- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My unemployment tax amended tax return

- When will I get my amended Unemployement tax refund back it’s been some months and I still don’t know anything

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello dessybeauty21

I understand it can be frustrating waiting for your additional tax refund!

First, you'll want to review your return and confirm you included the unemployment compensation on your tax return. It would appear on your 2020 Schedule 1 Line 7. If it was included, and no exclusion on your 2020 Schedule 1 Line 8, then you do not need to amend, the IRS is automatically adjusting the returns.

The IRS has said that payments will continue "throughout the summer," which means that unless we hear something else, payments could continue through September 22nd.

You may request a tax transcript that would reflect if the IRS has made changes to your filed tax return. There are different types of transcripts, I recommend the Record of Account Transcript.

https://www.irs.gov/individuals/get-transcript

Here is a link to check the exclusion amount you would be eligible.

https://www.irs.gov/newsroom/2020-unemployment-compensation-exclusion-faqs-topic-b-calculating-the-e...

If you did not include the unemployment compensation on your tax return, then you would need to amend.

https://turbotax.intuit.com/tax-tips/amend-return/how-to-file-an-amended-return-with-the-irs/L6kO691...

I hope you find this useful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

How can I check to make sure I added my unemployment compensation on my amended tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello,

You can review your amended tax return, Form 1040X, for your unemployment compensation. The taxable portion of your unemployment compensation will be on Line 1 Column B.

You will also now see the Unemployment Compensation, it would appear on your 2020 Schedule 1 Line 7. and the exclusion on your 2020 Schedule 1 Line 8.

Hope this information is helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

But how can I review my unemployment tax return like where do I go to review it because I don’t see nowhere I can review it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello,

You can access your 2020 tax return Form 1040 , and amended return Form 1040x, using this link. Both forms will be in the pdf that you download.

I hope this information is helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It doesn’t show it it only shows the one with my job and not the other one that’s the only one that shows up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello

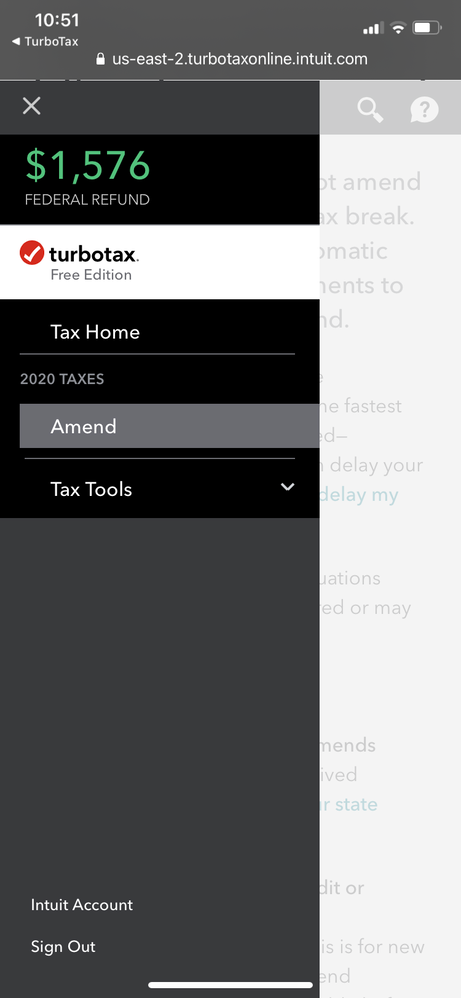

Scroll down to Your tax returns & documents (select Show if needed) and select Download/print return (PDF).

Once you have downloaded this pdf file, then open the pdf for all your 2020 tax returns that have been filed, including your amended, Form 1040X.

Hope this information is helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

How do I know if it has my unemployment compensation on it because I don’t see it on the form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello,

Your amended return, Form 1040X, would have an amount on Line 1 Column B.

If the unemployment compensation was on your return, it would appear on your 2020 Schedule 1 Line 7, and the exclusion on your 2020 Schedule 1 Line 8.

I hope this information is helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It has an amount on it but I don’t think it’s my unemployment amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can compare your Form 1099G with your unemployment compensation to your Schedule 1. The amount from Form 1099G Box 1 should be reported on your Schedule 1 Line 7.

I hope you find this information helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I filed it and it’s showing for the amend but but when I go to irs on where’s my refund they keep saying they have no information for me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

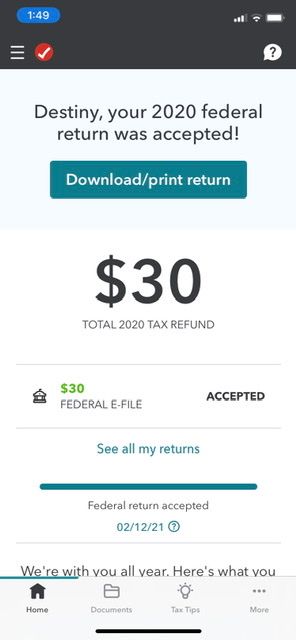

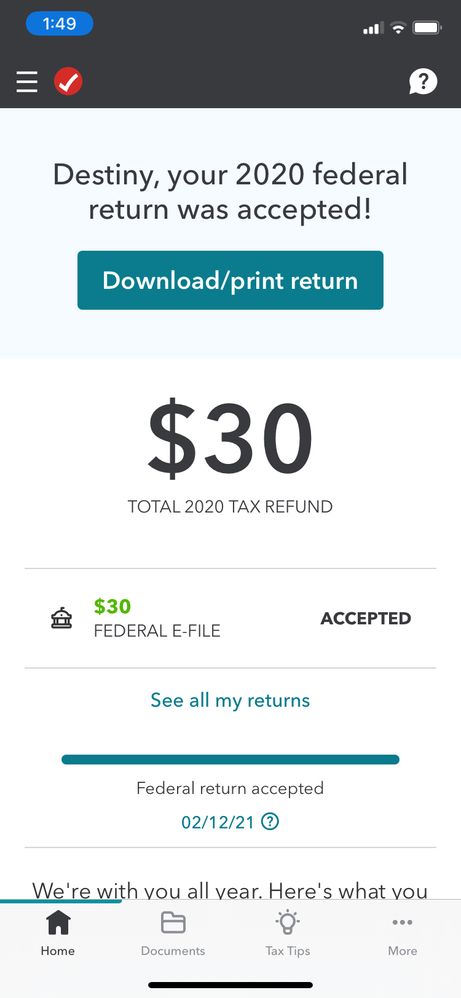

See look it’s only for my work tax return I can’t find my unemployment tax return

[PII removed]