- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What deductions beyond mortgage interest and charitable are there for senior citizens?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

There are no special deductions for seniors with the exception of an increased standard deduction amount and the Credit for the Elderly and Disabled which hardly anyone qualifies.

Schedule A lets you report certain deductible expenses like:

- Medical and dental costs above and beyond 7.5% of your AGI

- State, local, real estate, and personal property taxes

- Home mortgage interest

- Charitable donations and gifts

- Casualty or theft losses

- Unreimbursed employee expenses above and beyond 2% of your AGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

" increased standard deduction amount" -- this needs more explanation!

I'm 68 yrs old. Turbo Tax put an additional $1,600 onto my 2018 standard deduction of $12,000. This was the first time I saw it. So I looked back on my 2017 & 2016 taxes and saw Turbo Tax added $1,550 onto my standard deduction both of those years.

So I looked all over the internet including IRS.gov and the 1040 Instructions for anything about this senior deduction. I found nothing.

I don't want to search again, but would like to know if anyone here knows where to get the description, explanation, or anything in writing about this deduction!

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

someone already answered and I replied; I'm re-sending it to you directly, kilpatl8:

The answer needs more explanation and I don't have it. But here's what I know:

I'm 68 yrs old. Turbo Tax put an additional $1,600 onto my 2018 standard deduction of $12,000. This was the first time I saw it. So I looked back on my 2017 & 2016 taxes and saw Turbo Tax added $1,550 onto my standard deduction both of those years.

So I looked all over the internet including IRS.gov and the 1040 Instructions for anything about this senior deduction. I found nothing.

I don't want to search again, but would like to know if anyone here knows where to get the description, explanation, or anything in writing about this deduction!

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Your standard deduction reduces the amount of income you have to pay tax on. For 2018 tax returns and beyond, your standard deduction was nearly doubled from the amounts of earlier tax years.

Your standard deduction lowers your taxable income. It is not a refund

2018 Standard Deductions:

Single $12,000 (+ $1600 65 or older)

Married Filing Separately $12,000 (+ $1300 65 or older)

Married Filing Jointly $24,000 (+ $1300 each spouse 65 or older)

Head of Household $18,000 (+ $1600 65 or older)

Look at line 8 of your Form 1040 to see your standard or itemized deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Perhaps you didn’t see my question.

Look above, at the answer, with an additional question, from “chernon”

Where would a person find this info online, from IRS, or in the 1040 Instruction booklet?

Line 8 does NOT show how much to add to the standard deduction of $12,000.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@BGRS wrote:Where would a person find this info online, from IRS, or in the 1040 Instruction booklet?

Line 8 does NOT show how much to add to the standard deduction of $12,000.

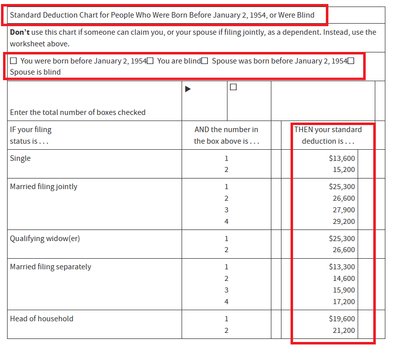

See https://www.irs.gov/instructions/i1040gi#idm139844929612032 (screenshot below).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@BGRS Not sure what you even mean by any question from "chernon." YOU do not add anything to line 8. When you enter your date of birth into the My Info section, the software uses your age to calculate your standard deduction automatically. It goes by your age at the end of the tax year.

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

Try reading page 35

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

See IRS Publication 501 page 22 Higher Standard Deduction for over 65