- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed as dependent for 2019 which left me out of receiving the two stimulus checks. I am filing as independent in 2020. Any way I can go about collecting what I missed?

Topics:

December 30, 2020

2:37 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

**Disclaimer: Every effort has been made to offer the most correct information possible. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post.**

December 30, 2020

2:39 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

If you are not a dependent on the 2020 federal tax return and are otherwise eligible you will receive the Recovery Rebate Credit on your Form 1040 Line 30.

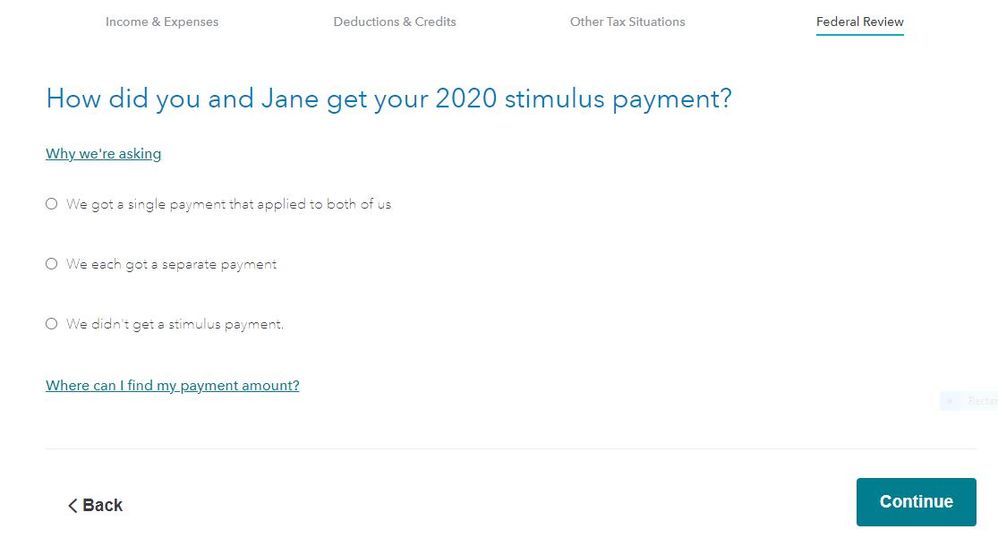

TurboTax will ask about the stimulus payment received or not received in 2020 after the Other Tax Situations section is completed.

December 30, 2020

2:41 PM