- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just had a near-catastrophic experience with TurboTax. It nearly cost me over $26,000 by missing something trivial. Where can I provide serious feedback?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can provide feedback directly in the software after completing your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello. My returns are filed and accepted. I looked closely, but never saw an opportunity to provide feedback through the entire process. I have searched manually and through the search window on both the Intuit site and the TurboTax site, and did not find any means to provide feedback. Astonishingly searching for feedback in the search windows came up with zero relevant results.

Would you please be so kind as to provide step by step instructions to get me to a form or email address where I can provide product feedback? Thank you.

Peter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@pfreeland Please feel free to reply here in the public forum with any feedback you have for the TurboTax product(s). This forum is moderated, and er will share your feedback with the appropriate party or department.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I just filed an extension for my federal taxes and it was rejected. I called customer support and found out that it was rejected because I was trying to do it prior to 5/17. Why on earth did the software not warn me of that? Apparently it will be rejected if you try to pay but accepted if you don't (because it is actually processed 5/17). I already re-submitted without payment before finding this out. SO frustrating!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

go here

https://directpay.irs.gov/directpay/payment?execution=e1s1

and select EXTENSION in the pulldown.

If you did that in the first place, and made a payment, your extension is granted automatically. without having to mail in the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

TurboTax doesn't ask for bank accounts for electronic payments and refunds until very late in the process. TurboTax told me that I would be receiving a check for my state refund before asking me whether I wanted to do electronic deposit. When a refund or payment is calculated, TurboTax should tell the user that "a bank account for electronic payments and refunds can be provided during the filing process."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

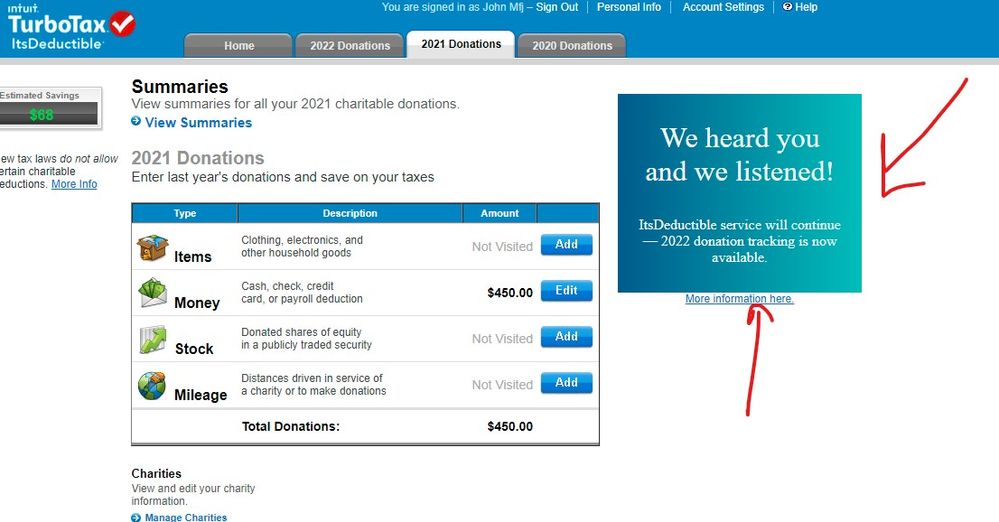

I just wanted to say thanks for keeping ItsDeductible as outlined in the letter I received from Intuit today and is attached below! I have been in the process of looking at other tax programs since ItDeductible was such a great integration with TurboTax and I wanted something that worked the same. You saved me time, and energy, by having to learn a new program after using your product for over 20 years.

Thanks again,

Doug

| Dear Valued Customer, We heard your feedback on ItsDeductible and we listened! We want to thank you for the feedback you provided over the past several weeks about our plans to discontinue ItsDeductible. We are pleased to hear how much the tool means to so many of you. Based on your feedback, we are happy to share that we have revised our decision and will continue to support ItsDeductible next year. Your account and the data in it will continue to be available without interruption. You can sign in and add any new donations for tax year 2022 at any time. Thank you again for being a loyal ItsDeductible customer, Your TurboTax Team |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

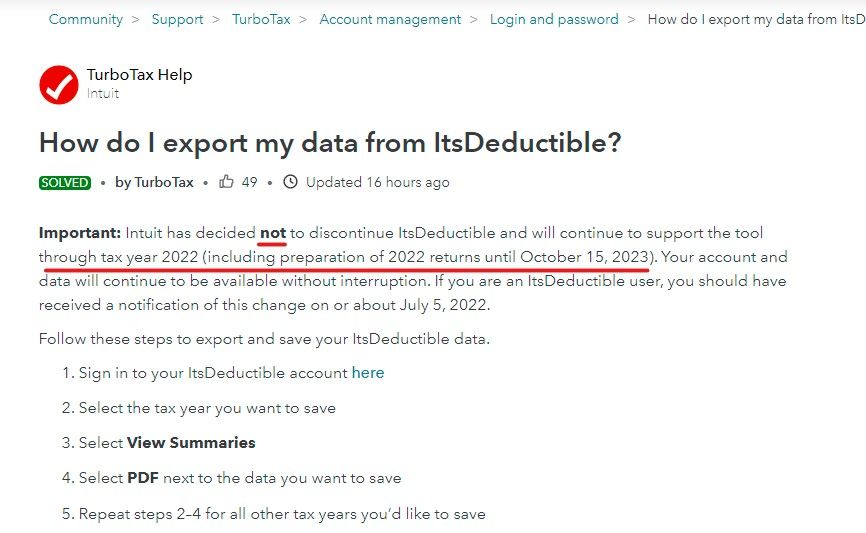

Note ... it is ONLY a stay of execution for one more tax year to give you more time to find something else.

Unfortunately, TT only reinstated ItsDeductible for the 2022 Tax Year through October 15, 2023 (see below link from ItsDeductible) . After that, they will discontinue it again. If this many people rely on ItsDeductible and will switch tax programs, all the Income TT loses will be much higher than the cost of keeping ItsDeductible going!

TurboTax Help Intuit

How do I export my data from ItsDeductible?

Important: Intuit has decided not to discontinue ItsDeductible and will continue to support the tool through tax year 2022 (including preparation of 2022 returns until October 15, 2023). Your account and data will continue to be available without interruption. If you are an ItsDeductible user, you should have received a notification of this change on or about July 5, 2022.

Follow these steps to export and save your ItsDeductible data.

- Sign in to your ItsDeductible account here

- Select the tax year you want to save

- Select View Summaries

- Select PDF next to the data you want to save

- Repeat steps 2–4 for all other tax years you’d like to save

We recommend keeping all tax return data for the last three years for your tax records.