- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

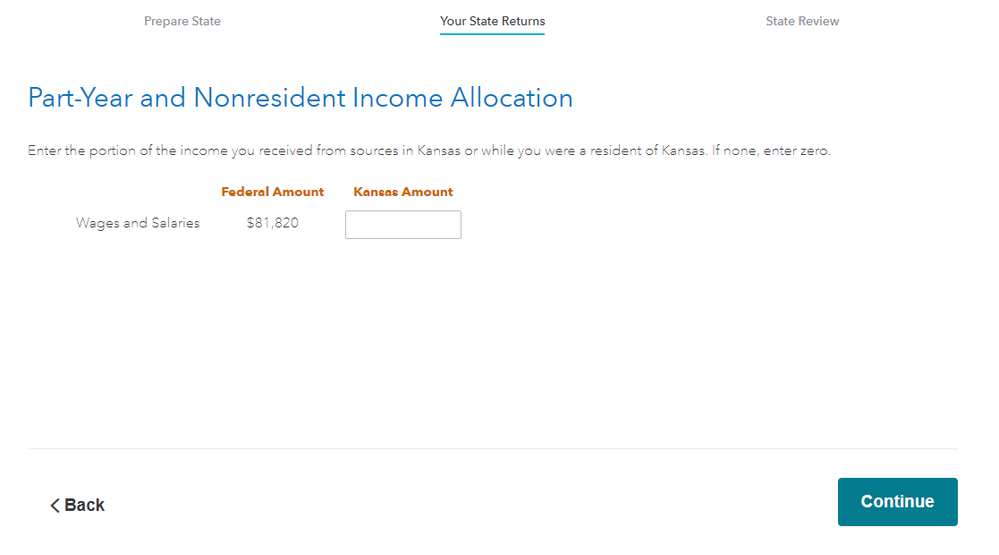

I have the same situation. First two months worked in KS and lived in MO. Income only from MO. Then moved to IN and worked there for rest of the year. Income only from IN. I reached up to Kansas Taxes and Credits page.

What I need to enter in the filed "Kansas - Income - Part-Year and Nonresident Income Allocation" and "Kansas - Credit and Taxes - Credit for tax paid to other states -Tax paid to Missouri"

February 5, 2021

12:26 PM