- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1116, TTax fills out itemized deductions in line 3b, such as HSA deductions, IRA deductions, SE Tax deductions, none of which relate to foreign deductions. Wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

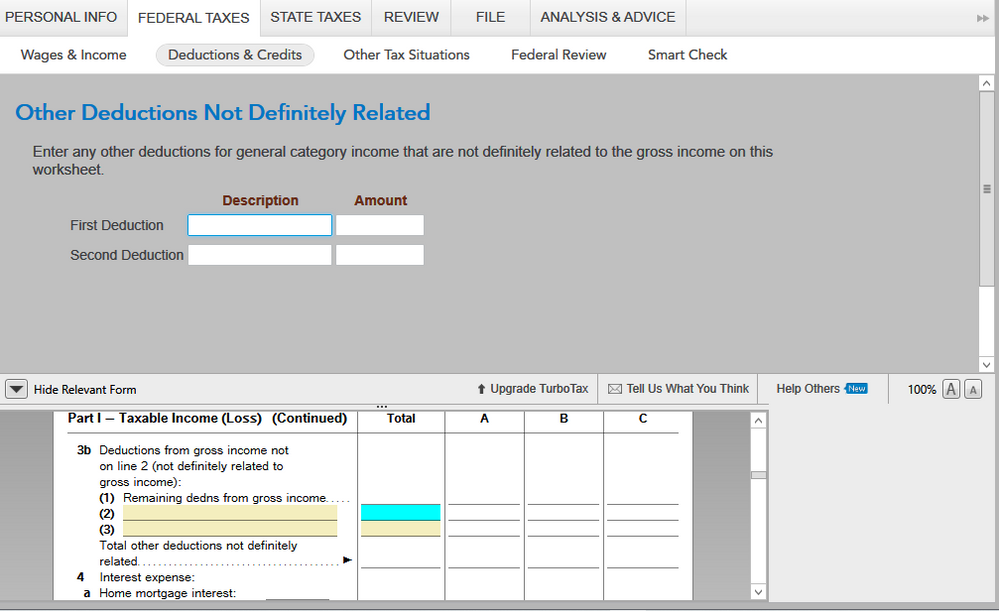

Line 3b is for deductions that do not relate to US or foreign source income, not foreign deductions as your posting indicates. The f1116 instructions uses alimony payments as an example. TT doesn't just fill in the data on it's own, rather the user does this. TT provides space for 2 entries during the interview as can be seen below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi TurboTax Expert,

It appears my 1116 form 3b automatically included IRA deduction amount and the smart check requires me to fill out explanation sheet.

Do I input merely IRA deduction $2,500 to explanation sheet?

Why does it (IRA Deduction) relate to Foreign Tax Credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I would insert the same info as indicated even though it appears redundant. That deduction along with numerous other data is used to determine the net foreign source taxable income in order to calculate the foreign tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The 1116 Instructions explain it (sort of):

"Line 3b. Enter on line 3b any other deductions that don't definitely relate to any specific type of income (for example, the deduction for alimony paid from Schedule 1 (Form 1040), line 18a)."

Look at Schedule 1 of the 1040. All the things you mention are in lines 10-21, adjustments to income. The IRS does not treat those items are related specifically to US or foreign income, so they have you back them our before the calculation of the ratio of US and foreign income is made.

As rogge1772 said above, just enter them when requested,

**Mark the post that answers your question by clicking on "Mark as Best Answer"