- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

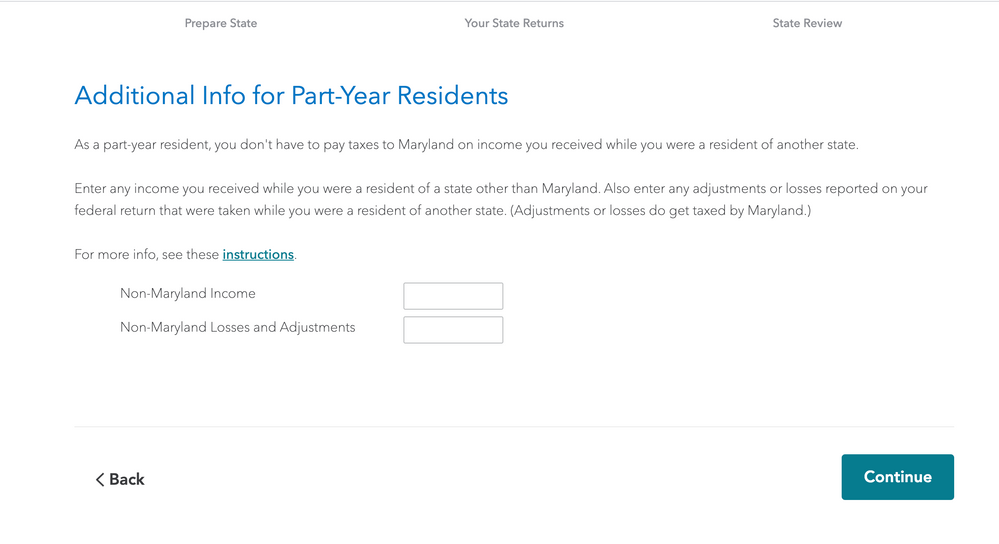

What does 'Non-Maryland Losses and Adjustments' mean?

Topics:

January 20, 2021

1:15 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

If you had income from another state, you will need to allocate income and other items for Maryland vs the other state.

Here's info on how to Allocate your Income for Part-Year Resident States:

January 20, 2021

2:51 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Wouldn't that be in regards to the 'Non-Maryland Income' field? I'm asking about the filed after where it says 'Non-Maryland Losses and Adjustments'

January 21, 2021

8:29 AM