- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file Wisconsin Taxes?

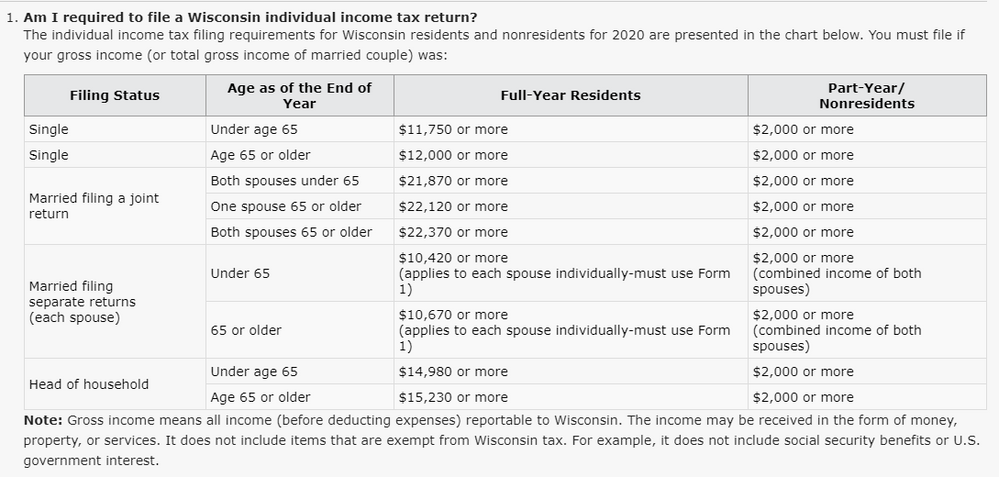

I Live and work mostly in New York. I had a short job scheduled in Wisconsin in 2020 that was canceled for the pandemic. I never went to Wisconsin. The company paid me one week's pay ($500) as a cancellation fee. TurboTax says I owe $1198 in Wisconsin taxes. Does that make any sense at all? I read that I don't have to file in Wisconsin if my Wisconsin income is less than $2000. Please help.

March 16, 2021

9:41 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You are correct. You do not have to file a nonresident Wisconsin income tax return because you gross income reportable to WI is below $2,000.

March 16, 2021

9:53 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

did you get a w-2 or 1099. regardless neither should show Wisconsin Compensation and you should not be filing a nonresident return or any return for Wi.

March 16, 2021

10:49 PM

333 Views