- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

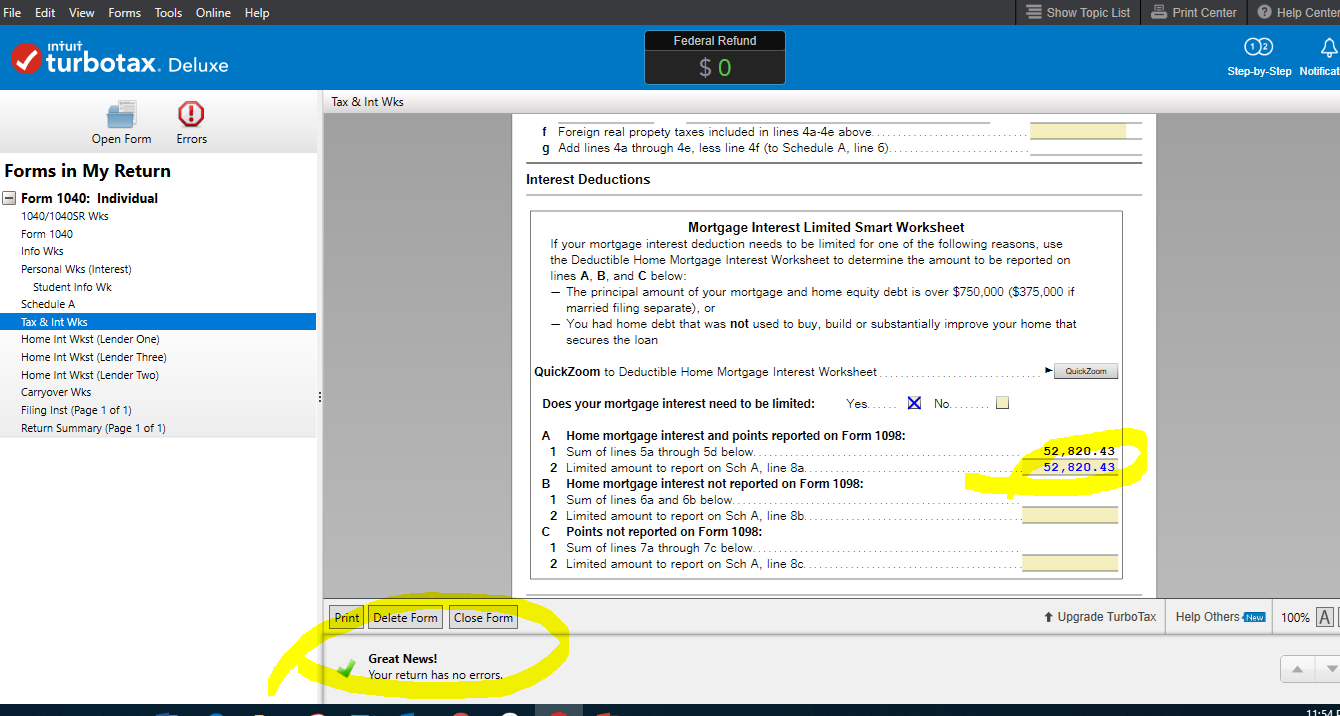

I may have figured this out. (Note: I am using the downloaded version of TT.)

- Click on the View link on the top menu bar

- Click on Forms

- Locate and click on 'Tax & Int Wks' on the left hand side of the screen (under Forms in My Return)

- On the form, scroll down to the 'Mortgage Interest Limited Smart Worksheet'

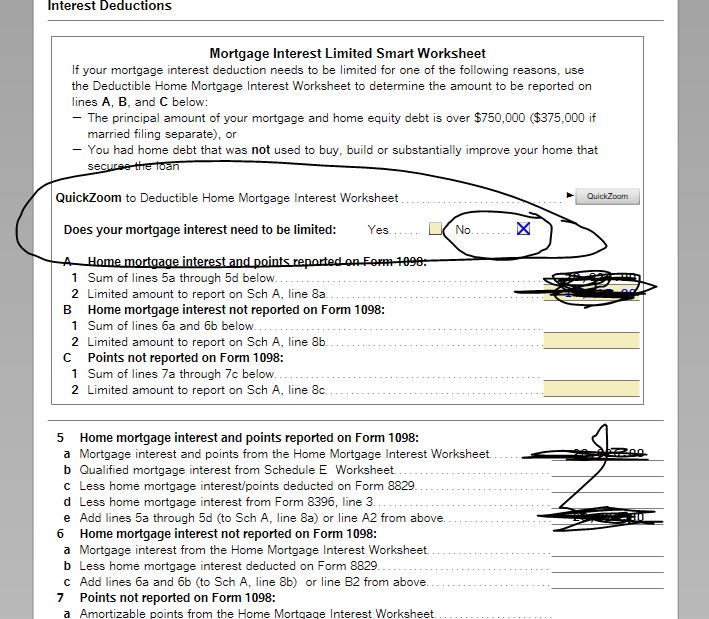

- Clicked on the 'No' box, to the right of the question 'Does your mortgage interest need to be limited' (the No box had been checked). I copied a screen shot below for reference.

Now, when I look at the Federal Review, there is no difference between the Mortgage Interest 'You Entered' and 'You're Allowed'. And my Federal Tax Due is less than it was before I made the change.

This is a big glitch and TT should fix it.

SCREEN SHOT of the FORM view:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Problem solved!! i have spent days searching for resolution to this but yours is only one that i could get to work. THANKYOU!! Would give you more thumbs up but only lets me do 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

UPDATE 2021

It looks like This may have been fixed like today 2/5/2021 or yesterday, update your software. I will post an image in a new reply.

There is definitely an issue with this and the CA 540 form. Selecting the override checkbox "fixes" the final result but it not does actually fix the information within the worksheets.

I had an HELOC and 1st mortgage that I consolidated into a new refi. I am under 750k. But within the CA 540 Ded Hom Mort breakdown as well as the Federal 1040, I noticed that it is not properly calculating the "Average Balance" for each loan. As well as my totally incorrect total loan balance in the CA540 mort ded worksheet part 2 line 2. Just like others have.

The reason the amounts are not calculating properly is because the software is missing two important things to calculate the averages. 1) It needs to know the ending principle that was paid off for each loan. 2) It needs to know the date in which the loan was paid off. Assuming you have loans that were paid off.

It needs this information to find the average over the months the loans were being paid. But then it needs to weight that average over all 12 months of the year.

To make it more complicated, if you changed your balance (say you added to your HELOC) you would need to break down the interval even more to account for the months in which it increased.

These methods of calculating the averages are detailed in IRS form 936. But they are really not discussed on TurboTax.

These things are not listed in a 1098. And they are also not asked of you anywhere within the software. You would have to pull them from statements.

I'm coming closer to just overriding the worksheet values since it does not affect the end result and I am under the cutoff. You should not have to leave out (consolidate 1098s). I don't think that would be a good idea.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Noticed that this is marked as "Solution Accepted." Just curious if this is supported by TT (i.e. will they back it up/support the calculation if you do this). There are a couple of workarounds for what appears to be TT complete incompetence here and I would really like them admit the problem and get a real support fix

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Finally someone with an answer. Thank you.

Would you also need to edit the "Home Mortgage Equity Interest Limitation Smart Worksheet" to accurately reflect the amount "Borrowed in 2019" and "Acquisition debt"? It seems to me that those should be zero for the 1098 that was sent from the lender that purchased the original loan and possibly the refinanced load. Not really sure even after reading through IRS Publication 936. I'm not a CPA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Box 1 is the interest paid in 2019

Box 2 is the balance of the loan on 01-01-2019 OR if the loan was originated in 2019, the balance on the 2019 acquisition date

Box 3 is the origination date, the date you signed the loan papers

The original loan is the loan you signed for at the closing table. It will always be the original loan, even when banks buy and sell your loan, until you refinance it.

Once you refinance the loan, the loan will forever be a refinanced loan.

If the loan is transferred to a new lender, Box 2 should continue the balance from the lender that held the loan prior. This will not be considered as borrowed in 2019. Box 3 should also stay the same.

If the loan is refinanced in 2019, that new balance will be listed as borrowed in 2019 and Box 3 will have a 2019 date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@pugpapa75 I don’t consider the problem solved. It will be solved when TR acknowledges there is a problem and fixes it.

An earlier post said if a person goes in and manually enters information into the sheets. Any guarantees or audit defense will be voided.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi

I am in the same situation. I did an IRRL refinance in 2019 and that loan was then sold back to my original loan holder. This gave me 3 1098s as well. My original mortgage was for 331k. The refi was for 336k just due to loan costs. I thought that the problem was that the new loan was higher, and that the additional money wasn't used to improve or buy the house, but it very well could be because TT is adding together all 3 loans.

I also called for help. I talked with the woman for over a half hour. She wasn't very much help, but I have to give her an A for effort. The solution that I came up with on my own, was to divide the first loan amount by the second. 331xxx/336xxx = 98.5%. I then added all the interest from the first loan, plus 98.5% of the interest from the next 2 loans, and entered that on lines A2 and 5e of the Mortgage Interested Limited Smart Worksheet. This reduced my deduction by about $180. When I had Turbotax check for errors, it passed, and I e-filed my returns. I could not get the window that asked if the first loan was paid off. I'm running desktop Premier version. I live in California too, and didn't have a problem with my CA 540, but this isn't right, and Turbotax needs to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes, TT fixed the 540 after I called. 540 was not working properly when I first entered my data in early Feb. It was working when I went back in on 2/23. BUT the Federal is still not working correctly and adding all the 1098s together and saying I need to limit my interest. I just updated again and it's still not working. I did the override to check the 'NO' box, but TT needs to fix this!! It is so frustrating to pay for Tax Software and then it not work correctly. Mortgage interest is a standard process for anyone itemizing. This has got to affect millions of customers. You should not have to do the calculation manually. I have not filed because I'm trying to hold out for the fix.

For CA Residents, there is also an error on the Schedule CA Adj. (not everyone uses this form, but I need it for HSA) The form shows correct year 2019 on the screen, but prints 2018 on the form. Doesn't matter if you print it with all filing forms or go to forms and print it, it still says 2018, even on the print preview. You won't know this unless you look at all your schedules. I was on the phone 1.5hrs trying to get this resolved. They couldn't access forms to see what I see. I even shared my screen. Then they wanted me to uninstall and reinstall...why should that matter if I'm doing the auto updates?!? I hung up. It's still not fixed.

After more than a decade of using TT, I've never been this frustrated with them. I think I'm going to try a different software next year...this is what happens when companies get too big. They lose (or no longer care about) Quality Control...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

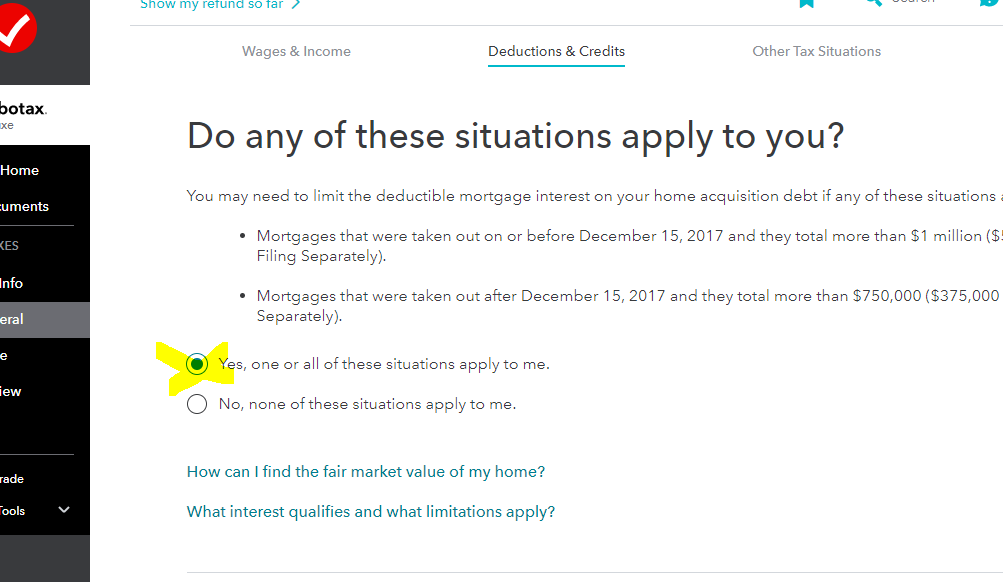

If you get an error concerning the balance, please follow these directions:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I have similar issues..

Loan was sold, then refinanced.. 3 1098's. Having to do these work arounds, that I am not confident in is ridiculous. We need a fix date before I will file. The correct answer vs the error answer is thousands of dollars different for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

This is not a work-around.

The program has no way to know what your acquisition debt is by the information you enter from the 1098.

The instructions above are the steps you need to follow.

Enter the 1098,

if the program asks if your debt is over the limit, you need to answer and make the adjustment in the program.

Perhaps in the near future the IRS will instruct the Lenders to report the average debt, but so far that is up to you to calculate and adjust.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Agreed. Based solely on the 1098's there is no way to know the acquisition debt. However, shouldn't the program be asking us on each 1098 if we paid off the mortgage this year? I think that is what's causing the issue (with that info, the program should be able to calculate the acquisition debt). Most if not all of of us seeing the issue are using the downloaded program and never get that question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I did answer the question that it was NOT over the limit and the program did not keep the answer and automatically changed it to yes and wouldn't allow me to change it back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@squirrels17 Did you ever get this resolved? I'm thinking of just leaving it be, and setting "Adjustment for Interest and Points Reported on Form 1098" to $0 instead of the negative number they incorrectly calculate from the worksheet.

Since the worksheet is just for personal records, that should be safe, right?