- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

My Form 1099-B has gross proceeds on it not net. In turbotax I checked the box and entered sales expenses (real estate commission, town transfer tax, and state tax stamps). On long term gain proceeds does not reflex the sales expenses it has the gross figure. We are not getting the use of the deduction for sales expenses. What am I doing wrong? Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

First make sure your TurboTax software is up-to-date. On the Online menu select Check for Updates.

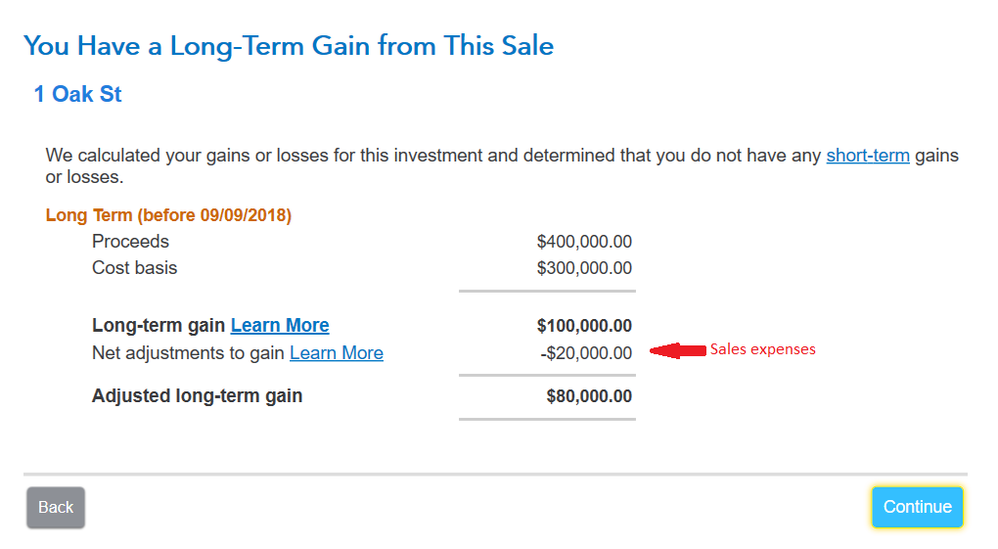

The sales expenses are an adjustment to the gain, not to the proceeds, as shown in this screen shot. The proceeds is the gross amount and the expenses are subtracted from the gain, not from the proceeds.

It's the same on Form 8949. The gross proceeds are in the Proceeds column. The sales expenses should be in column (g) with code E in column (f).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The screen shot solved the problem. We had no long term gain so the sales expenses did not show. That clarified the situation. Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I'm using TurboTax Premier 2019 for Mac. I sold a second home (not a rental) in 2019 and received a 1099-S for the full sales price. The Easy Step process tells me to enter the Net Proceeds. There is no place to document the Gross sales price nor the adjustments to the long term gain for costs of the sale. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The information on Form 1099-S is not directly entered into your tax return. You will use the information from Form 1099-S along with the settlement statement from the sale of your second home to report a capital gain if any.

To enter the sale of your second home with TurboTax open follow these steps:

- Enter home sale in the search box

- then click jump to home sale in the results box.

- Follow the screen prompts to enter your sale information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Did you have a specific question?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

My 1099-S only has gross proceeds listed Where can I find the way to deduct the commission and other costs associated with the sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@Terri1957 wrote:

My 1099-S only has gross proceeds listed Where can I find the way to deduct the commission and other costs associated with the sale?

You enter expenses of the sale and those expenses are subtracted from your Gross Proceeds when entering the second home sale in the Investment section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I sold two personal timeshares, one for a gain, one for a loss. Received two 1099s. When entering it add both together and I cant separate them. I should be paying tax on the gain and a wash on loss. TT is adding them together and showing a net loss for both combined. How do I show both 1099s as separate transactions. Some of the issue may be it is treating it as an investment when it is not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The sale of timeshares is treated as the sale of a capital asset. (However, losses from the sale of a personal use timeshare are deemed to be personal losses and are not deductible)

If you received a 1099-S for this transaction, you will enter it as the sale of a capital asset. On the timeshare that you had a loss on, make sure that you report the basis equal to the amount being reported as proceeds from the sale so that the two amounts cancel each other out (resulting in zero "0" capital gain or loss on the sale)

To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

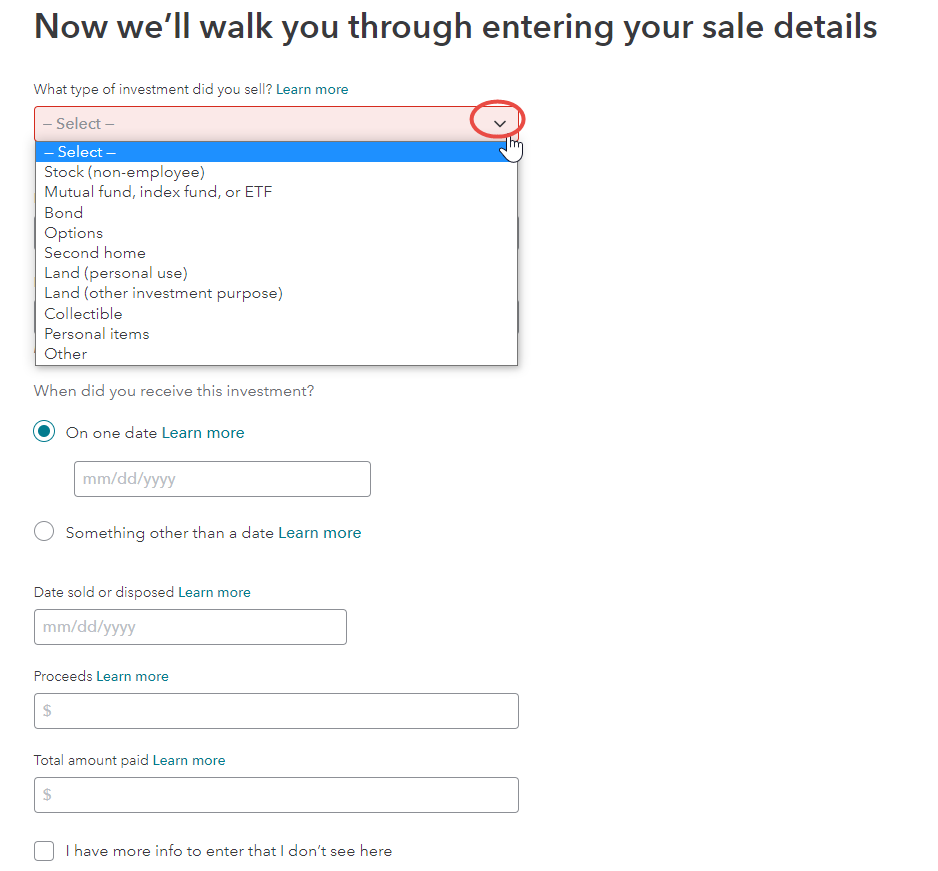

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot #1 below.]

- Click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen,

- Did you get a 1099-B or brokerage statement... click the No box.

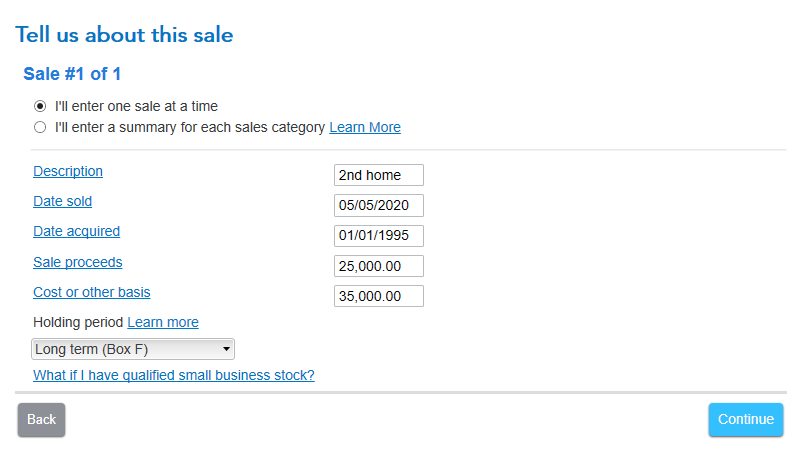

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Land Sale in box 1a.

- Enter the total sales proceeds as well as the other information requested. [See Screenshot #2 below.]

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi, Sold a second home, after entering Description, date sold and date acquired, the form asks for sale proceeds. Is this the gross proceeds or the net proceeds that I actually received? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It is the gross proceed. This is the total amount you received from the sale.

In most cases, your proceeds amount already has fees and commissions subtracted out of it, but if it doesn't you should enter them later when we ask about any sales expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"