- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

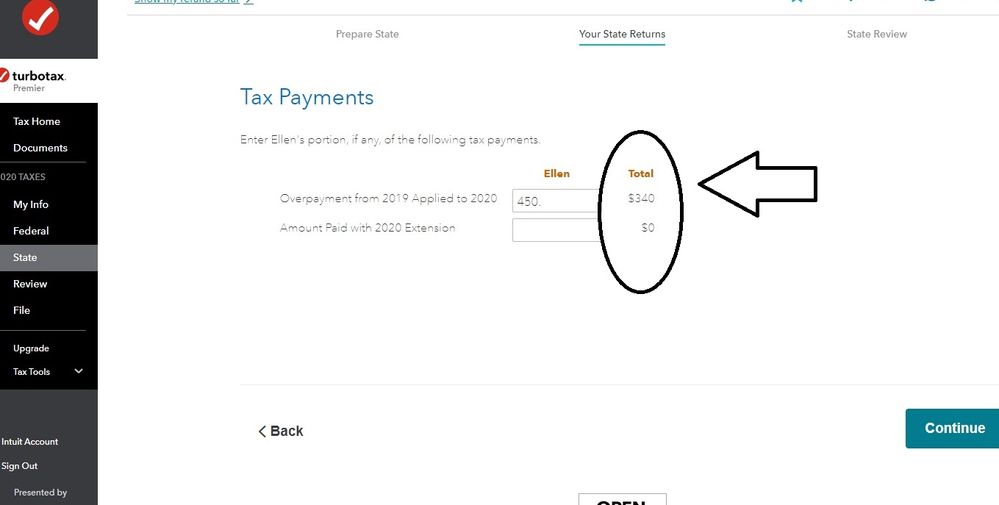

[Tax Year 2020] I applied $790 of our 2019 Iowa tax refund toward our 2020 taxes. TurboTax is showing that $450 was applied to my spouse with a total of $340. Why isn't the total $790?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You may have filed married filing separately in Iowa. The total of $450 + $340 = $790. It is often advantageous to file separately in Iowa and TurboTax is designed to legitimately maximize your refund.

See this explanation from Tax Expert @DanielV01 Iowa Married Filing Separate Advantage Explained.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Please read carefully. I am very familiar with filing separately on the combined Iowa form. That is not the issue. On the TurboTax screen there is one box to fill in. Plus there is a total that can't be changed. The prefilled fixed amount says "total" and has $340 in it. The total was $790 not $340.

It doesn't say "Spouse" and "Yourself". One of the boxes says TOTAL. The total was $790. That is not subject to debate. It's what was on my 2019 return filled using TT. The other box has my spouse's name. The TT form asks me to enter what portion of the total is attributable to her. If the total is incorrect - and it is incorrect - then it doesn't matter what I enter for her, it won't fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You need to review the "Income Taxes Paid" back in the Federal section under Deductions & Credits. There you can review the amount of 2019 Iowa overpayment applied to 2020. The 2019 amount you applied will reduce your 2020 Iowa tax liability.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I know what the refund was from 2019 that I applied to 2020. I am not asking how to find that amount. I know what it is - it's a total of $790. The TurboTax screen - in the state section - is telling me that the total is $340, which is incorrect.

Since TT is doing all the calculations, I have no way of knowing whether $790 was applied or if $340 was applied. According to the screen TT is using $340 as the total.

Screen shot attached.

Someone could say "add the 2 numbers together" - but it says the TOTAL is $340. The TOTAL is the final number by definition. It's not a number that you add to another number to get the final number. I have no way of knowing if the box is labeled incorrectly or if TT is using the wrong amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Have you gone in to reviewed your Iowa state return? You can review your 1040 and state summary in the following steps:

- While in your TurboTax account, select Tax Tools in the left margin

- Select Tools

- Select View a Tax Summary

- In the left margin, select "Iowa Tax Summary"

There you should be able to see the Total credits. Subtract out your Iowa withholding and you should be able to determine the amount of the carryover on your Iowa return.