- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Counting withheld tax on return with both 1099-ES and W2?

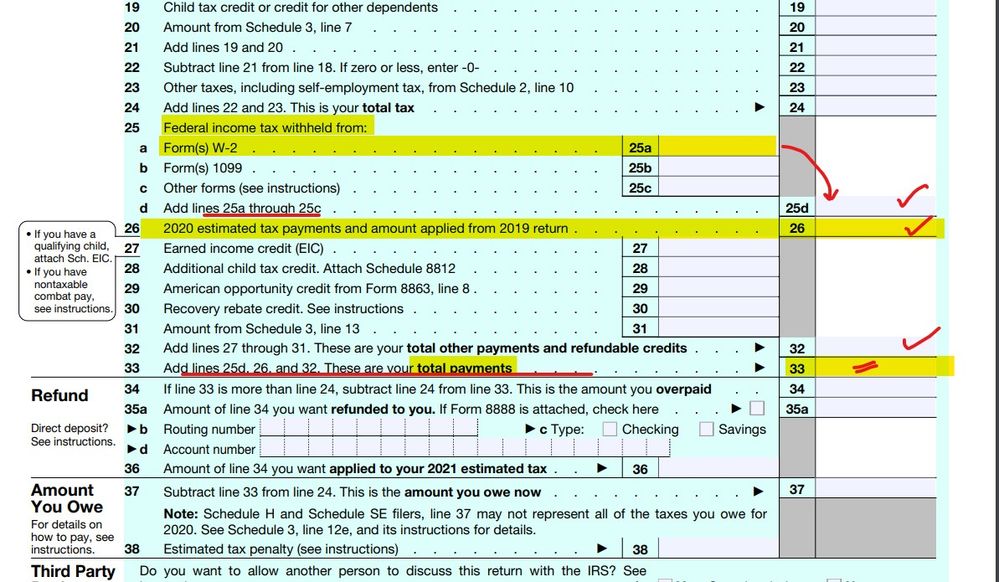

For the purposes of filing, if I'm submitting a return that has both a W2 and a 1099-ES on it, how do I indicate the quarterly taxes I've paid against the 1099 and the tax withheld by my W2 job? Do I combine them? (E.g. let's say I've paid $1200 in quarterly taxes and my federal withholding from my W2 is $6000. Does that mean I've had $7200 withheld?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The amount withheld on your W-2 and the amount you paid in estimated taxes are tax payments. Each type of tax payment is entered on different lines of your federal tax return. The TurboTax software will correctly enter the tax payments if you use the proper sections of the program for each type of payment.

Enter your W-2 in the Wages and Income section under Federal Taxes.

To enter, edit or delete estimated taxes paid (Federal, State, Local) -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Estimates and Other Taxes Paid

- On Estimates, click on the start or update button

Or enter estimates paid in the Search box located in the upper right of the online program screen. Click on Jump to estimates paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Your example means that you have paid in $7200 to apply towards your taxes for the next year. Technically your withholding is $6000 and your estimated payment is $1200. So saying you have $7200 withholding is not technically correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Look at the form 1040 ... see how it works ...