- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I select only one state or multiple states for exempt-interest dividends on 1099-div? No single state is listed other than the 47 states and their income tax info.

Topics:

March 13, 2021

9:54 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

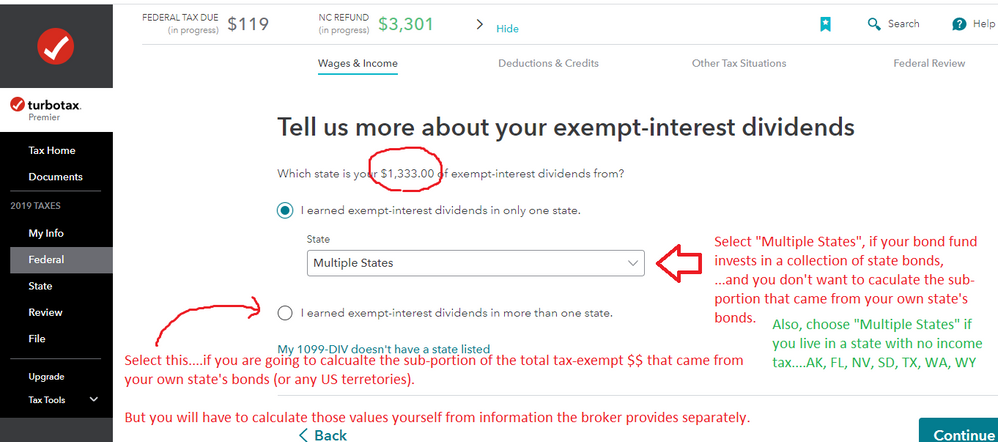

Unless you are willing to go thru the calculation to break out JUST the amount from your own state's bonds, you would select "Multiple States" for all of it

____________________________________

_____________________________________

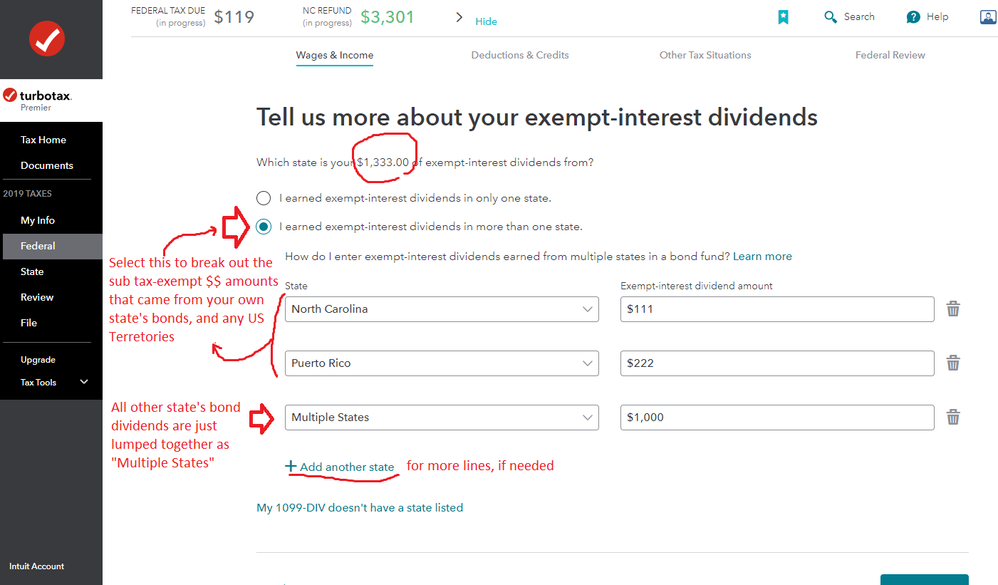

IF you are going to break out your own state's $$ then you check the selection that displays the extra boxes

(note, for a 1099-DIV, box 11, this is not allowed by Illinois, and CA & MN have severe restrictions on when it is allowed. NJ also allows DC to be listed as NJ-exempt, and UT also exempts a few other states bonds). The amount actually from your own state's bonds would have to be more than ~$50 or $100 before it had much of an effect.

____________________

Example is for a NC resident:

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

March 13, 2021

10:12 AM