- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

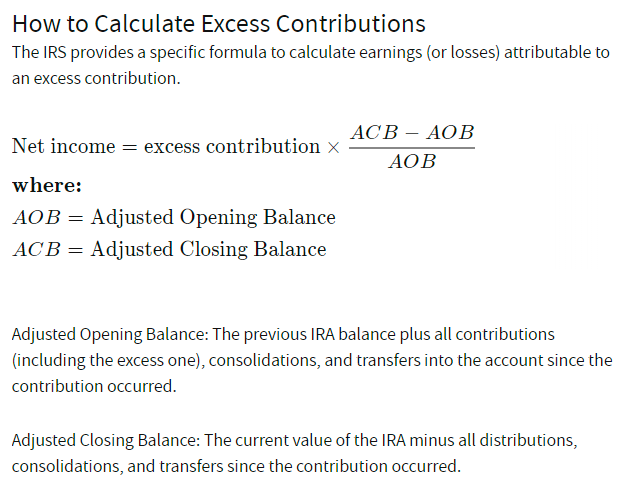

Thank you for the quick and thorough reply! Would you mind helping me with a few more details? I actually made the contributions in 2018 when the IRA was with Vanguard, I then moved it to Fidelity in 2019. Now I don't think I can use either Vanguard or Fidelity's "Return excess contribution" forms because the contribution was made into a Vanguard account but the money is now in a Fidelity account. So my understanding is I need to run the formula outlined in this article and then submit 1099-R with our 2019 return(s), is that correct?

I'd rather not amend the tax return to file jointly as the loan repayments would go up more than $600/month and I assume that would then be backdated for all of 2019. Thanks!

December 15, 2019

5:07 PM