- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just filed my 2020 tax return. How do I file for the first and second stimulus payment? I have not received either one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

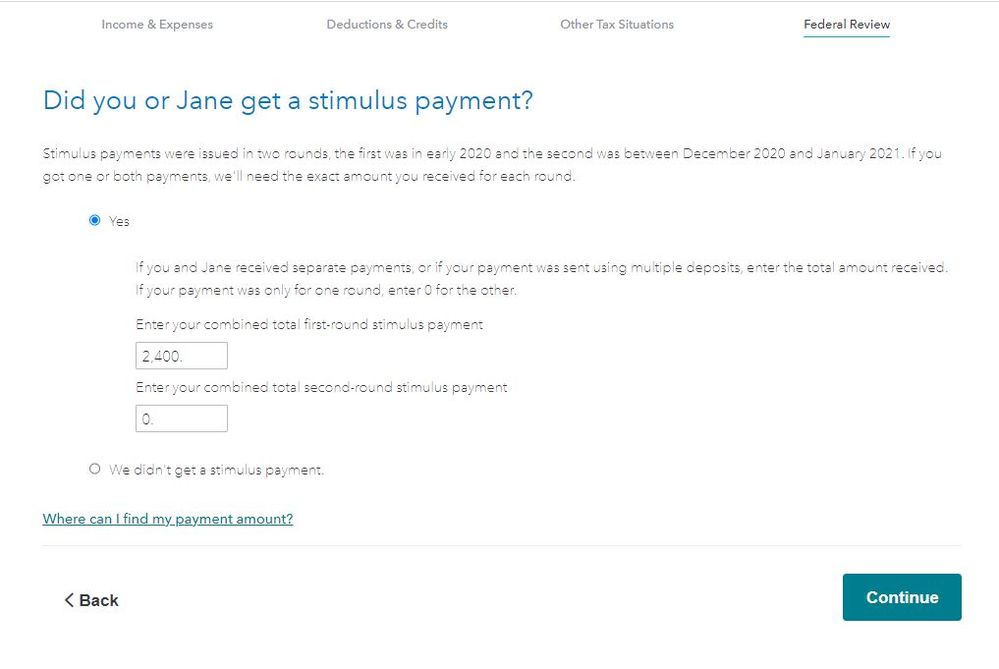

So you just skipped right by the page in the Federal Review section which asked about your stimulus payments which would have given you a tax credit for any payments not received and filed the 2020 federal tax return?

Did you e-file the federal tax return using this procedure? -

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled "Transmit my returns now".

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I was never asked that question or I would have filled it out. It was transmitted, but has not been accepted yet.

How do I go back and apply for the first stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Should I wait for it to be accepted then go back and do an amendment? If so how do I make an amendment on my return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

It will not be accepted (or rejected) until after January because the IRS has not opened the filing season yet.

If it rejects then you can make changes and re-file. If it accepts then you must wait for any refund to be received before amending which takes 4-6 months to process.