- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

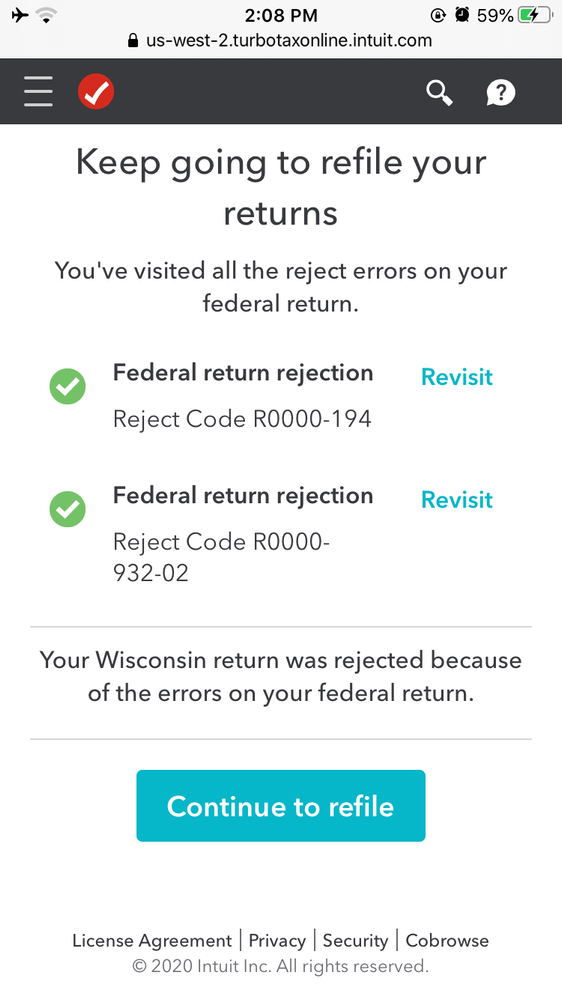

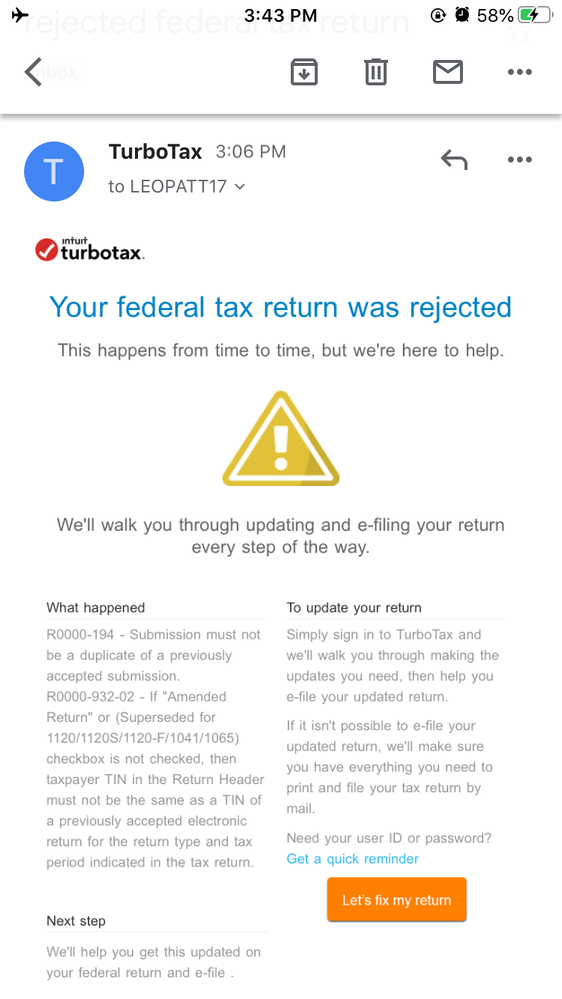

So when I finish filing my taxes, everything is okay now then I was redirected to a free benefit thing so I was curious about so I answer some questions, after that I refile my taxes because they want to... after an hour I received an email saying that my taxes are rejected.. so I sign in and fix it, then afterwards I received an email once again saying that it was rejected... I signed out instead of fixing it again and get an email..

-should I just wait until IRS says it was accepted in the first place?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

You can only e-file your tax return once. If you e-filed it and it was accepted then you are done. You cannot e-file it again. Sounds like you are confused as to whether your return was accepted the first time. Check your e-file status. What does it say?

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If it says accepted, then you are all set and can wait for the IRS to process your return. If it says rejected then post back and tell us EXACTLY--word for word--what the rejection notice says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

r0000-194 means someone filed a return using the same SSN as that on your return. the result is that you can no longer e-file federal or state. they must be filed by mail. use a method where you can get proof of delivery. follow TT mailing instructions for necessary attachments, mailing addresses, and other procedures. did you file a non-filers return to get your stimulus payment? if you did do a non-filers return this is the procedure the IRS says you should follow:

If a filer used the Non-Filers tool to register for EIP, they cannot file a subsequent tax return electronically. They must complete a paper Tax Year 2019 Form(s) 1040/1040-SR, print and write “Amended EIP Return” at the top, and mail the return to the IRS.