- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

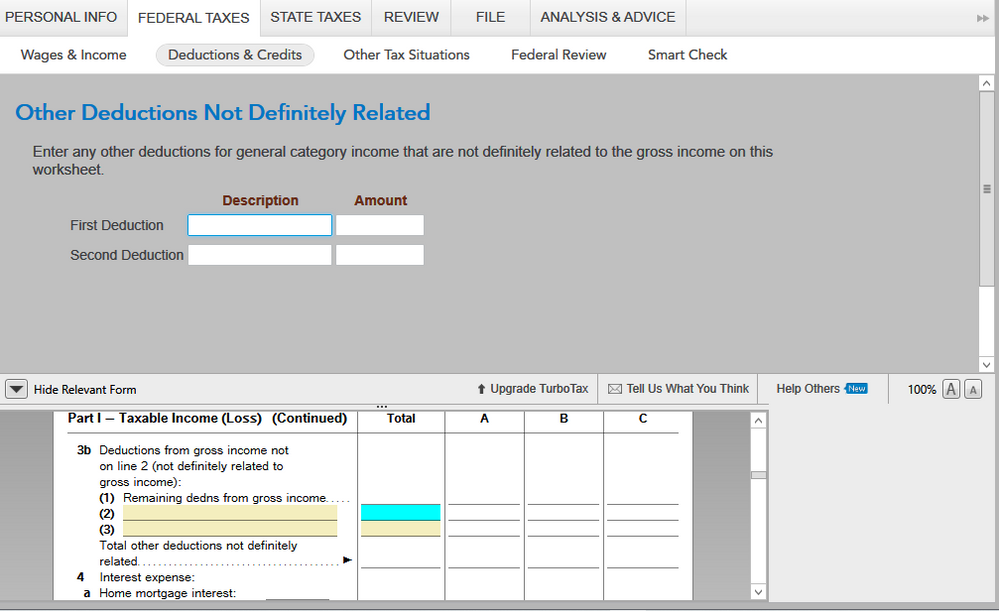

Line 3b is for deductions that do not relate to US or foreign source income, not foreign deductions as your posting indicates. The f1116 instructions uses alimony payments as an example. TT doesn't just fill in the data on it's own, rather the user does this. TT provides space for 2 entries during the interview as can be seen below.

July 15, 2020

5:52 AM