- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had to pay back relocation expenses to my previous company when I switched jobs in 2017. Can I claim this expense on my 2017 tax return?

I had to pay back relocation expenses to my previous company when I switched jobs in 2017 because I did not complete 2 year with my previous company. Can I claim this expense on my 2017 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends. If the moving expenses paid by your employer were not taxed, then you can't take a deduction.

If you did pay tax on these payments, then this situation is referred to as a Claim of Right under IRC Section 1341. It can be claimed as either an itemized (miscellaneous) deduction or as a credit if the amount repaid is more than $3000. The deduction is the simpler way to claim your repayment, but a credit might save you more money.

To claim the repayment as an itemized deduction, you would use TurboTax Online Deluxe or a higher version.

- Click on Federal Taxes on the left side of your screen.

- Click on Deductions and Credits.

- Select All Tax Breaks, and scroll down to Other Deductible Expenses.

- On Did you have any of these less common expenses? say Yes.

- If your repayment was less than $3000, enter the amount and description on the screen Tell us about your less common expenses

- Continue to the screen Did you have any of these other deductions? If your repayment was more than $3000, answer yes.

- Enter the amount on the next screen.

If you decide to claim your repayment of over $3000 as a credit, follow the information starting on page 33 of IRS Publication 525 Taxable and Nontaxable Income under Repayments. This requires a special computation, and you would need to use a Desktop version of TurboTax and enter your credit using the Forms mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@IsabellaG thanks for this! your logic makes sense, but I'm worried that this won't work anymore because:

1. The TCJA eliminated the miscellaneous itemized deduction on Schedule A line 28. Does this mean this deduction method won't work anymore?

2. my relocation expenses were taxed at income tax, but according to this article, relocation payback is not eligible for section 1341

https://www.worldwideerc.org/article/repayments-under-us-payback-agreements-no-longer-deductible/

what are your thoughts on this? Would love to hear them as I am in the same predicament! @dennisjemmatty

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi,

Hi, I am leaving my current employer and I must pay back my relocation package to him that i got in 2019. If I pay back the full amount (included taxes Gross-Up – Federal, Gross-Up – FICA and Gross-Up – Medicare). How can I get a credit for those taxes gross-up? they are more 3K. they are including in my W2 as wage (line 1). Please provide help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@carf01 wrote:

Hi,

Hi, I am leaving my current employer and I must pay back my relocation package to him that i got in 2019. If I pay back the full amount (included taxes Gross-Up – Federal, Gross-Up – FICA and Gross-Up – Medicare). How can I get a credit for those taxes gross-up? they are more 3K. they are including in my W2 as wage (line 1). Please provide help

If you paid back the income you received in 2019 then you can report that on your 2019 tax return. If the income is paid back in 2020 then that would be reported on your 2020 tax return.

When were these funds paid back to the employer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

i am going to pay back in 2020, but will i get a credit in my taxers for 2020? . Which form need my employer give me , for example W2 with negative wage, ?

thanks a lot for the information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

i am going to pay back in 2020, but will i get a credit in my taxers for 2020? . Which form need my employer give me , for example W2 with negative wage, ?

thanks a lot for the information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You will have to ask your employer if they will be deducting the repaid amount on your 2020 W-2.

If not then you can claim the amount repaid on your 2020 tax return to be filed in 2021. It can be entered either as an itemized deduction on Schedule A or if the amount repaid is over $3,000 then as a credit on your tax return.

Repayment over $3,000. If the amount you repaid was more than $3,000, you can recover the tax you originally paid using one of two methods. You can do it as a deduction on schedule A or a tax credit on line 18d of the 1040 form if when you included the income in a previous year, it appeared that you had an unrestricted right to it.

Figure your tax under both methods and compare the results. Use the method (deduction or credit) that results in less tax.

Method 1. Claiming a deduction for the repaid amount. You deduct it as a miscellaneous itemized deduction on Schedule A line 16.

This is the flow in TurboTax:

Federal taxes > Deductions & credits > I'll choose what I work on > Other deductions and credits > Other deductible expense>Go thru to third screen> answer YES to "Did you have any other deductions that are not subject to the 2% limitation?"

Enter the amount you repaid under, "Claim of Right Repayment (Only if over $3,000).

Method 2. Figure your tax claiming a credit for the repaid amount. Follow these steps.

1. Figure your tax without deducting the repaid amount.

2. Refigure your tax from the earlier year without including the income that you had to repaid.

3. Subtract the tax calculated in (2) from the tax shown on your return for the earlier year. This is the credit.

This is the flow in TurboTax (This can only be done in the Forms mode of the Desktop version of TurboTax)

Go to FORMS (top right of main screen) > Form 1040 Worksheet > Scroll down to Schedule 3 Part 2 below line 12 to "Other Payments and Credits Smart worksheet"

Please enter the credit on line D.

This credit should show up on Form 1040 line 18d

I've included a link to the IRS website for your reference: https://www.irs.gov/pub/irs-pdf/p525.pdf#page=34

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

2 more questions:

- hi, if my employer will be deducting the repaid amount on my 2020 W-2 but the repay is several time more than the amount earning in 2020 (i just worked January 2020 ). they can file a negative amount in my w2.

- Which documentation my employer needs to provide to me, for me to claim the amount repaid on my 2020 tax return to be filed in 2021, under the an itemized deduction on Schedule A or as a credit on my tax return

thanks a lot for your excellent orientation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@carf01 Doubtful that the employer can enter a negative amount on a W-2.

The employer only needs to give you documentation of the taxable amount repaid. It is your decision on how to report the repaid amount on a tax return. Either as an itemized deduction or as a Credit. The Credit would probably give you the best result from a tax standpoint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

- "the employer only needs to give you documentation of the taxable amount repaid" you means an invoice or something like that . there is not a specific form from IRS ??

- What do you mean with " it appeared that you had an unrestricted right to it " in the text below? “ You can do it as a deduction on schedule A or a tax credit on line 18d of the 1040 form if when you included the income in a previous year, it appeared that you had an unrestricted right to it. “

thanks a lot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@carf01 wrote:

- "the employer only needs to give you documentation of the taxable amount repaid" you means an invoice or something like that . there is not a specific form from IRS ??

- What do you mean with " it appeared that you had an unrestricted right to it " in the text below? “ You can do it as a deduction on schedule A or a tax credit on line 18d of the 1040 form if when you included the income in a previous year, it appeared that you had an unrestricted right to it. “

thanks a lot

1. You will need some type of documentation to prove that the amount was repaid if the IRS ever questions your tax return including the repayment. A letter from the employer on their letterhead and a receipt for the amount repaid would suffice.

2. That is what a "Claim of Right" is referring to - This means that at the time you included the income, it appeared that you had an unrestricted right to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

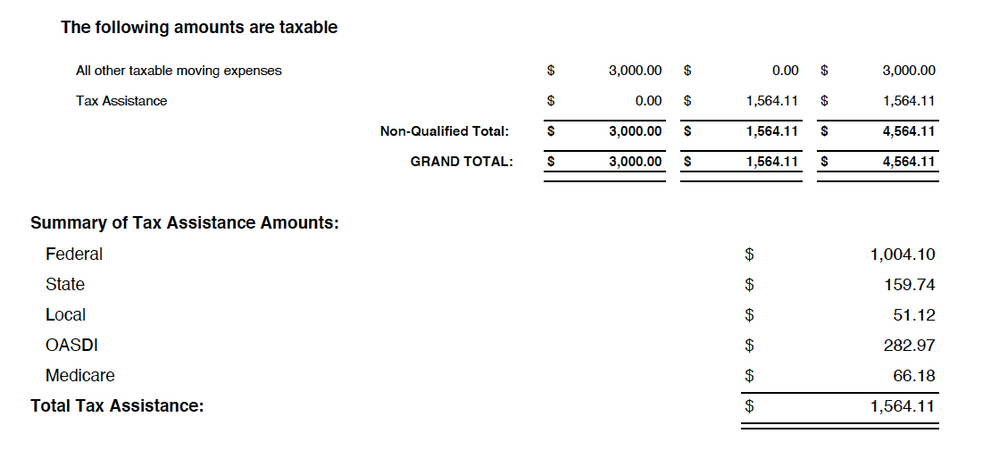

What if i am exactly at 3K and my employer paid tax as "tax Assistance"?(please see attached image) Can I still claim a refund?

Thanks!