- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need clarification on message I'm getting from TurboTax 2020

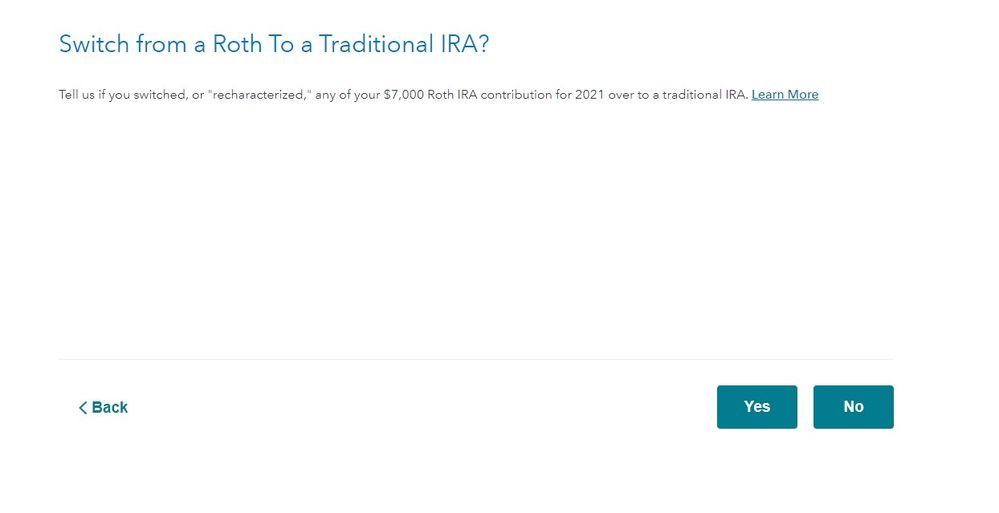

I contributed to Roth IRA in 2020, but when I did my taxes for that year in 2021, TurboTax told me I could not contribute to Roth because my income for that year exceeded the limit for Roth contributions. So I had the contribution and all its earnings recharacterized as Traditional IRA on February 2021. Now TurboTax is telling me that I over-contributed to IRA for 2020, and the amount it's saying I was over looks like the earnings from the contribution for 2020 before it was recharacterized, even though the earnings were also recharacterized. Is this correct? Do I really need to take this amount from my IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Here is where you made the error ... you indicated you made a ROTH contribution then when you are told you could not do it you should have indicated that you would remove the excess or recharacterize it to a traditional IRA. Return to that section and either make that election OR remove the ROTH contribution and enter the Trad IRA contribution instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

When I had the Roth contribution and earnings recharacterized as Traditional IRA, I thought I had to wait until I received the 1099-R documenting the recharacterization before I could amend my 2020 returns. Didn't I?

I didn't receive the 1099-R until earlier this year, which is when I started working on amending the returns.

If I just remove the Roth contribution and replace it with a Traditional IRA contribution in my returns, how would I deal with the income from the contribution? In fact, I think this is what TurboTax did when I started amending the returns. But I also think it didn't know how to deal with the income. Which is why it was telling me I needed to remove that amount from the IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

OK ... you have 2 issues. On the 2020 return all you have to deal with is the unallowed ROTH contributions ... you will indicate that it was recharacterized as a Traditional IRA and that you want the IRA contribution to be considered non deductible which will populate a form 8606.

Then the earnings ... since you recharacterized it in 2022 a 1099-R will be issued next January and you will report that on the 2022 return to be taxed on the earnings if you removed them from the IRA or converted them to the ROTH if you finish the conversion.