- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Payment to Massachussetts State Tax

On April 21, 2020, I filed my state E-File and paid my tax due of $155.00 using your service. The payment was via [removed]. I just received a notice from the state that I didn't make a payment and they are charging me a penalty of $3.10 plus $1.25 in interest for a total of $159.35.

I checked with my Visa statement and I can see the fee of $24.99 you charged me for filing with a credit card, posted on my statement on April 21, 2020. However, I don't see any payments of $155.00 to the state. Did you make the payment? If you did, please forward the information to my email: [email address removed]. If you didn't make the payment please do it before September 26th, or contact me immediately at [phone number removed].

[pictures removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

@Elviod412 This is a public web site that can be seen by everyone including scammers and identity thieves who would love to use your information or contact you and pretend to be from TurboTax. Please return to your post and click those three little blue dots on the upper right and remove the personal information you posted here. I have alerted the moderators, but a long holiday weekend is beginning and they may not see it to remove it until next week. NO ONE from this user forum will contact you. The filter removed some of your contact information but unfortunately your name and address are still posted here.

TurboTax does not make payments to the IRS or your state. If you enter information then TurboTax only passes it along to the taxing authority. Some states will not debit a bank account or credit card that you enter into your data. Or you might have entered a wrong account number---we cannot see what you entered.

But it is up to you to pay your state tax.

You must pay your state tax due using the state’s preferred method of receiving payment. For most states that will be by making a payment to the state’s own tax website, or by mailing a check or money order.

https://ttlc.intuit.com/questions/1901670-how-do-i-contact-my-state-department-of-revenue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Just a note (and you probably already know this):

1) The billing form from MA would indicate that their state tax filing was accepted.

2) The TTX $25 charge for the state e-filing indicates the user was using the Desktop software, so logging into an Online account is highly unlikely to show anything for a Desktop e-filing.

__________________________

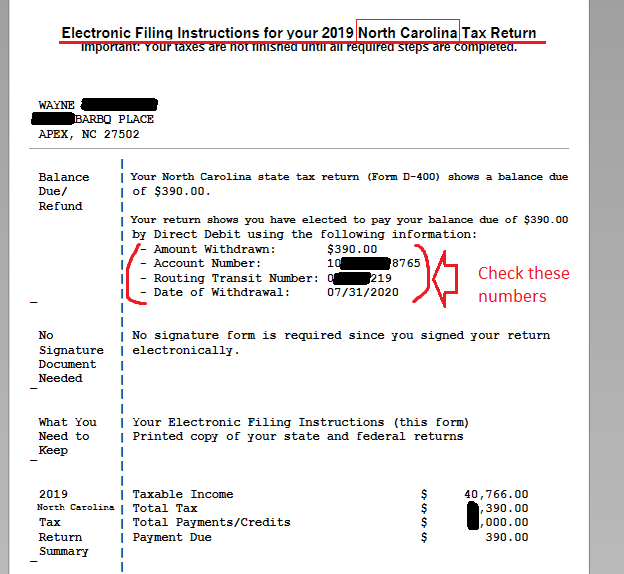

IF...if you did arrange to have your taxes paid when you e-filed (by having MA Debit your checking account, or thru a credit card payment) ...then you should check your "Electronic Filing Instructions...." sheet, either on your printed tax set, or by opening your tax return in "Forms Mode" to look at that sheet.

It should look like the following if payment was properly arranged....(check the numbers too). IF details of the payment are missing, then you didn't arrange the payment, or MA simply doesn't allow payment to be arranged with your e-file forms, at the time you e-filed. (example is for a NC resident, MA would look similar).

_______________