- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My unemployment tax payment of $29,830.00 when will I get it?

I received a 1040 stating I was owed $29,830.00 for unemployment compensation after the new tax reform for the tax exclusion of $10,200 of non-taxable unemployment, after I already filed an overpaid on unemployment tax but I still haven't received anything from the IRS what actions or action do I need to take to get my money?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

The IRS is calculating the tax refunds based on the unemployment compensation exclusion. They are sending the refunds in batches starting in May and continuing throughout the summer months.

Go to these IRS websites for information - https://www.irs.gov/newsroom/irs-continues-unemployment-compensation-adjustments-prepares-another-1-...

https://www.irs.gov/newsroom/2020-unemployment-compensation-exclusion-faqs

Q1. How much unemployment compensation do I exclude from my gross income? (added April 29, 2021)

A1. If eligible, exclude up to $10,200 of unemployment compensation paid to you in 2020 (and up to another $10,200 of unemployment compensation paid to your spouse if you're married and file a joint tax return). You don't have to pay tax on unemployment compensation that is excluded from your gross income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@aguy6788 Can you explain what you posted? What is the $29,830? You have a refund for that much? Or was that your total unemployment? And you received a 1040? From who? Or one you filled out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I received a 1040 that was already filled out with all my info an unemployment payments info on it I don't know where it came from, an I have received any payments for unemployment but on the 1040 it showed I was owed after taxes $29,830.00 is my refund amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@aguy6788 What? When you prepare a tax return it is prepared on a Form 1040----you do not "receive" a Form 1040. And it is extremely unlikely (impossible) that your refund is going to be nearly $30K if you were on unemployment.

" I don't know where it came from,"

Explain that. Did it come to you in the mail? Sounds like a scam.

Please explain what YOU did to prepare and file a 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@aguy6788 wrote:

I received a 1040 that was already filled out with all my info an unemployment payments info on it I don't know where it came from, an I have received any payments for unemployment but on the 1040 it showed I was owed after taxes $29,830.00 is my refund amount

A Form 1040 is the federal income tax return. It is not sent by anyone. You are the one that has to complete and file with the IRS the Form 1040 to report your taxable income that you received in 2020.

If you received unemployment compensation from the state in 2020 you would have received a Form 1099-G from the state for the unemployment received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@aguy6788 I suspect you are confused by the document you received. Did you actually receive a 1099G from your state that shows that you received $29,830 of unemployment compensation in 2020?

You have to PREPARE a tax return and enter the 1099G on a Form 1040 and file the tax return with the IRS.

A 1040 is the tax return form you prepare here to send to the IRS. If you start entering data in this software you are preparing a Form 1040. Please look at it so you will know what you are sending to the IRS:

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

You will have to enter a 1099G that is issued by your state.

Some states will mail out the 1099G. Or you might need to go to your state’s unemployment website and use the password, etc. that you have been using to certify for weekly benefits to get your 1099G from the state’s site.

Enter your 1099G in Federal>Wages & Income>Unemployment

Go through the screens very carefully, making sure to enter any federal/state tax you had withheld from the unemployment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

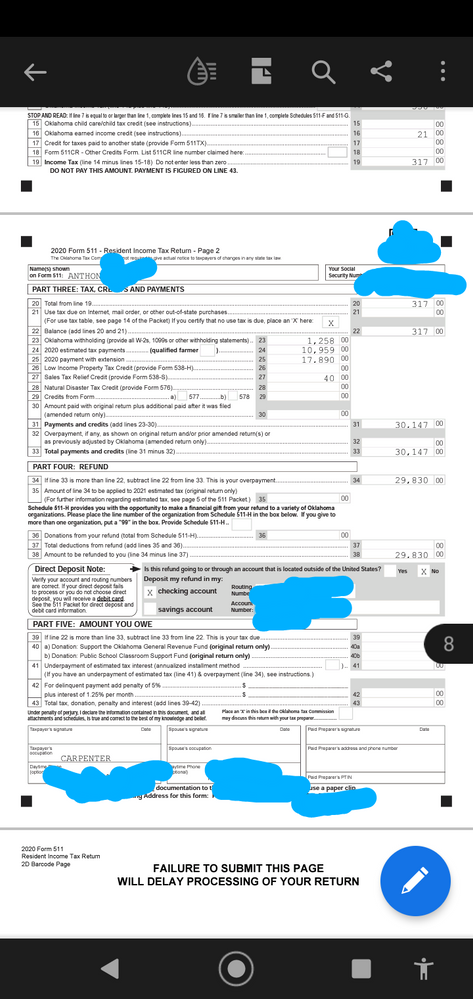

This is what a 1040 looks like. Do you have one of these? How much is on it? Like what's on lines 15, 25b and 35a?

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Or did you get a 1099G

https://www.irs.gov/pub/irs-pdf/f1099g_20.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

No it showed in my tax documents on my Credit Karma account I didn't fill it out but all this info an adjustment are correct an it not just an adjustment on my overpayment of unemployment taxes is also back back starting all the way back from the beginning of Covid-19 when I first lost my job I unemployment card in the mail after waiting so long an not getting anywhere or any money I just gave up on messing with it tell I received 1040...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@aguy6788 What you posted is a screenshot of your Oklahoma state income tax return. Not the Form 1040 Federal tax return.

What is shown on the OK state return is that you have indicated on the tax return that you paid to the state of Oklahoma $10,959 in estimated tax payments and $17,890 in tax payments made with an extension request. These payments have nothing to do with unemployment.

Did you pay these amounts to the state of Oklahoma? If not, then you entered these amounts in the wrong section of the TurboTax program. Why did you enter these amounts of tax payments?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I didn't fill this form out, I filed my taxes back in April 15th, this form showed up in turbo tax account in the tax documents section after I filed an received my taxes which I only received $924 on my refund for 2020 idk where that form or those numbers on that form came from I'm so confused...