- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

According to IRS Publication 590-A and IRS Section 219(g), the minimum deduction for an IRA, the credit it $200. However, making a $10 Traditional IRA contribution does not affect my taxes owed at all (when it should be adjusting my income down $200) and lowering my taxes owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Go to this IRS website for information on the Retirement Savings Contributions Credit - https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-savings-contributions-save...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

adamsh18, you are confusing tax deductions with tax credits and how each of these works with respect to an IRA contribution. Under no circumstances will a $10 IRA contribution reduce your tax liability by $200. A $10 deductible traditional IRA contribution will generally reduce your AGI by $10 (although sometimes there are side effects that can cause it to reduce your AGI by slightly more than that). For a majority of people a $10 reduction in AGI will not change their income tax liability because the tax tables for the most part operate in $50 increments of taxable income.

If you qualify for the Retirement Savings Contributions Credit, a $10 IRA contribution will give you a tax credit that directly reduces your tax liability (separately from any deduction you might get for the contribution) of, at most, $5 (50% of the $10 contribution), often less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

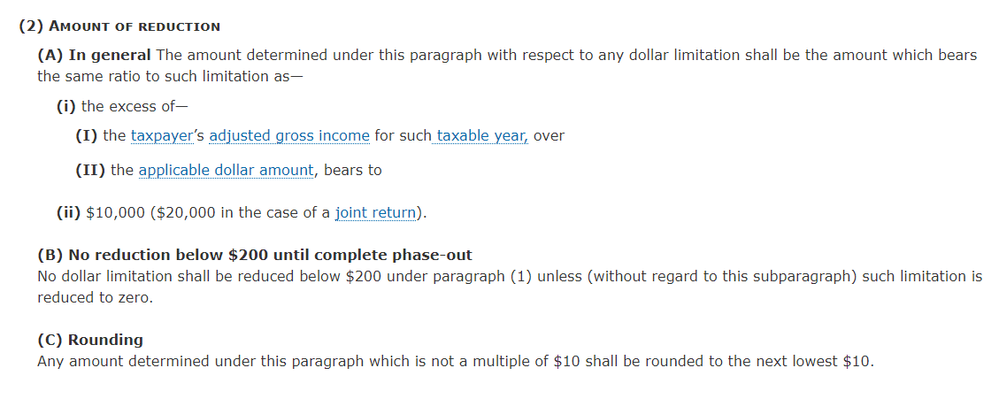

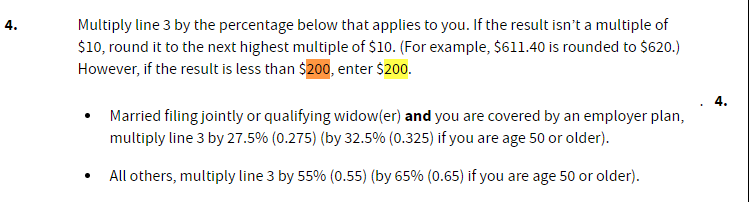

Here is IRC 219 (g) stating that the reduction should be no less than $200.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Section 219(g)(2) governs the limitation of your deduction for a traditional IRA contribution based on modified AGI when you or your spouse is covered by a retirement plan at work. The limitation gradually drops from the full contribution limit when modified AGI is below the phase-out range to $200 as your modified AGI approaches the top of the phase out range, then drops from $200 to zero as your modified AGI reaches the top of the phase out range. This $200 is the limitation ion the deduction, not the deduction itself unless your contribution is at least $200 and your modified AGI is near (but not at) the top of the phase-out range. This calculation is implemented properly on TurboTax's IRA Deduction Worksheet.

For example, an individual with a modified AGI of $73,999 in 2019 ($1 below the top of the phase-out range) will receive a deduction of $200 or the amount of of their traditional IRA contribution, whichever is less. Increasing the modified AGI by $1 to $74,000 will cause the deduction to drop to $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I agree that if you are below the phase-out and contribute anywhere between $10 and $200, according to Publication 590-A, you get a $200 deduction to your MAGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No, that's not what it says. You cannot get a deduction of more than the amount you contribute. See section 219(a):

(a) Allowance of deduction

In the case of an individual, there shall be allowed as a deduction an amount equal to the qualified retirement contributions of the individual for the taxable year.

Section 219(g)(2) simply further limits the permissible deduction.