- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Why do you think you need a refund?

The fees for the TurboTax online product are for the use of the program to prepare your tax return. They are the same whether you efile your return or print and mail it.

If there is some reason you think you should receive a refund, you can contact TurboTax support directly to request it: https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-contact-turbotax/00/26991

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Because the amount that was approved by IRS is almost $3000 less than what TurboTax showed me as my refund. When I paid for TurboTax, it clearly said that the filing fees is refundable if the amount is not approved by IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

It said no such thing. You misunderstood something. The IRS can change your refund or offset it if you owe child support, back taxes, etc. Or they can change your refund if they find that you entered something incorrectly. You still have to pay your TurboTax fees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

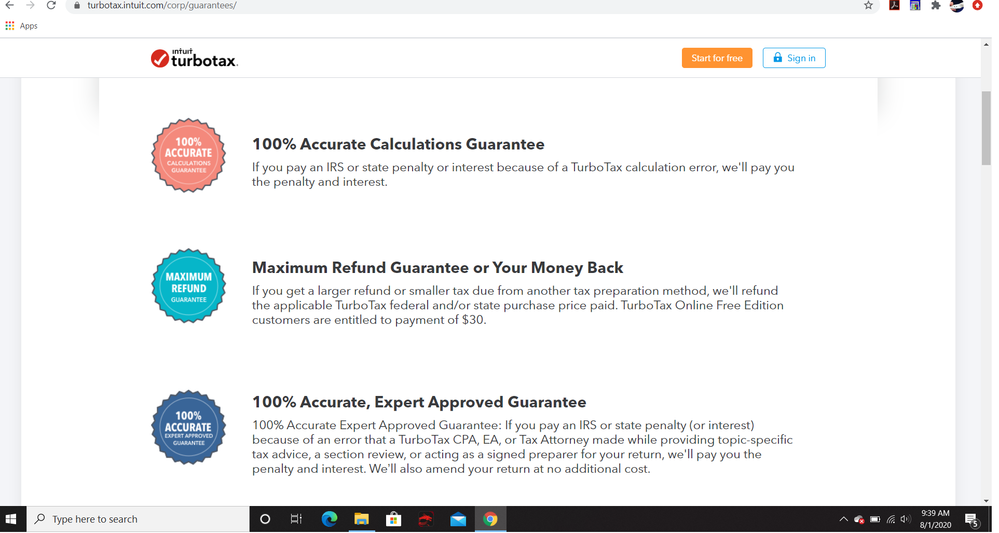

There is nothing in TurboTax that states what you describe. TurboTax has an accuracy guarantee which basically says if anything on your return was calculated inaccurately, TurboTax will pay any interest and penalties that result from the inaccurate calculation.

The satisfaction guarantee is for 60 days on the CD/download product only. Once you pay for the online product, there is no satisfaction guarantee.

You need to wait and find out why the IRS reduced your refund. The IRS should send you a letter with the reason. There are many things that can cause it almost all of which have nothing to do with the TurboTax

program. See this IRS topic: https://www.irs.gov/taxtopics/tc203

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@iabbas1 wrote:

Can you explain these statements here on the website for turbotax? Maybe im missing a fine print

Since you did not pay any penalty or interest to the IRS due to a TurboTax calculation error, the only statement in question is the Maximum Refund

See this TurboTax support FAQ - https://ttlc.intuit.com/community/charges-and-fees/help/what-is-your-maximum-refund-or-tax-savings-g...

Simply put, our Maximum Refund (or Tax Savings) Guarantee says that if you get a bigger tax refund (or owe less taxes) through another tax preparation method, we'll refund the purchase price you paid for TurboTax.

As with any guarantee, there are stipulations. For example, you have to notify us within 60 days of filing your return in TurboTax, and your return must be identical to the return prepared using the other tax-prep method.

You can read the fine print at the Intuit Software End User License Agreement for TurboTax Desktop Software or the End User License Agreement for TurboTax Online. Enter maximum refund in the Find feature in your browser (usually listed under Edit) to go to it quickly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Neither the first or third guarantee refund fees.

The second guarantee basically says if you prepare your taxes using another providers program and it yields a larger refund or smaller tax due, your fees will be refunded.

According to your post, the IRS reduced your federal refund. It has nothing to do with you preparing your tax return using another providers program and getting a different result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I was charged for self employment for this year in which I did'nt have. I need to be refunded once I get it my refund back in fact I should get all my money back since I only had a simple return a total of 167 dollars in charges

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@orobear20 You posted to a pretty old thread here...but if you went ahead and filed using that software you are very unlikely to get a refund. You could have cleared it and started over in a less expensive version of the software. No one in the user forum can resolve a billing issue. Talk to customer support.

No one in the user forum can resolve a billing issue. If you have a question about your TurboTax fees or billing, make sure you use the word “billing” in your request for help. Do not use the word “refund.”

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number