- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

Hi Dear,

I would greatly appreciate some help on this.

I live in the US, last year, I sold a foreign company stock in that country and also paid local tax in that country, how do I file foreign tax sale ( I saw TT help saying just treat as a regular stock sale)

AND

how to deduct the local tax I have paid in that country from my capital gain tax paid in the US? (should I use itemized or tax credit?)

TIA

Dave

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You could put it in as a 1099-B even though you don't actually have a 1099-B and the foreign tax paid as a credit under less common income.

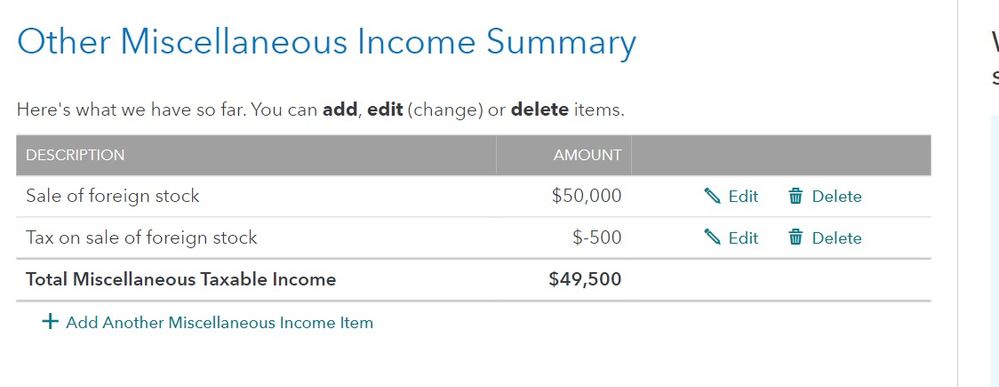

You can also report both as:

- Wages and Income

- Less Common Income

- Miscellaneous

Someone else may have another solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks for the information but I did stock sale, my understanding is that it is part of capital gain, not treated as regular income...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

In that case, use the 1099-B as if you had been issued a 1099-B and mark it for capital gain.