- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect TTax Treatment of IRS Refund?

Does anyone understand the following apparent discrepancy between Worksheet 2 of IRS Pub. 525 and the 1040-X which I produced with Turbo Tax? Either Pub. 525 or Turbo Tax are incorrect, or I am using one or both of them incorrectly.

I received an IRS state refund in 2019 as a consequence of an amendment to my 2017 return, which included a Schedule A calculation of the deductible. When I prepared my 2019 return with Turbo Tax Deluxe, I didn’t remember the refund from 2017.

Now I am using the same software to prepare a 1040-X for 2019 to document the receipt of the refund, even though when I manually use Worksheet 2 of 2019 Pub. 525, I conclude that the refund isn’t taxable. In particular, I calculate that Line 8 of the Worksheet in my case is zero, and the Worksheet says: “If the result is zero or less, stop here. The amounts on lines 1 and 2 aren't taxable.” Line 1 contains the value of the refund from 2017. [Emphasis added]

However, the 2019 Turbo Tax amendment, generated in dialog mode, treats the refund as taxable income with the result that I owe over $400 in additional tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

A federal tax refund is not reported anywhere on a federal tax return or on an amended federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

however, the refund likely included interest which is taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@DoninGA wrote:

A federal tax refund is not reported anywhere on a federal tax return or on an amended federal tax return.

Correction - On an amended tax return you only report the federal tax refund you have received for the same year as the amended return you are filing.

So if you are filing a 2019 amended return you only report the federal refund you received from tax year 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Or do you mean you got a State refund? A state refund can be taxable if you itemized deductions on Schedule A and took the state tax deduction instead of sales tax.

And if it was a federal IRS refund how or where did you enter it? Did you enter it as a 1099G state refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I see I made a mistake in my original question.

The refund in question was a state, not a federal refund.

Sorry about that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@VolvoGirl Yes, it was a state refund, did use Schedule A, and I did include state income tax, not sales tax.

As to how I entered the information in TTax, I used the Step-by-Step mode and tried to read the questions carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Mike9241 It was state, not a federal, refund.

The refund did include interest, but I don't remember the TTax dialog asking about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Don't know about your state refund entry on the amended return except it is probably taxable on your 2019 return. But be sure to add the interest as a 1099 INT and put the amount in box 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Since you must be using the downloaded program switch to the FORMS mode and compare the worksheet you filled in against the one on the program ... can you see what is incorrect ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

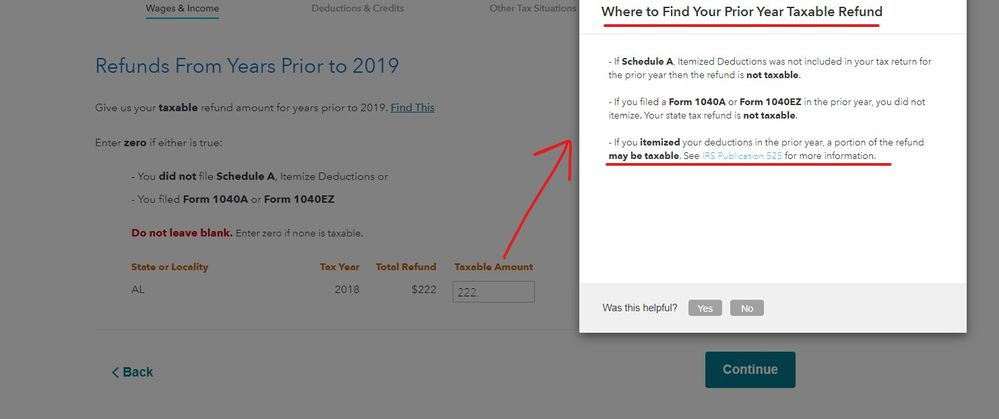

TurboTax does not support calculating the taxable amount of a state refund for other than the immediately preceding year. TurboTax for 2019 will not calculate the taxable amount for a 2017 state refund received in 2019. You have to use Worksheet 2 in Pub. 525 to calculate the taxable amount yourself. If none of the refund is taxable, you do not have to enter it in TurboTax at all. If part or all of it is taxable, enter the refund in forms mode in Part VII line 36 of the State and Local Income Tax Refund Worksheet. Enter the taxable amount in column (d) on that line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

As far as I know, the Costco version of Turbo Tax Deluxe, the version I'm using, doesn't have a worksheet that does the job of the one in IRS Publication 525.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Correct ... the program allows you to enter the prior year info but you must decide how much is taxable yourself ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you are correct about this shortcoming of TurboTax Deluxe, that would certainly explain the discrepancy I describe in my original post.

Would you please tell me how you learned of this?

Wouldn't it be helpful if Intuit would maintain on-line a searchable list of the situations which the various versions of TurboTax don't handle properly, and, whenever possible, embed a warning screen in the program that was triggered whenever a user attempts to use a version in such situations?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

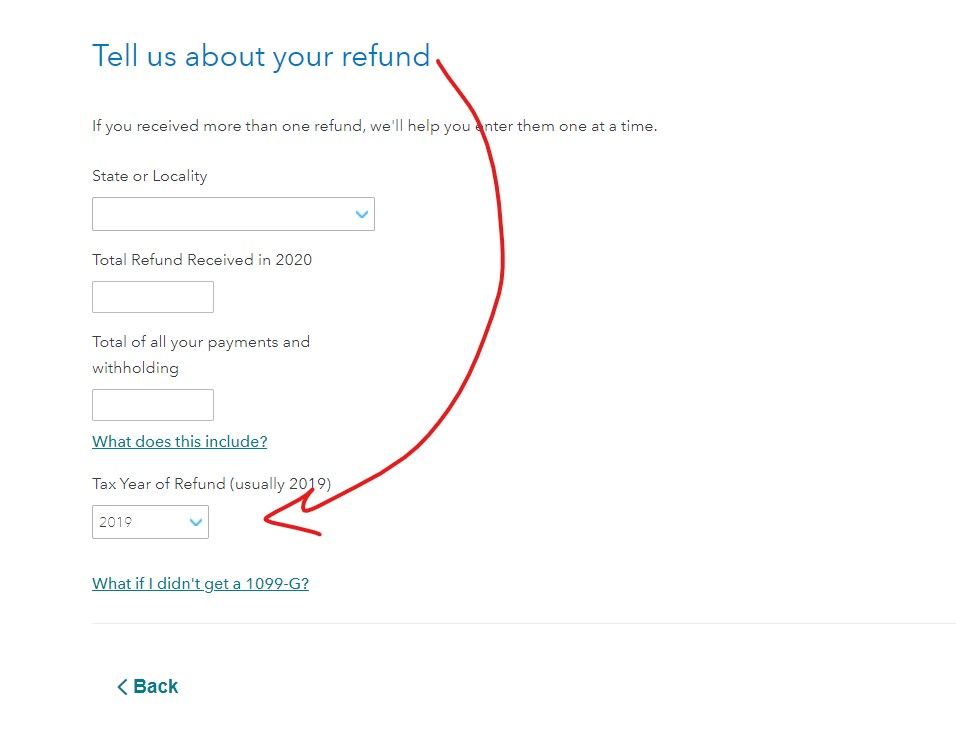

I did encounter the screens that you show in your reply, and I see now that you and @rjs are correct.

There would have been a better chance of my understanding this limitation of the software if the title of the popup had been "How to Determine the Extent to Which Your 2017 or Earlier State Refund is Taxable." The information in the popup isn't how to find the refund.