- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

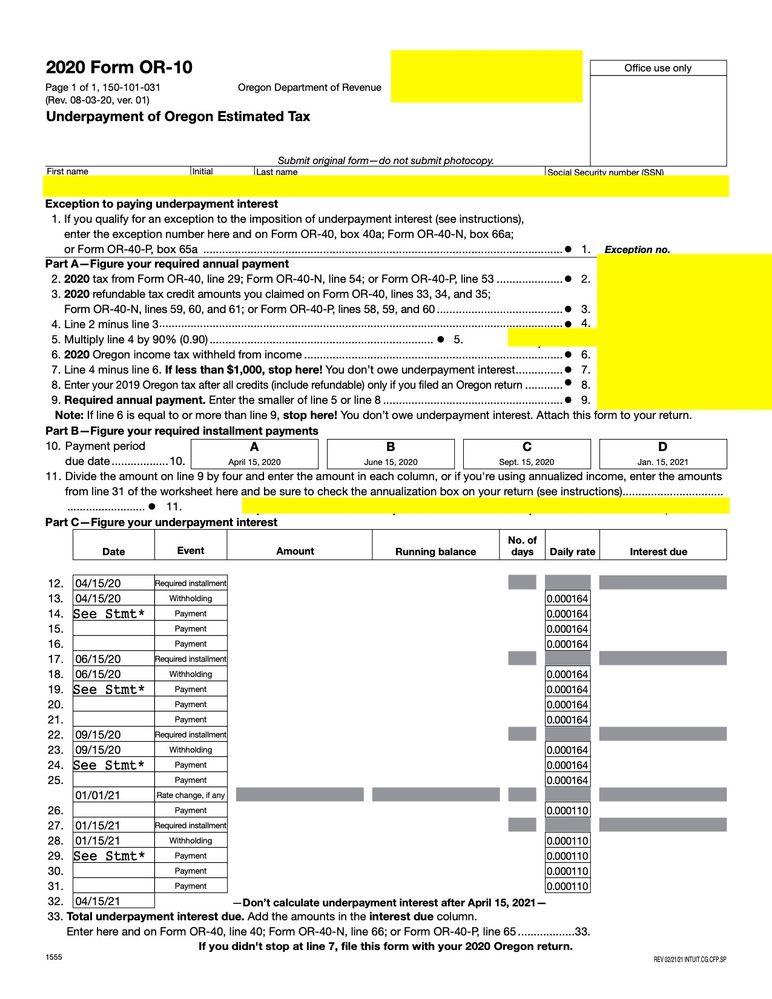

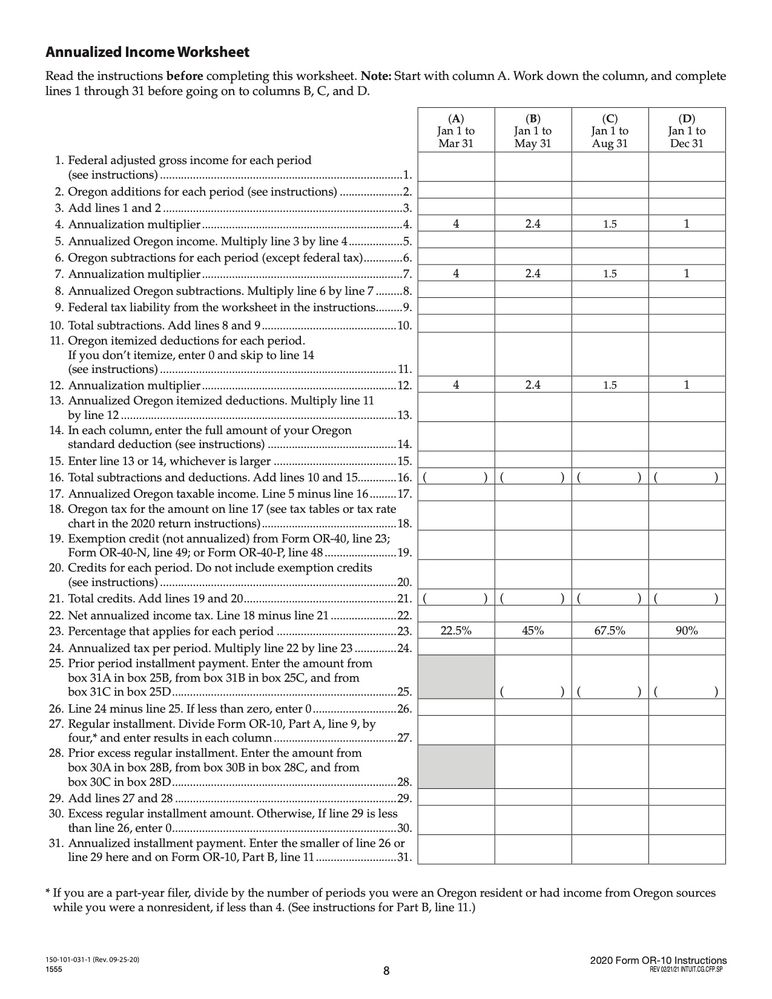

Why did TurboTax fill out form OR-10 (Underpayment of Oregon Estimated Tax) incorrectly ($0)? I received a bill for the under-payment from the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It depends. Oregon could have assessed an underpayment penalty (when TurboTax did not) if you made an mistake in entering the date paid of any of your state estimates.

Generally, you are required to make estimated payments if the tax on your return after all credits and withholding will be $1,000 or more. Your annual estimated tax payment may be paid in up to four installments. Unless an exception applies, underpayment interest is charged for each installment period when you underpaid or made late payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I don't think that's it. I did not make estimated payments (never do, I know, I know...). In past years TT calculated a minor penalty. This year, exact same circumstances, it failed to fill in OR-10 or charge a penalty, so the state billed me