- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If we filed with TurboTax, does the IRS have our bank information to have the stimulus direct deposited? Will we me the mailed recipients of the check?

Me=be

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

It depends on your filing situation. If you had no TurboTax fees or paid the fees by credit or debit card up front *and* you got a refund, the IRS should have your real direct deposit info and the stimulus should go there. However, if you had fees deducted from your refund, the IRS got direct deposit info for Santa Barbara TPG instead of your bank; what will happen there is uncertain. https://www.sbtpg.com/coronavirus-stimulus-payment-info/

If you owed the IRS money for both 2018 & 2019, they may not have your direct deposit info at all. However, the IRS plans on creating a special portal where taxpayers can provide direct deposit info and avoid paper check delays. https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know (This will also apply if SBTPG doesn't forward stimulus checks and the IRS sends them paper checks.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Very good answer.Apparently,the last time stimulus checks were given to Americans,Turbotax did what you said.Those who owed Turbotax any fees for filing were sent a check and the no fee customers who had their direct deposit info on file received stimulus check via direct deposit with no issues..

Now of course things could be different this time.We should know definitively when Turbotax announces it,hopefully in a few days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

If you had your filing fee taken from your return the IRS does have your personal banking information. Turbo tax takes their fees from the front end. I got this information from a Turbotax agent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

So if we had fees deducted from taxes...which got sent to Santa Barbara....then our personal bank....irs has our bank info correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I paid Turbo Tax fees using my federal refund. However, when I review my tax return, the tax form has my bank routing and account number. Does this mean the IRS has my information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes. The government will be able to leverage the direct deposit information in your 2019 tax return to deposit these stimulus funds electronically into your account.

What do I need to know about the coronavirus stimu ...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Please confirm if this is true if I received my refund from Santa Barbara bank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I believe most of us...rec the remaining of our refund from Santa Barbara bank...however...the tax expert is right ...if you look at your tax return...your account number and routing number is visible

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@NCOGNDO Yes. The government will be able to leverage the direct deposit information in your 2019 tax return to deposit these stimulus funds electronically into your account.

What do I need to know about the coronavirus stimu ...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

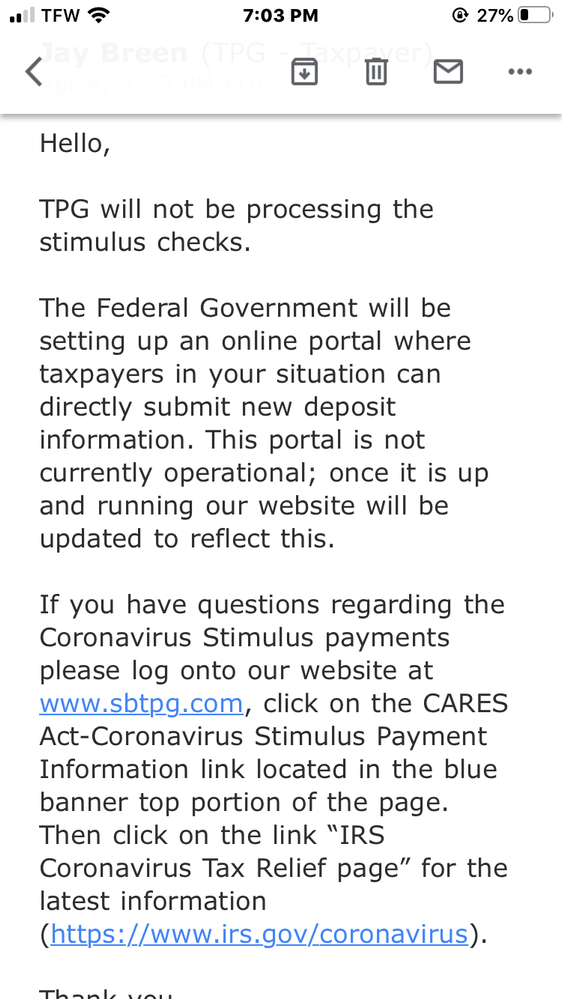

@ChondelLO I see that you are a TurboTax employee and EXPERT while @RBBrittain is "only" a CHAMP, but the link he posted from Santa Barbara TPG https://www.sbtpg.com/coronavirus-stimulus-payment-info/ is indeed unclear about whether the IRS already has our direct deposit info.

I elected to have my TurboTax fees deducted from my 2018 Federal refund (I haven't yet filed for 2019). Looking at my 2018 return PDF, my direct deposit info only appears to be on pages relating to Intuit and Santa Barbara TPG, not on the "official" Federal IRS Tax forms.

Direct deposit info is also on a sheet called "California Online e-file Return Authorization for Individuals" but I'm not sure how that will relate to the Federal level.

Should I use TurboTax's free Stimulus Registration just in case to ensure the IRS definitely has my direct deposit info?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, you should.

The website is: CORONAVIRUS TAX CENTER: 2020 STIMULUS

In the coming weeks, the IRS plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail. That site is not up yet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

“I am still confused by your site. If we got direct deposit, but fees were taken out through sbtpg will we get direct deposit to our bank? Or will the funds still go through sbtpg before hitting our bank?” Is what I asked SBTPG

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

In regards to your stimulus checks, it will be directly deposited to your accounts if your direct deposit information is listed on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I am still confused then. From SBTPG he is appeared to say if my refund funneled through them I will have to sign up through the IRS portal to get my refund.

Just to clarify you are telling me that though I had fees taken out through SBTPG for turbo tax it will still go through to my personal bank without me having to go through the IRS portal?