or social security of provider, amount paid. TurboTax will do the calculation for you.

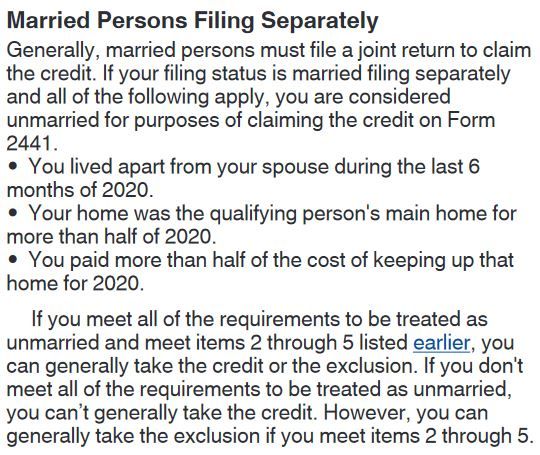

When filing MFS, you are not allowed to claim the child and dependent credit at all. You are allowed to have a dependent care FSA to pay for care, but your maximum FSA is $2500 instead of $5000.

Turbotax will not want to give you the credit on form 2441 if you are MFS, but if you have an amount in box 10 of your W-2, the program should be required to fill out the form. The previous expert @ThomasM125 indicated you can't do this with TT online, I haven't verified that myself.

Turbotax will ask how much you spent on care, how much reimbursement you got, and how much was forfeited in the account. It will get the size of the account from your W-2. If your expenses are more than $2500, any amount over that will not be eligible for the credit if you are MFS. Any amount paid to you that does not match to qualified expenses will be taxed as regular income, and any amount forfeit is just forfeit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@Opus 17said: Turbotax will ask how much you spent on care, how much reimbursement you got, and how much was forfeited in the account. It will get the size of the account from your W-2.

I agree. I am using TT Premier, but I'm not seeing this dialog. I'm not trying to obtain a "credit". I know I'm not eligible if filing MFS. I am trying to zero out pre-tax FSA contributions shown in Box 10 of W2. I'm not seeing that dialogue in TT. Once you check MFS, TT doesn't seem to want to let you do anything else. Perhaps I am missing something obvious.

Does anyone know what sections of form 2441 need to be completed to get this done? I'm OK with filling in the form manually, but it is not clear to me what lines need to be filled in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@williasp wrote:

@Opus 17said: Turbotax will ask how much you spent on care, how much reimbursement you got, and how much was forfeited in the account. It will get the size of the account from your W-2.

I agree. I am using TT Premier, but I'm not seeing this dialog. I'm not trying to obtain a "credit". I know I'm not eligible if filing MFS. I am trying to zero out pre-tax FSA contributions shown in Box 10 of W2. I'm not seeing that dialogue in TT. Once you check MFS, TT doesn't seem to want to let you do anything else. Perhaps I am missing something obvious.

Does anyone know what sections of form 2441 need to be completed to get this done? I'm OK with filling in the form manually, but it is not clear to me what lines need to be filled in.

What happens if you go specifically to the Child and Dependent Care interview? It's on the Deductions page, in the "You and your family" section. You may have to select "let me choose what to work on" or "show me more options" to get the program to show you the full list.

Are you use Turbotax online or installed on your own computer? @ThomasM125 indicated you needed to make an entry in the program on the desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It works fine for me. You may need to delete your dependent or W-2 and start over. Remember that you can't claim the credit, although you can exclude the FSA amount from your income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

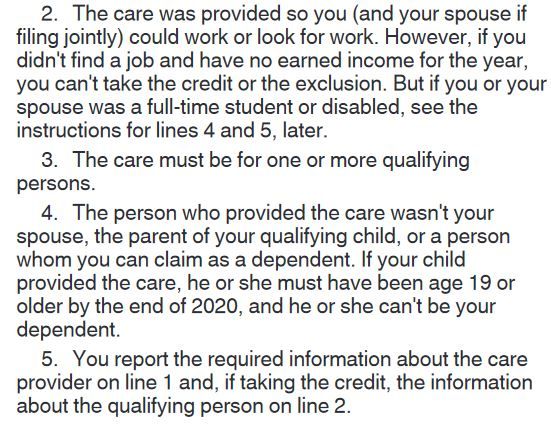

IRS rules/directions:

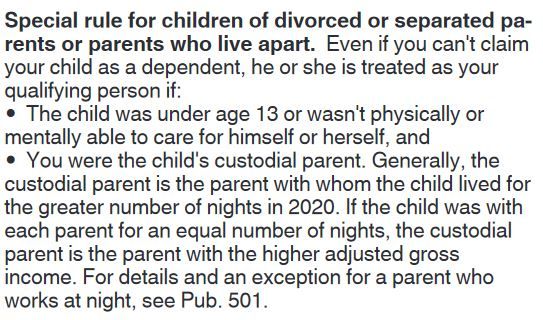

So how do I get TT to correct its program so it will fill out the 2441 correctly for someone filing MFS with a child not claimed as dependent, but who should be a qualifying person for child care expenses covered by an FSA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@williasp wrote:

IRS rules/directions:

So how do I get TT to correct its program so it will fill out the 2441 correctly for someone filing MFS with a child not claimed as dependent, but who should be a qualifying person for child care expenses covered by an FSA.

Did you live apart from your spouse for all of the last 6 months of 2020 (from July 1 onward?). In that case, the parent who had actually physical custody of the child more than half the nights of the year can file as head of household.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

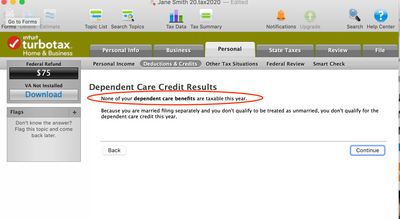

I am filing MFS and not claiming my daughter as a dependent this year. I completely used my dependent care FSA to reimburse child care expenses, however TurboTax is claiming that this is taxable money.

In form 2441, box 18b is checked, however I am not able to enter my dependent care FSA expenses. When going through the prompts, TurboTax tells me that I do no qualify for the credits (which I am not trying to claim), and it does not allow me to include the expenses I used to reimburse my FSA. I am also not able to manually type these expenses into the form. As a result, it's concluding the FSA money is taxable. Has anyone had this issue, or know a way to work around it and edit the form?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

See this post for answer:

If you file MFS and don't claim the child as a dependent, then that child is not a "qualifying dependent" under Pub. 501 and you are not entitled to claim certain benefits, including DCFSA. Thus, the entire amount is taxable even though you actually used it for dependent care. My son was in the same boat last year.

Wouldn't it be great if the IRS would just spell this out clearly and succinctly in the Instructions for 2441.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@mmd88 wrote:

I am filing MFS and not claiming my daughter as a dependent this year. I completely used my dependent care FSA to reimburse child care expenses, however TurboTax is claiming that this is taxable money.

In form 2441, box 18b is checked, however I am not able to enter my dependent care FSA expenses. When going through the prompts, TurboTax tells me that I do no qualify for the credits (which I am not trying to claim), and it does not allow me to include the expenses I used to reimburse my FSA. I am also not able to manually type these expenses into the form. As a result, it's concluding the FSA money is taxable. Has anyone had this issue, or know a way to work around it and edit the form?

Thanks!

There is no workaround, that's the law. When filing MFS, you can't use a DCFSA unless you are the parent who claims the child as a dependent.