- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

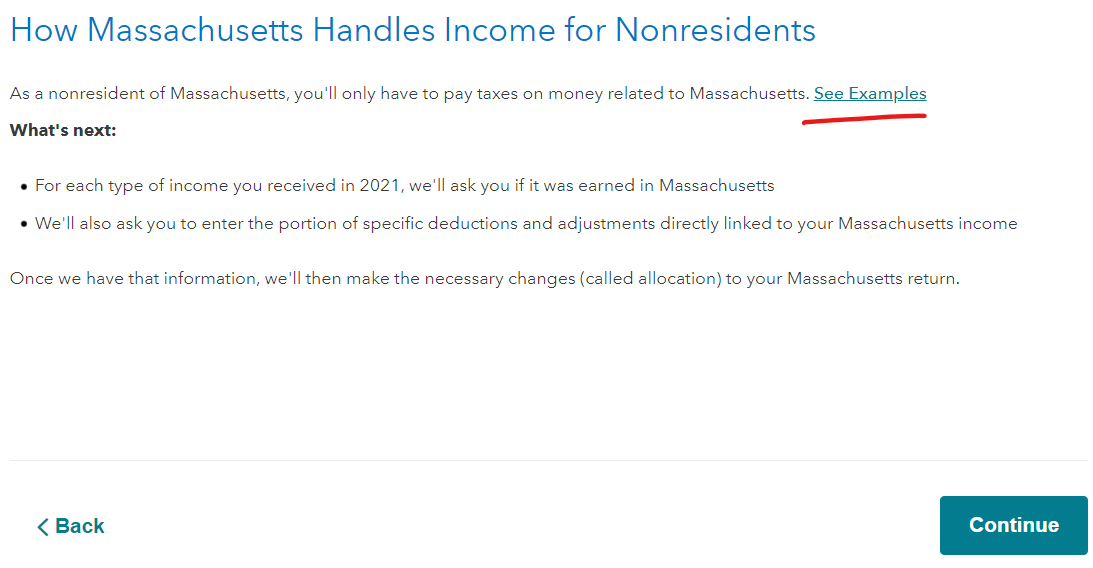

When you have multiple states' returns to prepare, always prepare your non-resident return first. In your case, prepare MA return first. As a nonresident of MA, you'll only have to pay taxes on money related to MA.

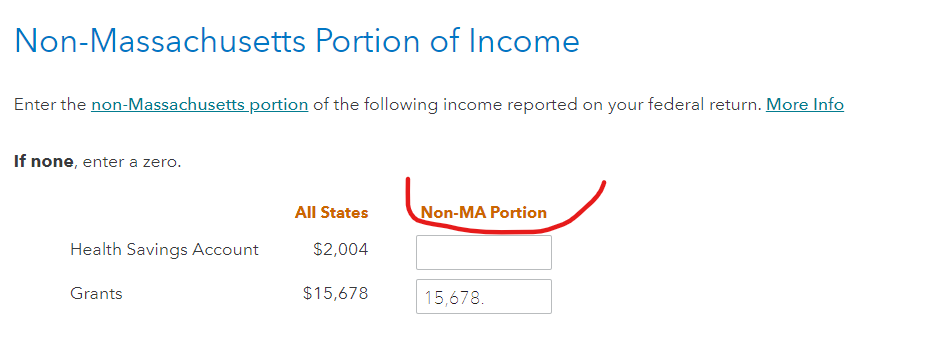

Sort out the sources of income and let MA that the 1099-G from CT is not taxable by MA.

As you assign your income to Non-MA portion, you will see your MA balance due decreases or refund increases.

Here are two of the screens you will see when preparing your MA return:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 9, 2022

2:11 PM