- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1

I received a Final K-1. It is a passive partnership with investments in real-estate. Turbo tax asks how it was disposed. The partnership funds just finished with all real estate in the fund having been sold. The form does not specify the type of disposition. what do I use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

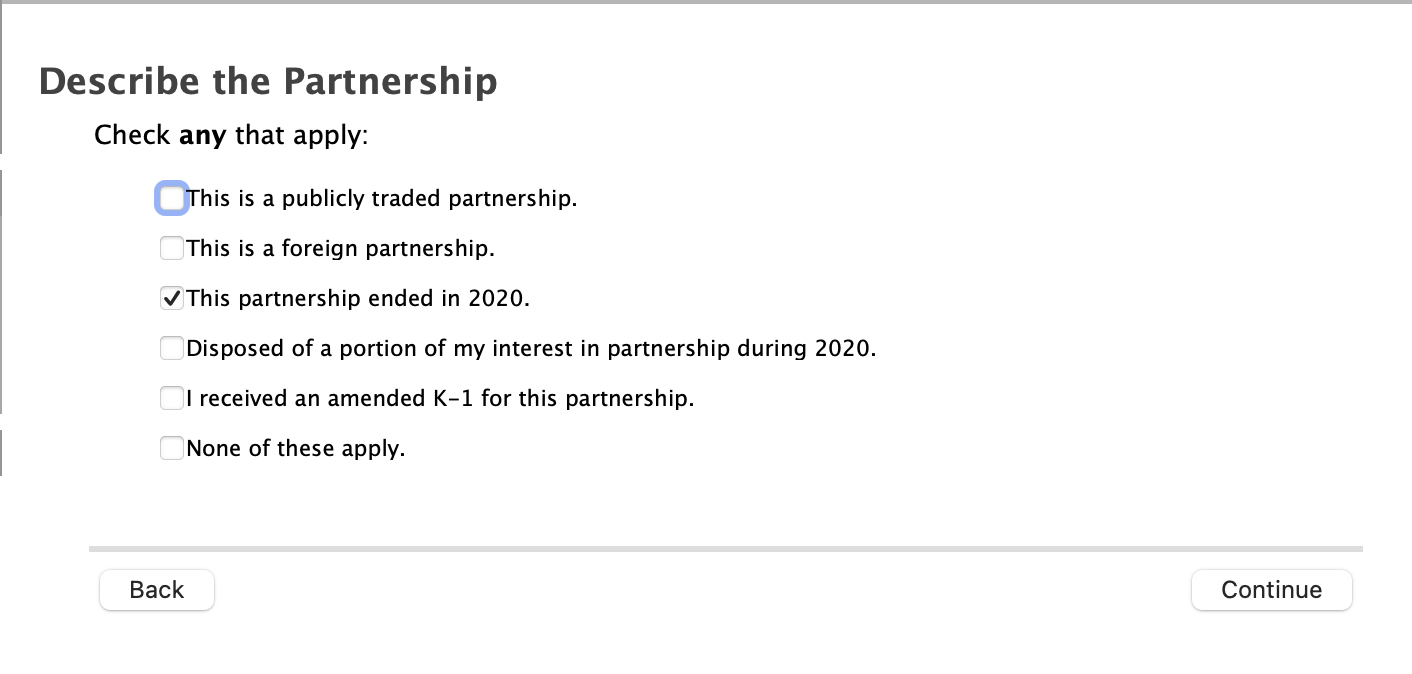

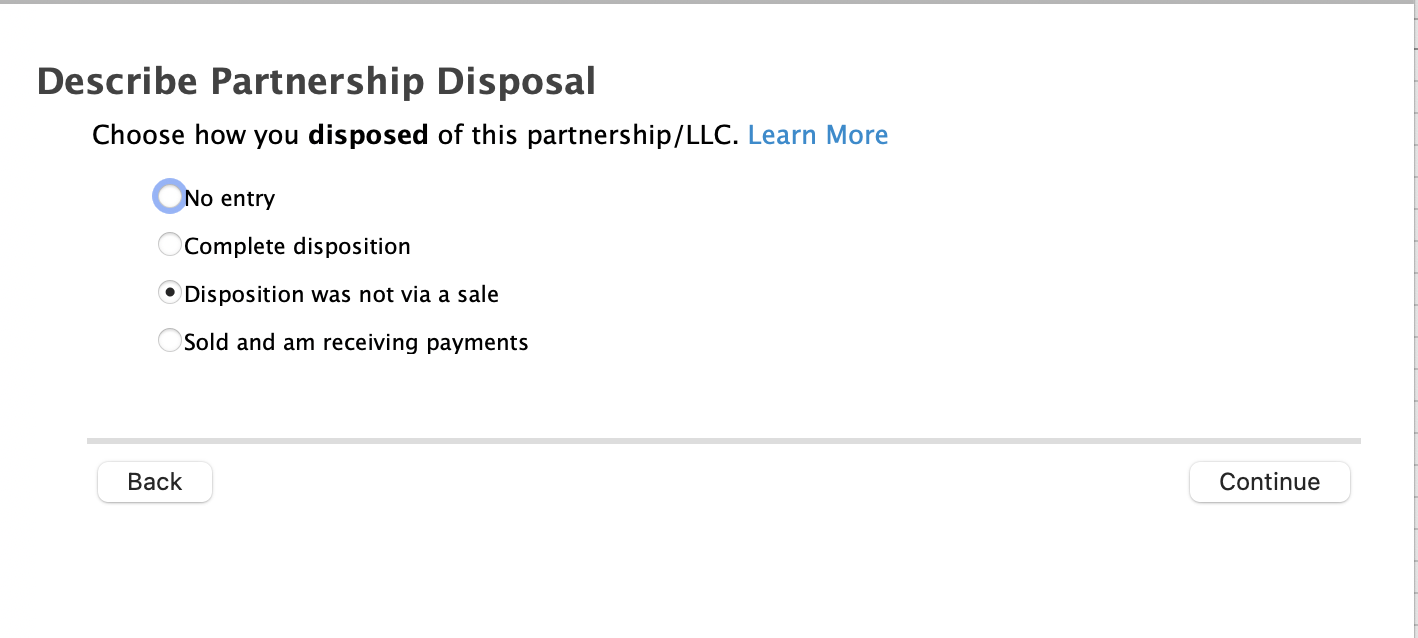

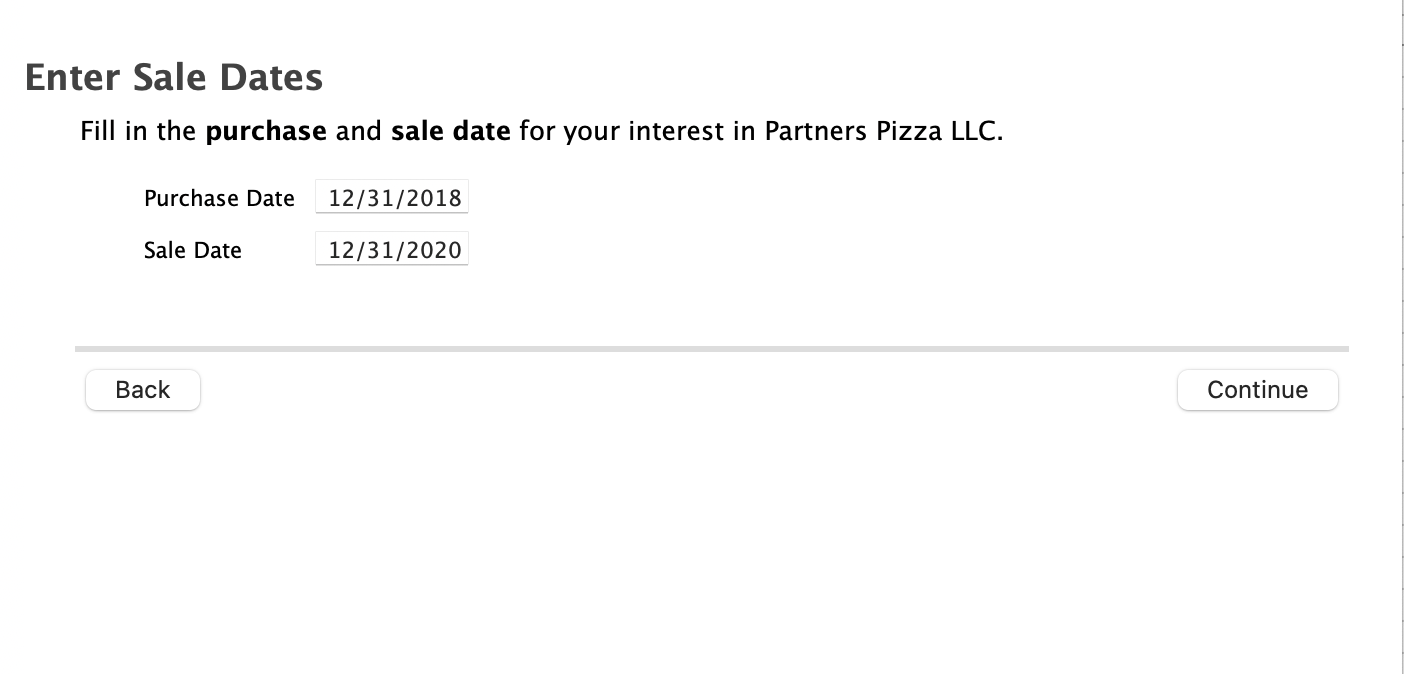

In this case, the partnership ended, disposition was not via a sale, and the "sale date" (next screen) can be 12/31/2020 or the exact date the partnership terminated (if you know).

See the attached screenshots for how this looks in the K-1 interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Why wouldn't it be classified as a "Complete Disposition"? If this box is checked you get a far different deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Either way, you should be reporting the distribution(s) you received from the liquidation of your interest in the partnership.

A complete disposition would only be the sale of your interest whereas the liquidation of the partnership would be the disposition of all interests of the partnership.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

So is it then classified as a "Disposition was not via a sale" in the TurboTax question screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes. If you sold your share of the business to create your final k-1, then it was a sale. If the whole business was sold, then all got a k-1 from a sale. Otherwise, business ended in a disposition.

**Mark the post that answers your question by clicking on "Mark as Best Answer"