- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Post 45 days and just got my refund but missing 1200 dollars

It took the IRS to update the website for me on the 45th day after I had filed and my taxes had been accepted on 2/12/21! According to their website if I don't have my refund by the 45th day they owe me 3% of interest just like they would charge me! I didn't get my refund for another two days (so they owe me $140 in interest) and was charged a $40 bank processing fee that I did not agree to! I am also missing $1200 (an exact amount of a dependents stimulus money, I find this suspicious) from my refund with no explanation from the IRS. According to the website I was suppose to get a paper stating why 3 days ago and I still don't have it. There is a [phone number removed] phone number and ext 332 and it does not get me to a customer service representative like it says on their website. I am thoroughly disappointed in turbo tax and the IRS in this matter. If ANYONE has ANY ideas please let me know here!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Please be aware that the IRS states:

- "If you file your return on or after April 15, IRS has an administrative time (typically 45 days) to process your return without paying interest on your refund.

- If IRS pays you interest, then interest on the refund will start on the return due date, late filed return received date, or date the payment was made, whichever is the latest."

Generally, the due date is April 15 but this year the due date has been extended to May 17.

Therefore, the IRS does not owe you any interest since your received your refund before the due date of the return.

You can call 1-800-304-3107 to find out if you had an offset that affected your tax refund.

Please see Treasury Offset Program for additional information.

Please be aware, if you received Notice 1444 in the mail but have not received your payment as mentioned in the notice, then you need to request a trace to be able to claim the Recovery Rebate Credit on your 2020 tax return. Please see How do I request a payment trace to track my first or second Economic Impact Payments?

But I agree, the IRS should send you an explanation statement why your refund changed (if your refund wasn't offset).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I understand what the IRS states... " IRS has an administrative time (typically 45 days) to process your return without paying interest on your refund." They did not process and update until the 46th day, thus exceeding their administrative time. Then did not receive my payment for an additional 2 days. SO 48 days. IF I paid 3 days late they charge me interest- it is a "two way street" as they state.

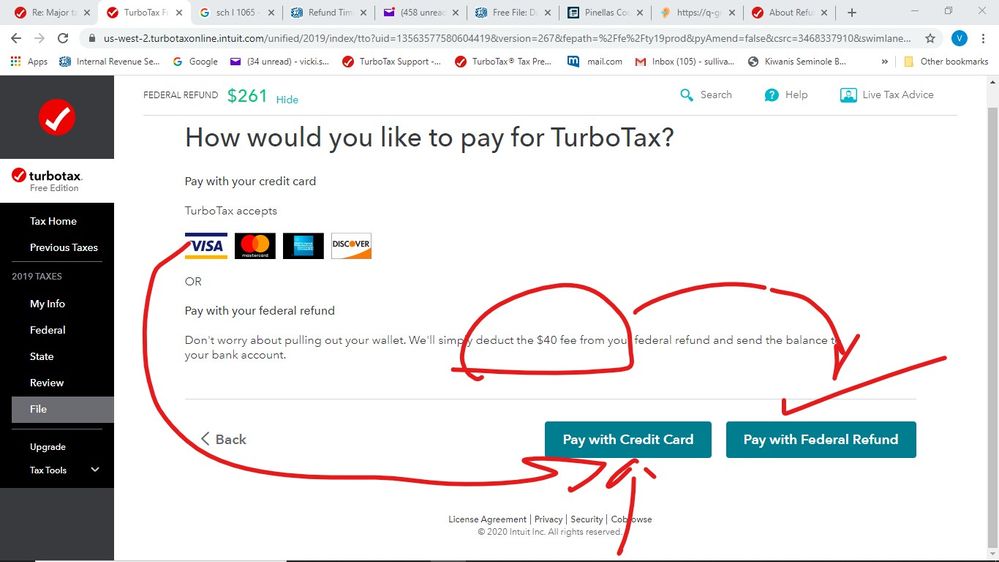

The phone number that you provided was no help apparently I have to wait for the paper work from the IRS for a phone number to contact. I did receive my refund, however, it was $1200 short plus the $40 banking fee that was not disclosed through Turbo Tax because of the 3rd party bank they use to process everyone's refunds. IS there a way to get the $40 fee back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No. The only way to not pay up front with a credit card is to have fees withheld. In order for that to happen, someone has to withhold the fees. Since TurboTax is not allowed to operate as a bank, a third party has to do it. They charge for this service. The screen asks if you want to use this service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Teryan14 wrote:

I understand what the IRS states... " IRS has an administrative time (typically 45 days) to process your return without paying interest on your refund." They did not process and update until the 46th day, thus exceeding their administrative time. Then did not receive my payment for an additional 2 days. SO 48 days. IF I paid 3 days late they charge me interest- it is a "two way street" as they state.

The IRS page you are probably quoting does not actually correctly quote the law.

Interest is due if the refund is paid more than 45 days after the filing deadline, or more than 45 days after the filing date if the filing date is after the filing deadline. In other words, for all returns filed before the filing deadline, no interest is paid unless the refund is more than 45 days after the filing deadline, not 45 days after the actual filing date.

https://www.law.cornell.edu/uscode/text/26/6611

If any overpayment of tax imposed by this title is refunded within 45 days after the last day prescribed for filing the return of such tax (determined without regard to any extension of time for filing the return) or, in the case of a return filed after such last date, is refunded within 45 days after the date the return is filed, no interest shall be allowed under subsection (a) on such overpayment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

First the IRS ... read the answer already given ... the 45 day processing time for the IRS starts on the filing deadline NOT when you filed the return OR when it was accepted for processing.

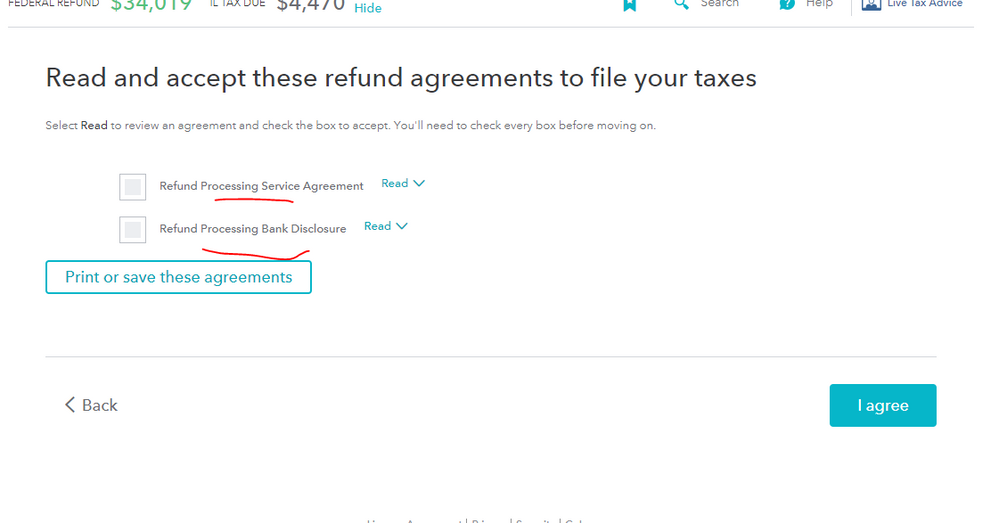

Next the $40 processing fee ... it WAS posted in the program and you had to agree to it 3 times before you filed the return ... at any point before you filed you could change your mind and pay upfront... see screen shots below and look at the CONTRACT you agreed to in the PDF file of the return.

Finally ... for future reference ...

If you qualify you can use one of the 10 IRS FREE FILE options to file a fed & state return for free ... but you must log in thru the IRS site :

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

For Filing Season 2021, you must make $72,000 or below to use one of the 10 IRS Free File partner offers.